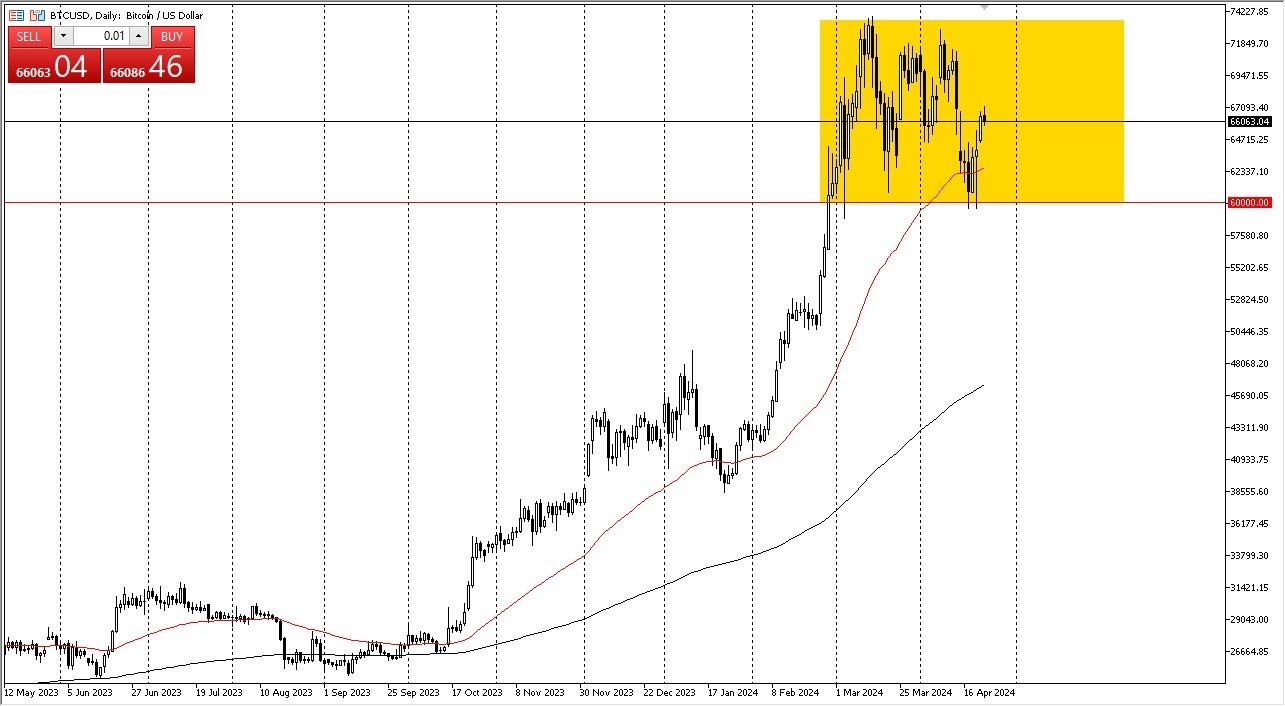

- Bitcoin has gone back and forth during the early hours on Tuesday as we continue to see the market look somewhat consolidation based.

- As we are in the middle of what would be the consolidation area, it does make a certain amount of sense that we would see a little bit of hesitation.

- This market has been so bullish that sooner or later people are going to take a break, which is what we have been seeing over the last several weeks. How long that lasts will be the tricky part to get correct.

Minor Resistance, Long Term Bulls

At this point, I think the $66,000 level is a minor bump along the road. But after the big move that we've seen over the last couple of days, it's actually a good thing to see the market stall just a bit. If we can break above the top of the $67,000 level, then I think it's likely that the market goes looking to the $70,000 level and then possibly the $73,000 level.

Top Forex Brokers

Underneath the $60,000 level continues to offer massive support and we have seen it tested a couple of times here recently and I think a lot of people will be looking at it as a floor in the market. All things being equal, this is a market that is simply consolidating after rallying quite drastically. So I think a lot of this makes sense. After all, Bitcoin had gained 92% in six weeks and that is a rally that takes a lot to digest.

This remains a buy on the dip type of scenario and if we can break above the $74,000 level, it's very likely the Bitcoin eventually goes looking to break out to the $75,000 level and then eventually as high as $80,000. But that would take significant effort and momentum to make that happen. Eventually I think it does, it's just that in the meantime we continue to chop around in this well-defined range. In other words, you probably have time to accumulate a bit of BTC in this region.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.