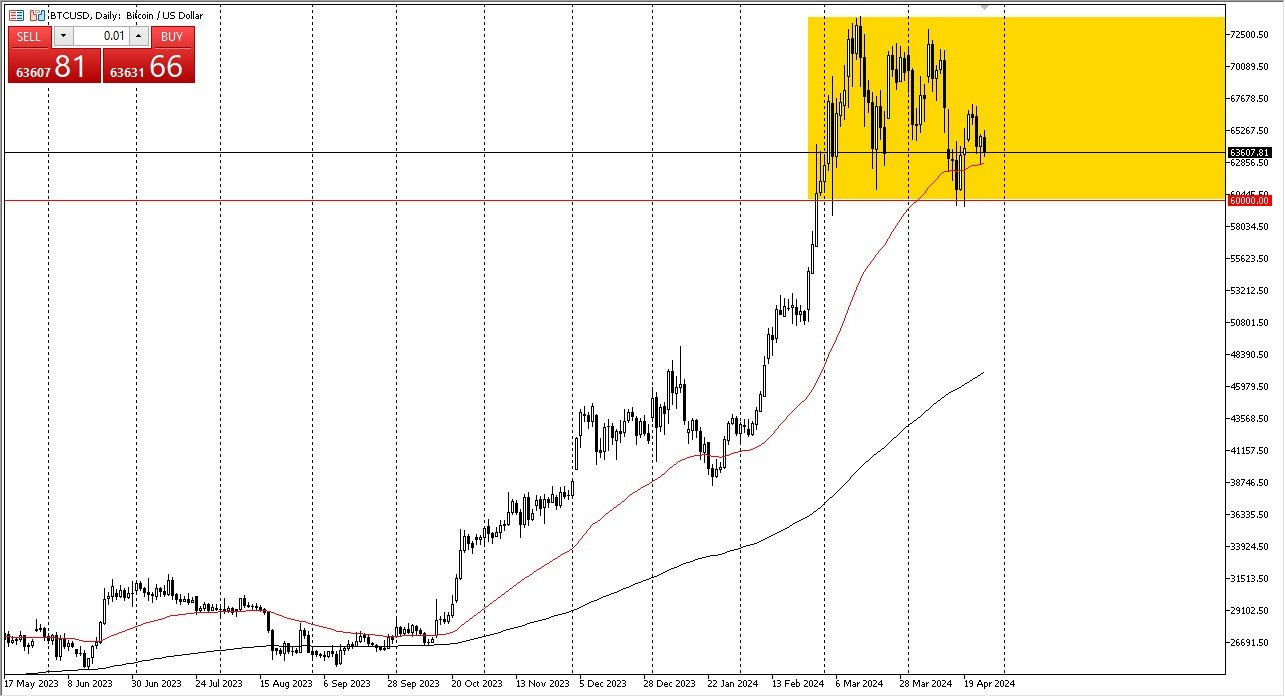

- Bitcoin fell a bit during the trading session on Friday, but it still looks fairly well supported just above the 50 day EMA.

- By staying stable in this area, it does suggest that perhaps sooner or later we will turn things around and rally.

Keep in mind that Bitcoin of course, is dealing with a very strong U.S. dollar, but perhaps more than anything else, it is dealing with the excess froth of rallying 92% in six weeks like it did after the announcement of the ETF and the subsequent inflow of money from institutions. This has been amazing to watch, but at the same time, we need some type of stabilization to continue higher over the longer term, which is what people are expecting.

At this point, there is a lot to chew through and work through, so we have to keep that in mind. And I think this is a market that continues to consolidate overall. The $60,000 level underneath should be a reasonable support level. Assuming that we break down through the 50 day EMA to the upside, we have the $74,000 level as resistance, and it is the top of the overall consolidation area.

Top Forex Brokers

Rising Won’t Be Easy

We don't necessarily have a situation where I think we take off to the upside easily, but I don't think we sell off either. So, with that being said, ultimately this is a market that you are a buyer of the dip, and you obviously don't want to short it, because even if we were to break down below the $60,000 level, the $52,000 level becomes support at that point, and I think the next area of true interest. In other words, I'm looking for value in the Bitcoin market, as the market has been run up so high. The Bitcoin market will continue to be volatile, but positive from everything I see. If we broke down from currently levels, then the markets will become a possible frenzy, as we have seen so many people sitting around and waiting to get long again.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.