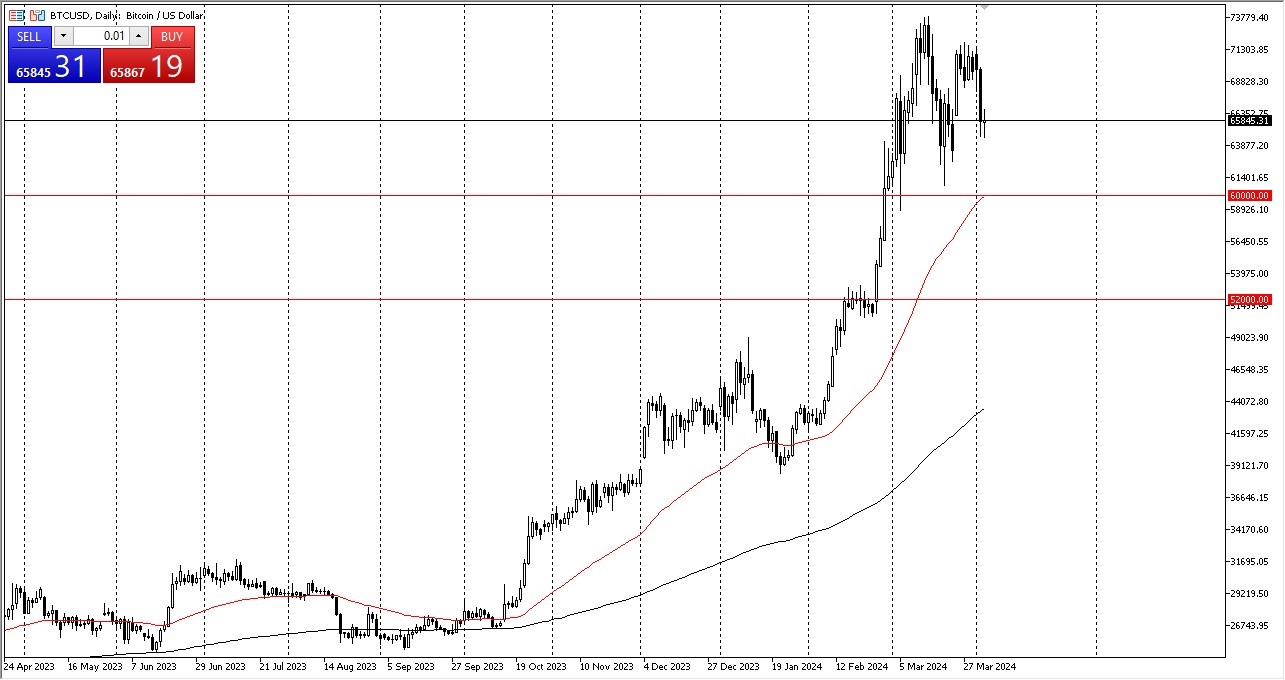

- Bitcoin has gone back and forth during the course of the early hours on Wednesday, and as we continue to see a lot of noisy behavior in general..

- I think this is a market that will continue to be very noisy.

- This makes a certain amount of sense, considering that we had shot straight up in the air previously.

- Now we have to work off some of the excess froth, the ETF inflows will have abated by now, at least the massive hot money running into them.

So, all of this ties together quite nicely. When you look at the chart, you can make an argument for a little bit of a potential triangle being formed. So that'll be interesting to see whether or not that breaks higher or lower. At this point, I would suspect that we go higher, but underneath the $60,000 level needs to hold and support the 50 day EMA in that area, of course, makes quite a bit of sense as well.

Top Forex Brokers

The Next Support Area Below

If we were to break down below there, then the $52,000 level would be a bit of a support level as we've seen previous resistance there. In general, this is a market that I think continues to have more of a buy on the dip attitude, but I also recognize that the $75,000 level above insignificant resistance. If we were to clear that, then fine.

The Bitcoin market can continue to go much higher. That being said, after we gained something like 92% in just two months, it does make a lot of sense that we need to work off some of this excess. That typically means you either pull back or you grind back and forth in a range. At this point, it looks like we're probably doing more grinding back and forth than anything else. On short term pullbacks. It should offer a little bits and pieces of value that people were willing to get in on.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.