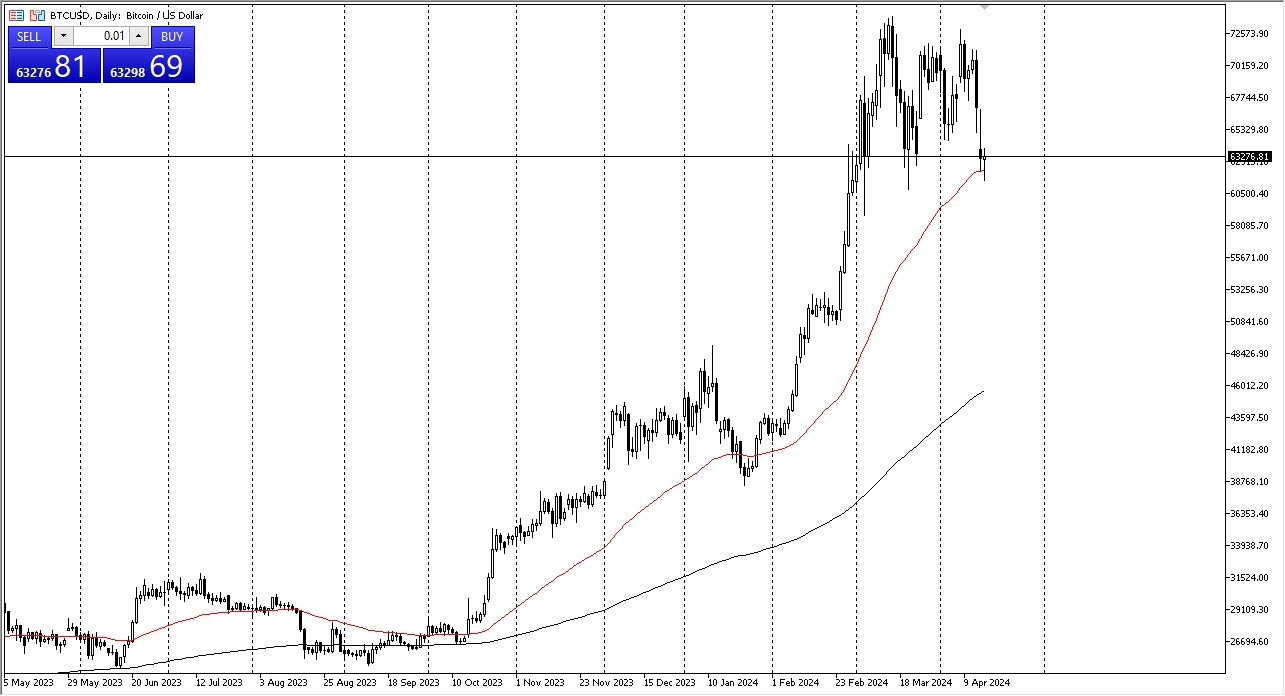

Potential signal: on a daily close above $64,000, I am more than willing to put a position on and aim for the $70,000 level above. I would have a stop loss at $62,000 underneath.

- Bitcoin initially plunged during the trading session on Tuesday, breaking below the 50-day EMA, but has since seen buyers come back into the market in order to pick it up.

- It'll be interesting to see what happens here because I believe that the $60,000 level is significant support from a psychological standpoint, if nothing else, and the fact that we have bounced from that region twice already.

- The “market memory” in this area will more likely than not attract a lot of attention, as technical traders will look for value in that area.

Top Forex Brokers

The 50-Day EMA

The 50 day EMA is an area that certain technical traders will pay close attention to so would not be a huge surprise at this point in time to see a little bit of a bounce from here. If we can continue to go higher, perhaps breaking above the $64,000 level, then I anticipate that Bitcoin could travel all the way up to the $70,000 level as we continue to try to keep the uptrend intact. The alternate scenario would be a significant breakdown below the $60,000 level perhaps opening up a pullback to the $52,000 level, which is an area that previously had been resistant. A little bit of market memory in that area certainly would make quite a bit of sense.

Regardless, it's not a huge surprise to see this market bounce around the way it has because it shot straight up in the air for an entire month and a half or so gaining 92% in six weeks just isn't typical. The market has to digest a lot of inflow. The ETF in Bitcoin on Wall Street has changed the dynamic of this market so it'll be interesting to see how that plays out but right now I suspect there's more of a risk to the upside than the down. That being said, you need to be cautious because of course Bitcoin has ruined a lot of traders in the past for those who have gotten far too aggressive.

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.