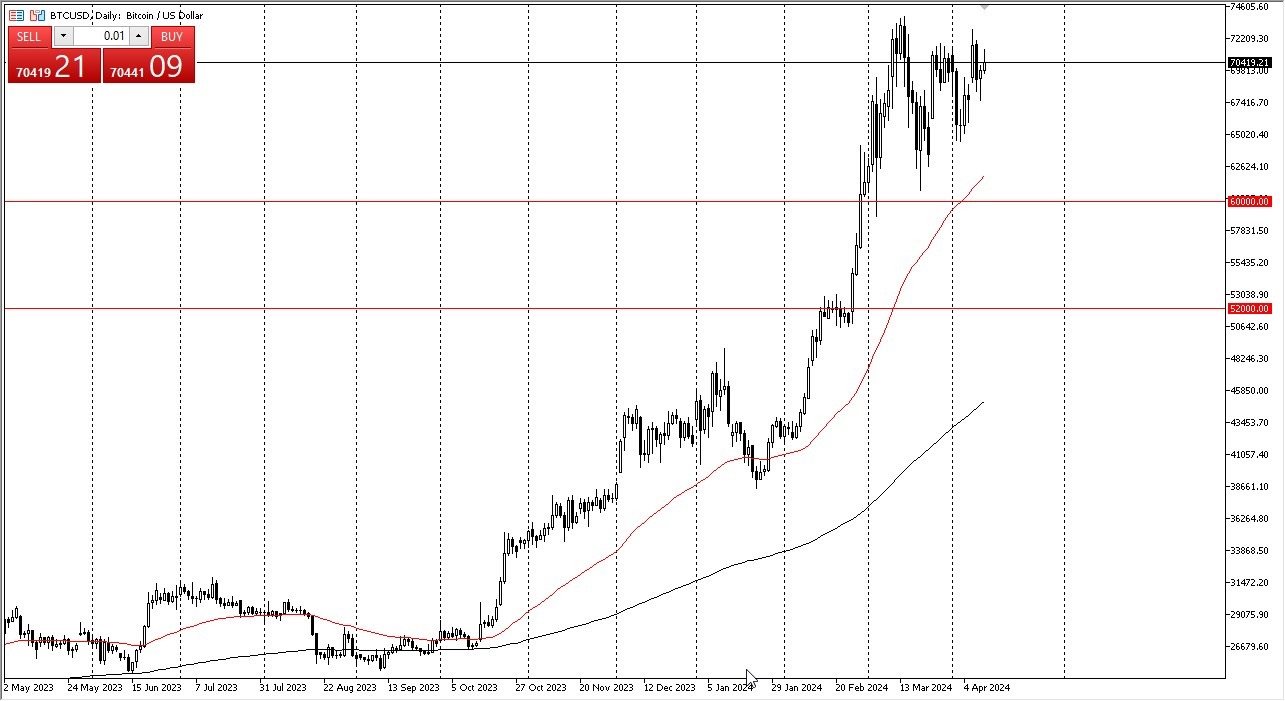

- Bitcoin rallied slightly during the trading session here on Thursday as we continue to see a lot of upward momentum.

- Ultimately, I think the $74,000 level above is a major ceiling that we need to pay close attention to.

- If we can break above there, then we can continue to go much higher.

Next Leg Higher?

That would probably kick off our next leg to the upside. One thing that I would bring to your attention is that every pullback seems to be finding buyers at higher levels. This means lower highs as we move along in what is starting to become a bit of an ascending triangle underneath. We have a massive amount of support near the $60,000 level, and I think that your floor in the market, the 50 day EMA, sits near the $62,000 level, which also offer support.

Top Forex Brokers

We have each and every short term low price that we have made since then. Ultimately, I do think we will eventually break up to the upside. We could be looking at $75,000, followed somewhat quickly by $80,000. There's a lot of money on Wall Street flowing into Bitcoin, but in the midst of all of this noise, we just seem to be working off a lot of that excess froth as the market had gotten out of control.

After all, it's not normal to gain 92% in something like 6 or 7 weeks. So, what we've seen over the last month and a half or so does make perfect sense. At this point in time. It's more or less a buy on the dip scenario. This has been the case for some time, and I don’t think this will change anytime soon. The market will continue to see a lot of volatility, but in the end, this is a market that is the “new thing” for Wall Street, so this will continue to attract inflows overall.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.