- Bitcoin fell initially during the trading session on Wednesday and the hotter than anticipated CPI numbers clearly have had a bit of a negative effect on Bitcoin as well as the US dollar took off.

- That being said, I think it's probably only a matter of time before we turn things back around and start rallying again because this is a market that's been at an uptrend for some time.

- It's likely the central banks out there will more likely than not continue to cut interest rates.

So if that's going to be the case, there's no argument to be had here other than you just simply look for a little bit of value. After all, we've been consolidating for a while, so it does make a certain amount of sense that we continue to do the same.

Top Forex Brokers

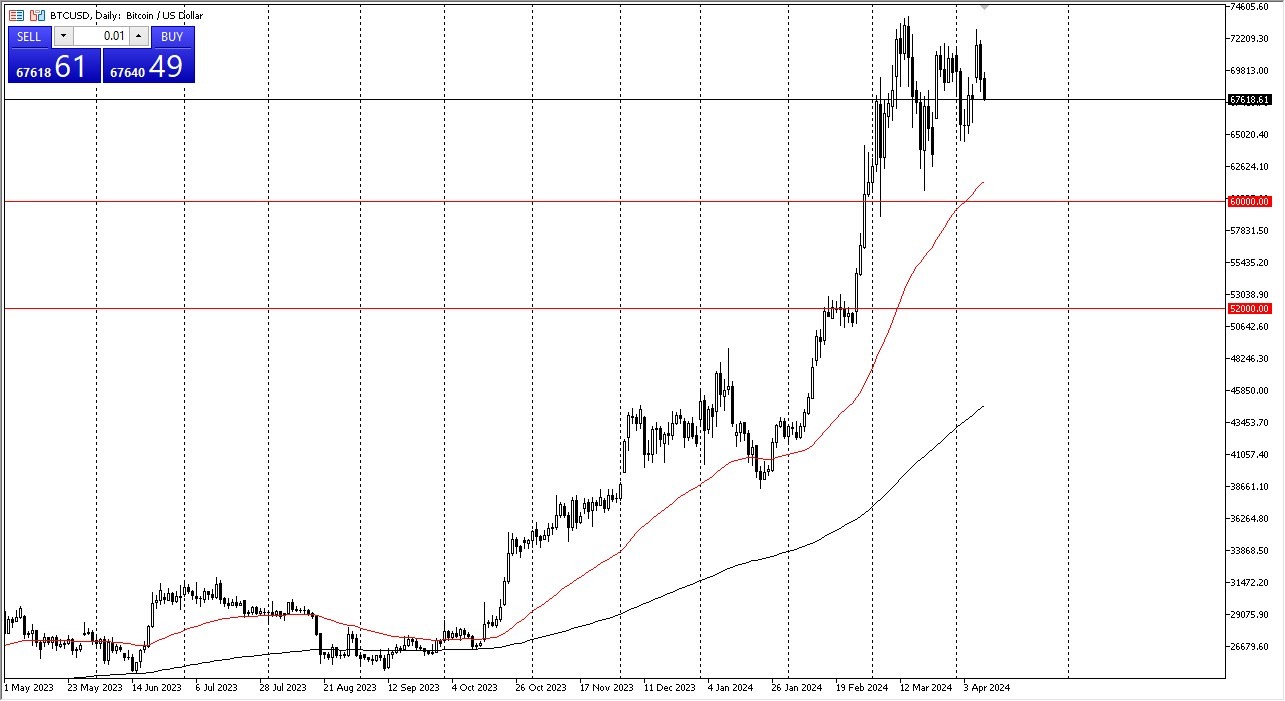

The BTC/USD market had rallied at 92% in just a couple of months, so working off some of the froth is something that we've needed to do for a while. In this environment, I think you have a situation where you can buy the dips because the knee-jerk reaction most likely won't be the correct one. The 50-day EMA sits just above the crucial $60,000 level, which I think is the floor and the trend at the moment.

On the Upside…

On the upside, we have the $74 level offering a significant amount of resistance and breaking above that would clearly open up the possibility of a move to $75,000 above and then eventually the $80,000 level. There is still a lot of excitement about Bitcoin, and I think that continues to show up in the chart, but the hotter than anticipated CPI numbers have caused a little bit of noise. I think that's all it is though. I think it's just noise.

Because of all of that, I believe the market will continue to look at this as a situation where you look at any pullback in order to take advantage of the “cheap coins” that appear from time to time, as the BTC markets continue to see inflows overall.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.