- Bitcoin has been all over the place during the course of the trading session on Wednesday.

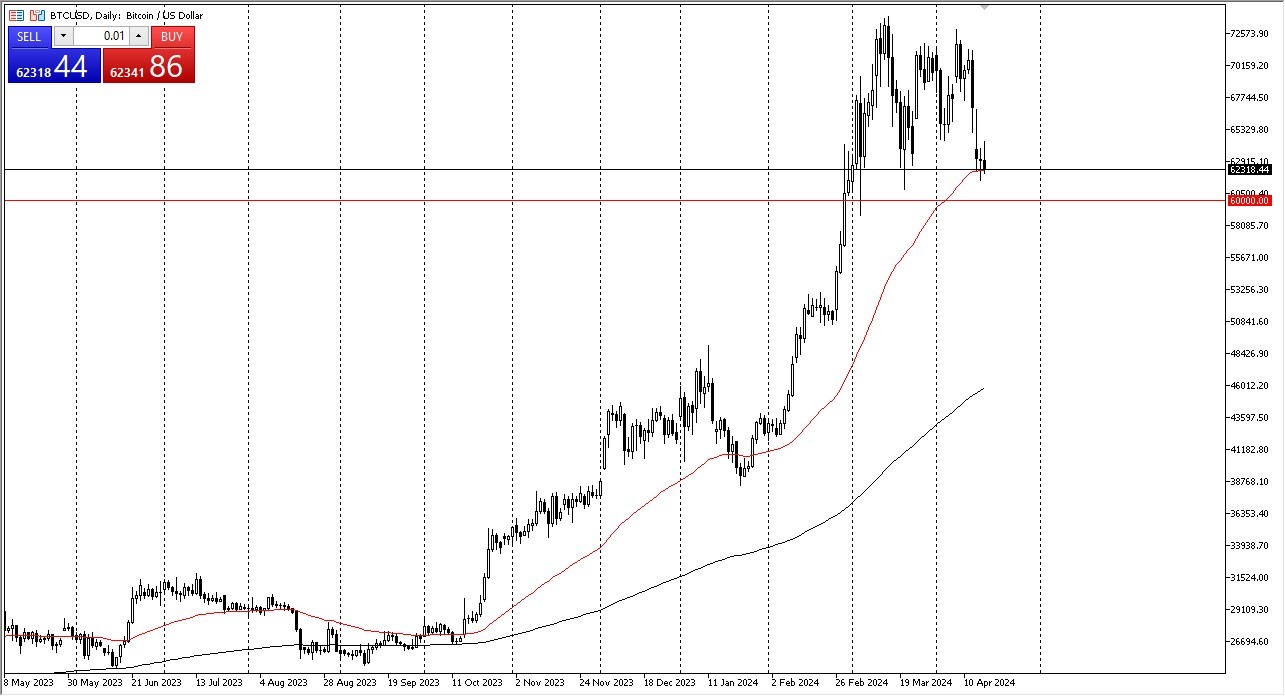

- As we are hanging around the crucial 50 day EMA we are sitting above a major support level in the form of the $60,000 level as well.

- So, I think at this point in time, I believe the market is going to continue to see a lot of noisy behavior and perhaps a bit of interest in the market trying to pick it up again.

We'll have to wait and see how this plays out. But clearly this is a market that I think has been consolidating for a while after seeing such a huge shot higher. I think nothing has changed other than we are exploring the bottom of this range. As long as $60,000 holds our support, I suspect Bitcoin is fine overall, but also know that the volatility is probably going nowhere at this point in time.

If We Fall Apart...

Top Forex Brokers

If we do break down below $60,000, then the $52,000 level is your next support barrier in general. We have a lot of froth to work out in this market, because we did see a 92% gain in six weeks as money flew into the ETF. Now that institutions have their hands in Bitcoin, this market will never be the same.

This is going to trade more like an index. Therefore, you will see long periods of consolidation and probably massive amounts of volatility from time to time like we did in the past. But it will be much shorter. Remember, institutions don't like that type of volatility. If we can break above the high of the day on Wednesday, it's very possible we could go looking to the $70,000 level above. This also could open the possibility of a move to the $74,000 level, which has been a brick wall so far, but clearing that allows for a new leg higher in this market.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.