- The bitcoin market has been all over the place during the trading session on Friday, as it reacted quite negatively to the potential expansion of the Middle Eastern conflict, as Israel attacked Iran.

- However, we saw that the attack was more or less just for show, and at this point in time it looks like traders have returned to try to pick up “cheap coins.”

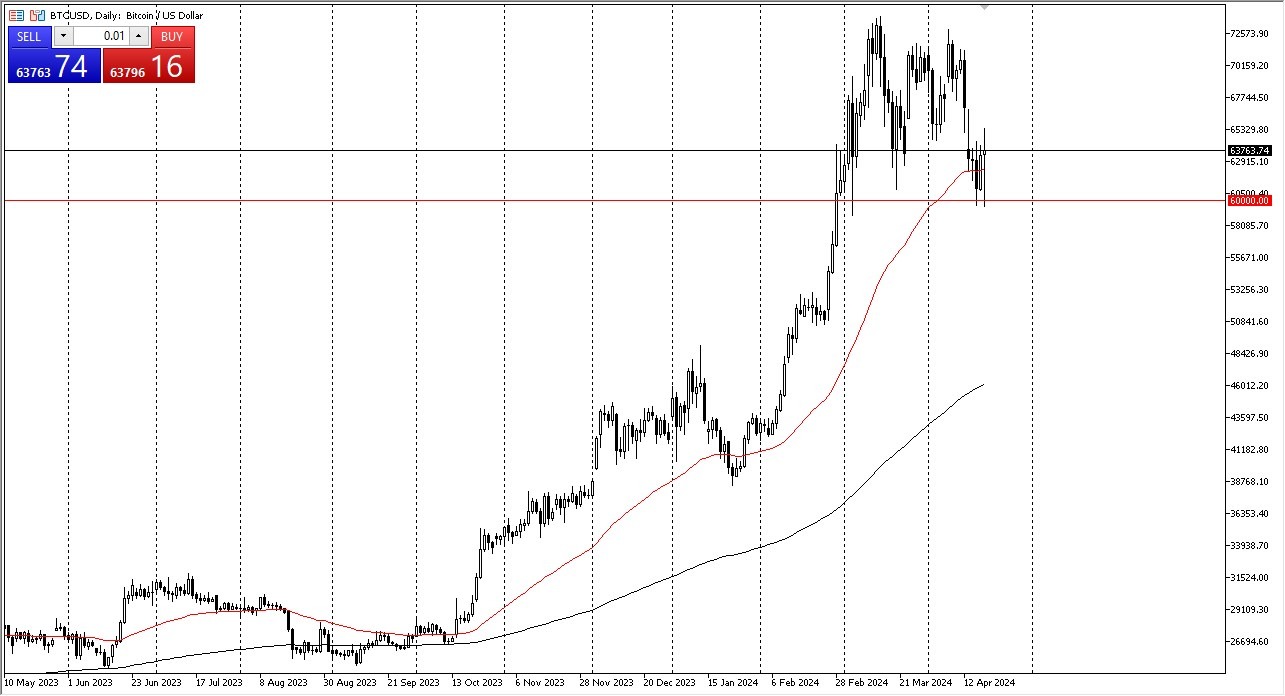

Underneath, I see the $60,000 level as being crucial, and as long as we can say above there, which it is worth noting that we bounce from there early in the Friday session, then I think you have a real shot at the market taking off to the upside again. At the very least, I would anticipate that we should continue to see a lot of consolidation, meaning that we could go looking toward the $74,000 level before it is all said and done. In the short term, I would be happy with $70,000 as a target, but I also recognize that we could extend a bit further than that.

Top Forex Brokers

Buying On the Dips

I think at this point in time, most people are willing to buy Bitcoin on the dip, as it is proven itself to be rather resilient. As long as we can stay above the $60,000 level, we are most decidedly in an uptrend, and I just don’t see how that changes. Furthermore, Wall Street will continue to push the ETF, meaning that more and more money will go flying into the spot Bitcoin market via the ETF.

The 50-Day EMA indicator is slicing through the candlestick for the trading session again, therefore I think you’ve got a scenario where traders will have to look at this through the prism of the market just simply try to consolidate at a potential support level and indicator simultaneously. The market had recently rallied 92% in 6 weeks, so it does make a lot of sense that we might consolidate in this general vicinity and try to work off some of that excess froth. Regardless, this is a market that remains bullish from everything that I can see.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.