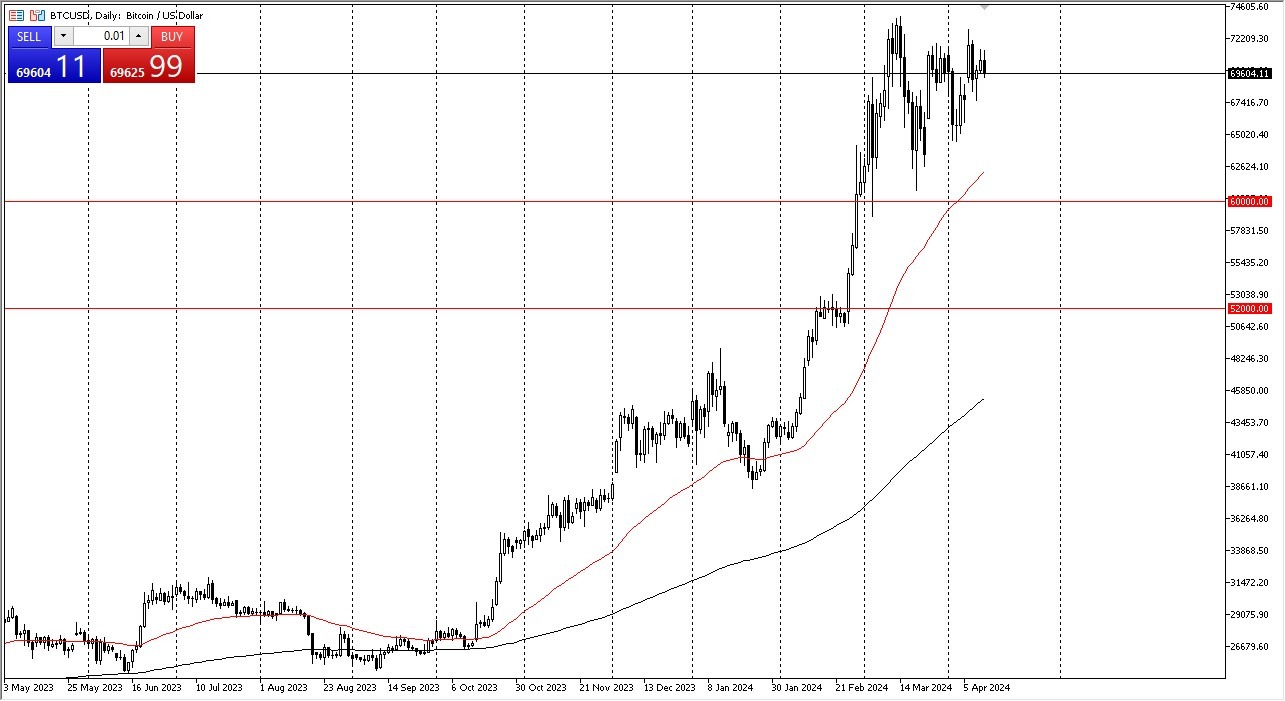

- Bitcoin initially tried to rally during the Friday session but gave back gains as we continue to see a lot of noisy behavior.

- Ultimately, this is a market that I think will continue to be noisy. And it does make a certain amount of sense, considering that we had shot straight up in the air, gaining something like 92% in six or seven weeks.

This move has been massive, and of course out of control recently. The BTC/USD market has been one of the favorites as of late, but like most fads on Wall Street, it tends to be fleeting – at least for a while.

Top Forex Brokers

Hot Money? Its Already in the Market

That is a significant amount of upward momentum that has to be digested. The hot money running into the ETF is probably done at this point as the initial first time buyers have jumped into the market. So, here's the question that I think a lot of traders will be paying attention to. And that is whether or not there is going to be enough momentum to push this market even higher.

With that being said, I also think that you need to keep in mind that a little bit of consolidation is probably a good thing. The $60,000 level underneath is a major floor in the market with the 50 day EMA sitting just above there. Any dip towards that area gets bought into, and it's probably worth noting that every dip that we've had recently, buyers have jumped back in to pick it up more aggressively each time. In other words, the buyers are definitely going to try to take control again, but we have to pay attention to the $74,000 level. The $74,000 level is a barrier that I think if we can break above, that would be a big deal. But right now, we just don't seem to have the momentum. That being said, if you're patient enough, you should get paid holding Bitcoin, but it also looks like you'll get the opportunity to pick it up cheaper.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.