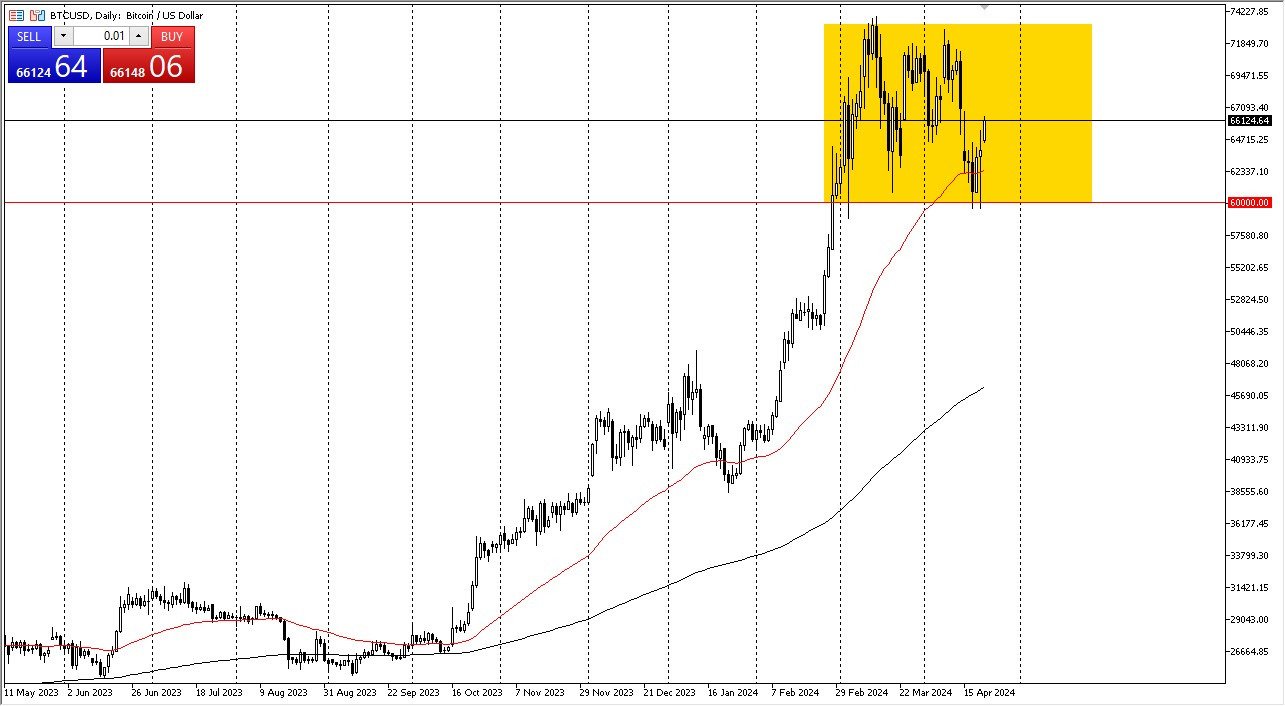

- Bitcoin continues to power higher during the Monday session as it looks like we are willing to step in and continue the overall consolidation.

- With that being the case, the markets continue to be very noisy and I think at this point, you have to look at them through the prism of basically just going back and forth between two levels.

Quite frankly, the Bitcoin market sees the $60,000 level underneath as a major support level, and the $73,000 above as a major resistance level. The 50-day EMA sits right in the middle as well, and it does suggest that market participants continue to see a lot of volatility and noisiness, but at the end of the day, I just don't see how anything changes in the short term because we are working off a lot of froth from previous action.

Top Forex Brokers

If we were to break down below the $60,000 level, it could open up a move down to the $52,000 level, an area that previously had been a major resistance area. This area will continue to be an area that a lot of people would be looking to “find value” as the uptrend has been so violent and obvious. Any type of value in this market will almost certainly attract a lot of attention from traders who have missed the run up, and those who are simply looking to add to an already existing position.

Market Memory

It now should have a lot of market memory there. If we can break above the $73,000 level, then I think we could go looking to the $75,000 level, and then possibly even further to go looking for $80,000 in the Bitcoin market. All things being equal, this is a market that I think is just simply killing time after that massive move higher. So therefore, as we dipped, buyers came in to pick up a little bit of value. It's typical market behavior. This market got far too ahead of itself, and the last month or so has simply been an attempt to get things more normalized after the massive amount of money that was allocated to the ETF on Wall Street.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.