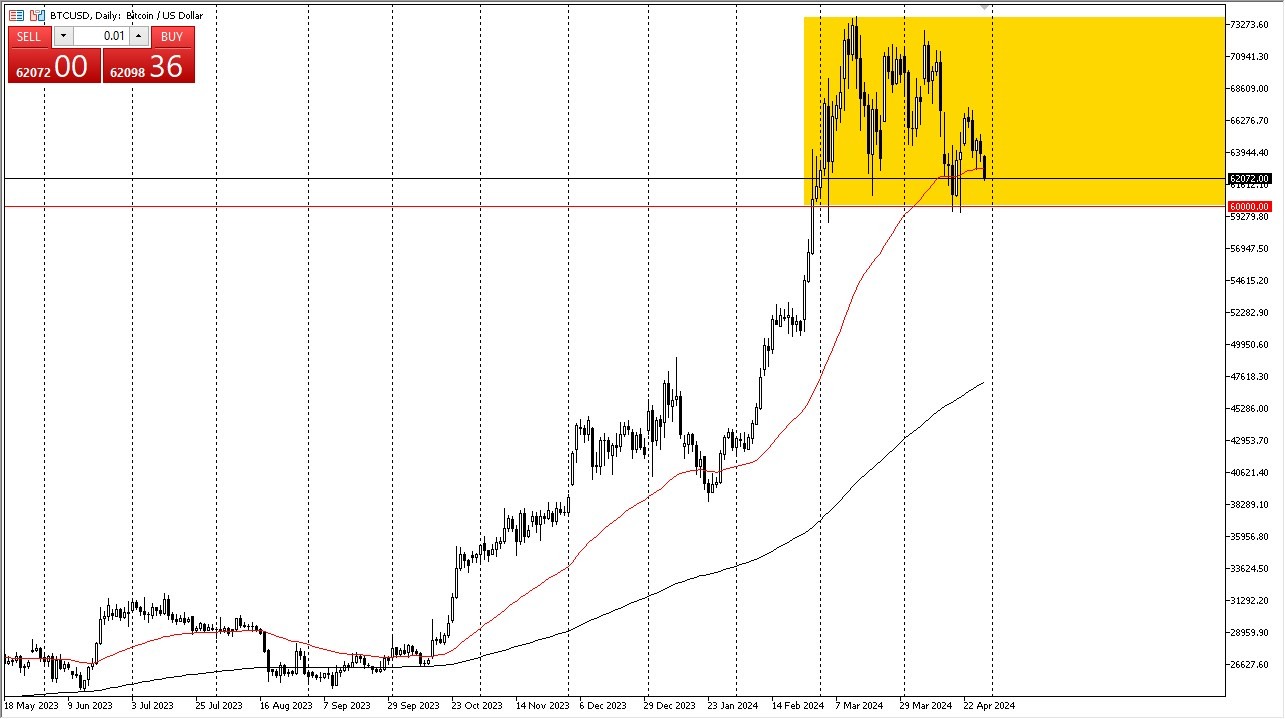

- Bitcoin fell a bit during the trading session on Monday and we have dropped below the 50 day EMA.

- But ultimately, I think this is a market that is going to, eventually trying to find buyers perhaps down at the $60,000 level.

- I don't know, but this is a market that continues to be very noisy, very, tired, probably after this massive rally higher.

But, given enough time, I think you've got a situation where eventually value hunters come back in and try to take advantage of the idea of cheap bitcoin. If we were to break down below the $60,000 level, then it's possible that we could drop all the way down to the $52,000 level. This is an area where we have seen a lot of consolidation previously, and therefore I think you have a certain amount of market memory to deal with.

Top Forex Brokers

Can We Break Higher? Maybe. With Effort.

On the other hand, if we turn around and break above the highs of the last couple of days, then it's likely that we could go looking to $69,000 area, possibly even, $74,000, given enough time. In general, this is a market that I think is going to be noisy. But I also believe that eventually the buyers will return. After all, it's just recently that institutional traders are able to easily jump into the spot ETF and take advantage of a rise in this market.

There's a lot of chaos out there. So, it does make a certain amount of sense that people might want to jump back into BTC/USD in order to take advantage of the idea of being out of, the central bank fiat currencies that are being printed hand over fist. However, we did rise to these levels. So, there's a lot of time here, I think that might be used to work off some of that excess. The excess of course is great considering just how much momentum we have seen to the upside recently but at the end of the day it is still a very bullish market regardless period.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.