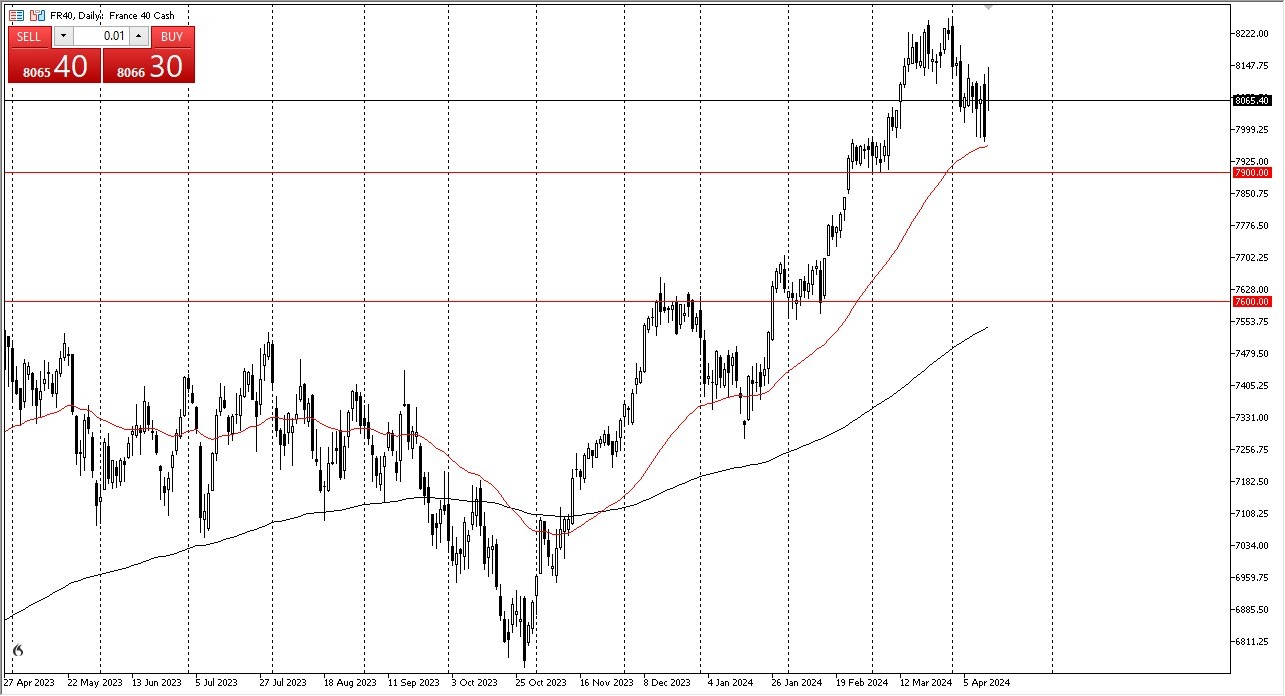

- The Parisian CAC 40 has initially rallied during the training session on Monday, but has given back in the early gain.

- While we did end up forming a bit of a shooting star, it’s not necessarily something that I’m overly concerned about, as it looks more like consolidation at this point than anything else.

- In fact, you could almost make an argument that we are in the midst of forming some type of Polish flag, which of course a lot of traders will pay attention to.

The Trend

The trend has been higher for stock markets around the world for some time now, as it appears that people are waiting for central banks to cut rates yet again. The European Central Bank might even be cutting it soon as this summer, and if that’s going to be the case it could add a little bit of liquidity to the CAC, the DAX, the MIB, the AMX, etc. In general, I think European indices should do fairly well, at least initially. The question then becomes whether or not the ECB is cutting because of some type of emergency that it can get its arms around?

Top Forex Brokers

Technical Analysis

At this point, I’m very interested in the €7900 level as a potential support region. It’s probably also worth noting that the €8000 level sits just below current trading, so that probably comes into the picture as well. The 50-Day EMA is racing toward the current trading levels, so I think that is essentially going to be the “floor in the market” as things stand right now. I was an area we had broken out of as significant resistance, during the beginning of the year. Ultimately, this is a market that I continue to buy dips in, and I do think that it is probably only a matter of time before you rally again, but it does make sense to work off a little bit of upward momentum. Markets don’t go in one direction forever, so there’s no reason to think that the CAC would be any different at this point.

For additional & up-to-date info on brokers please see our Forex brokers list.