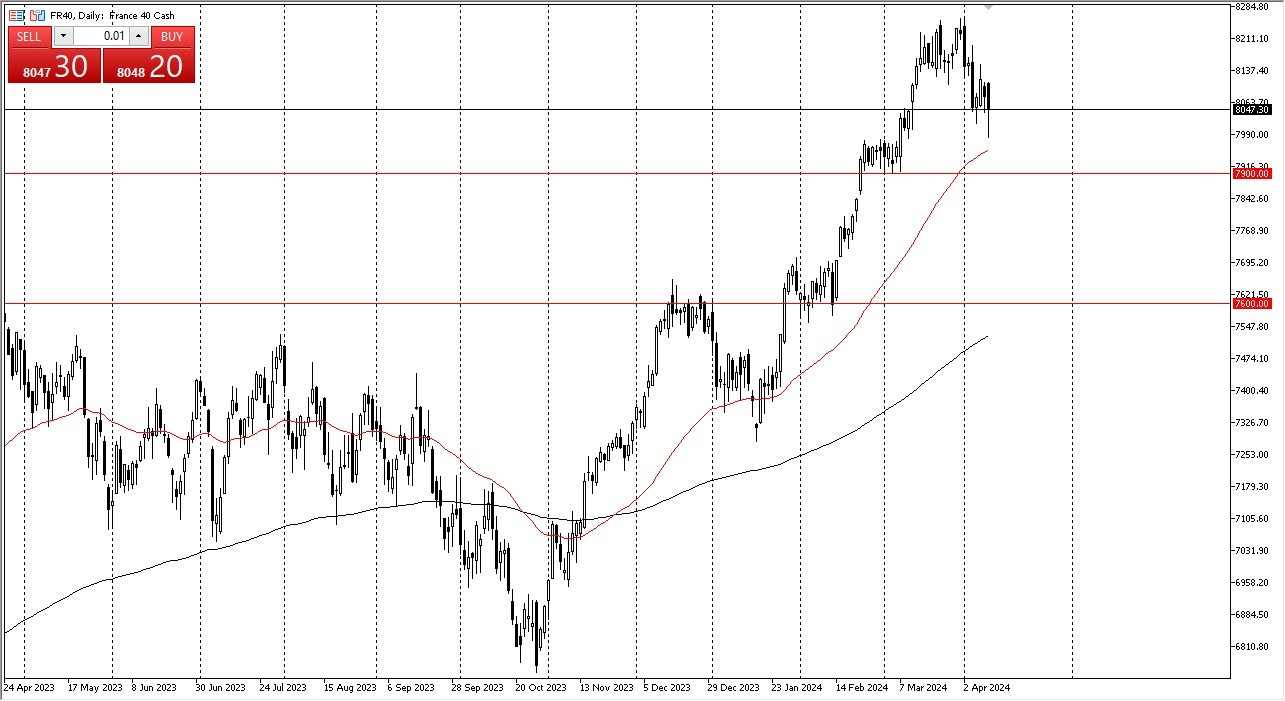

- The Parisian market felt rather significantly during the course of the trading session on Wednesday, reaching down below the €8000 level.

- A lot of this may have to do with the fact that we have seen inflation in America continue to show strength, which of course has shaken the markets in general.

- This has been felt in the CAC 40 just like it has been felt across the world.

Technical Analysis

It’s worth noting that we did bounce significantly from the 50-Day EMA, which of course attracts a lot of attention. I think there is a significant amount of extending from the €8000 level down to the €7900 level. The fact that we bounce the way we have done suggests that perhaps we have further to go. If we can break above the top of the candlestick for the trading session on Wednesday, then I think the market has a very real shot at going to the €8250 level.

On the other hand, if we were to break down below the €7900 level, then we could drop down to the €7700 level, an area that previously had been resistance. All things being equal, this is a market that I think have seen a lot of upward volatility, and therefore it does make a certain amount of sense that we need to grind back and forth in order to work off some of the excess broth that we had seen.

Top Forex Brokers

European Central Bank

Keep in mind that there is an ECB meeting during the Thursday session and it will certainly have a major influence on what happens in the French stock market. With that being said, you need to be very cautious but it’s obvious that we are in an uptrend and I think that any debt will more likely get bought into unless of course the ECB does something to truly shock the markets. Nonetheless, it’s very likely that they will loosen monetary policy sooner rather than later, and that of course help stocks in France just like they would in Germany, the Netherlands, Austria, or anywhere else.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.