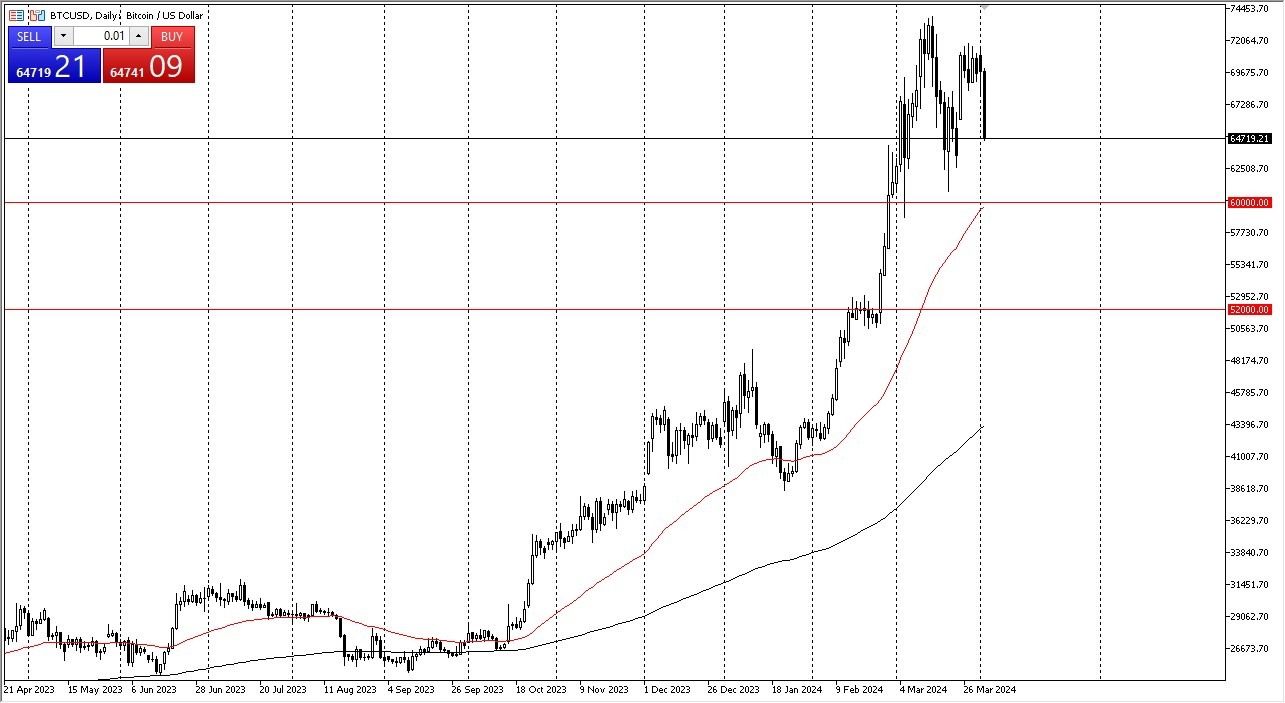

- Bitcoin plunged during the early hours on Tuesday as we continue to see a lot of noisy behavior in this market.

- Now, the candlestick of course is very negative looking, and it is something that's somewhat concerning, but at the end of the day, it's very likely that we need to consolidate in this range.

After all, the market rose 90-something percent in a very short amount of time. So, somebody somewhere is going to be taking profit. Furthermore, the massive inflow of hot money into the ETF will have stopped or at least slowed down because not everybody is looking to jump into the BTC/USD market.

Top Forex Brokers

So, all of those who had been desperately waiting took advantage of the opportunity that they had and now we have to digest those gains. As things set up right now, I believe that the $60,000 level underneath is a support level, especially as the 50-day EMA sits right there as well. On the upside, I believe that the $75,000 level is a significant resistance barrier, so if we could break above there, that would obviously be a very bullish sign, but I don't think we're going to, at least not in the short term.

I expect to see a lot of back and forth and sideways action in this $15,000 range. However, if we were to break down below the 50 day EMA, it could open up and move down to the $52,000 level, which is where we had launched from previously. In general, this is a market that I think continues to see a lot of volatility, but still is one that you can't get short of, at least not in this environment. This is a market that is in the throws of a major change in attitude and mechanics. This is a market that will continue to be one of high speculation, and therefore its difficult to analyze it thoroughly form the fundamental side. After all, it isn’t used much in the real world, and therefore it is always a lot of “what if?” as the market consistently has changed what it believes Bitcoin is. However, there is money to be made here.

Ready to trade our daily Forex signals? Here’s a list of some of the best crypto brokers to check out.