- Bitcoin continues to consolidate overall as we sold off rather rapidly during the early hours on Friday, we have seen a recovery after the jobs figure came out and now it looks like we are still very much at risk on type of attitude.

- With that being the case, I think this is a market that given enough time, we should see plenty of buyers jumping into this market at any hint of value.

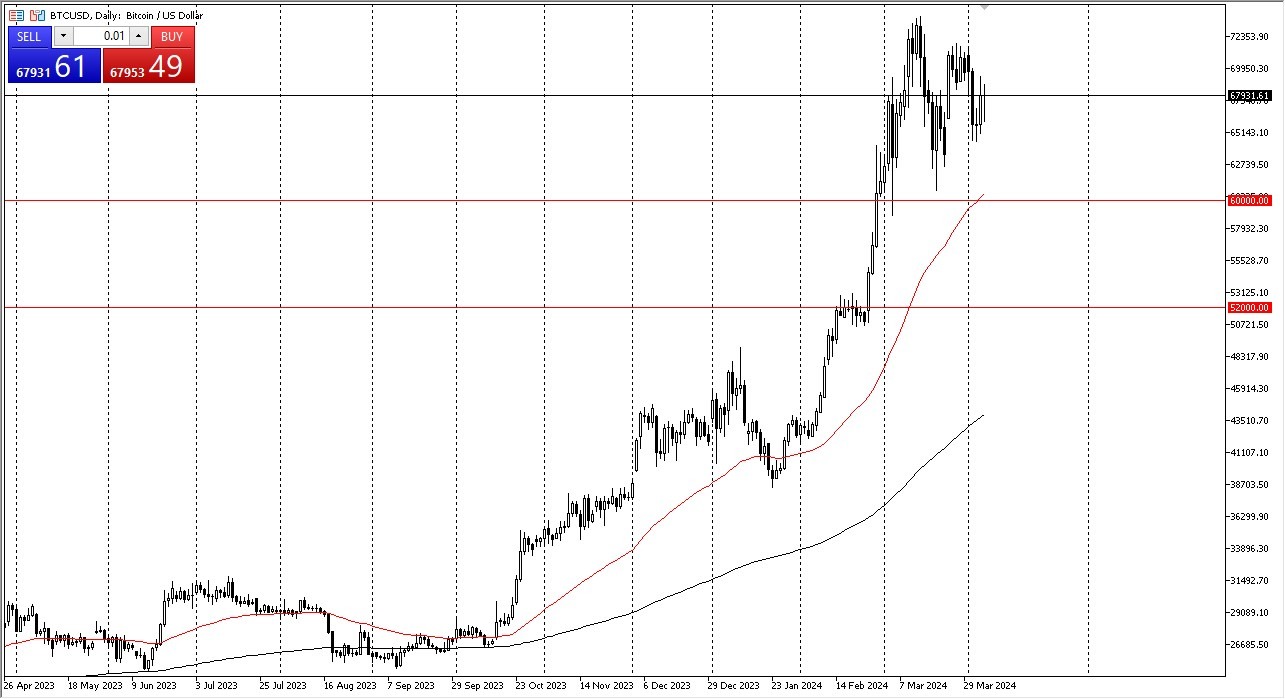

The Bitcoin market obviously has a lot of support underneath, and it's especially apparent near the $65,000 level. And even more so. And the $60,000 level, which is not only a large, round, psychologically significant figure, but also where the 50 day EMA is currently sitting and of course, an area where we've seen buyers in the past.

Top Forex Brokers

Market Memory?

So, one would have to assume that there's a certain amount of market memory there. As things stand right now, it looks very much like we were trying to go looking to the $75,000 level above the $75,000 level is the top of the overall consolidation area right now. And although it is a kind of large, round, psychologically significant figure, I don't know that it holds over the longer term.

We are currently working off a lot of the excess froth from the shot straight up in the air at the end of last year and early this year, and I think it makes quite a bit of sense that we continue to see churn, but it most certainly favors the upside in general. This is a market that continues to run on emotion as well, and at this point in time, there are a lot of people that will be willing to push this market higher. We have seen this movie before, where BTC simply ignores everything for a while, and just goes higher.

It will end eventually, but at this point I think we aren’t near that time. This is a market that shows itself to be a product of the times, simply a boom and bust cycle over and over again. This is a bullish market at the moment, so this should be treated as such.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.