- Crude oil markets have been rather quiet during the Tuesday trading session, but I think that makes a lot of sense considering that the Consumer Price Index numbers come out on Wednesday.

- Even though it’s not a direct oil related number, it does give you an idea as to what the Federal Reserve might do.

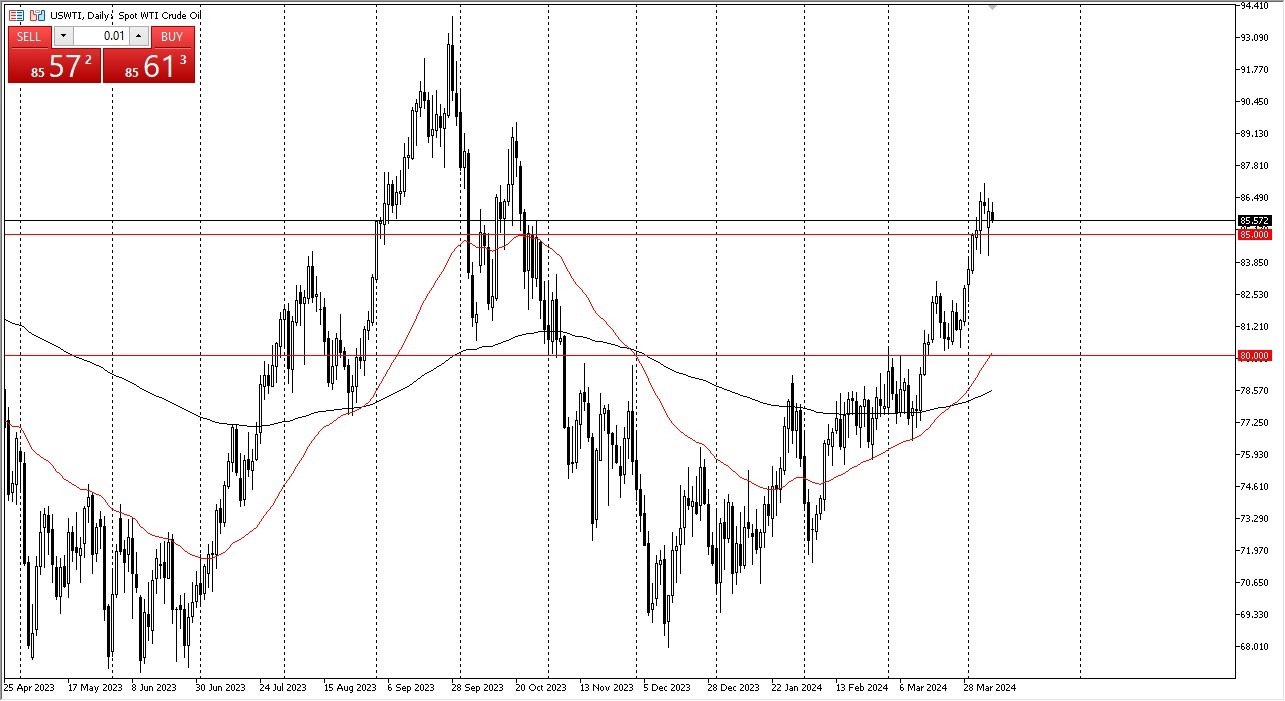

West Texas Intermediate Crude Oil

The WTI Crude Oil market currently sits just above the $85 level, a large, round, psychologically significant figure that a lot of people will be paying attention to. This was also an area where we had seen significant resistance previously, so I think it makes a certain amount of sense that we would see it come into the picture for potential support. If we were to break down below there, and perhaps more importantly, the Monday candlestick, then we could get a little bit of a deeper correction, perhaps sending the West Texas Intermediate market down to the $82.50 level. After that, then you have the $80 level where the 50-Day EMA currently resides, which I believe is the “floor in the market” at the moment. Buying dips at this point continue to work.

Top Forex Brokers

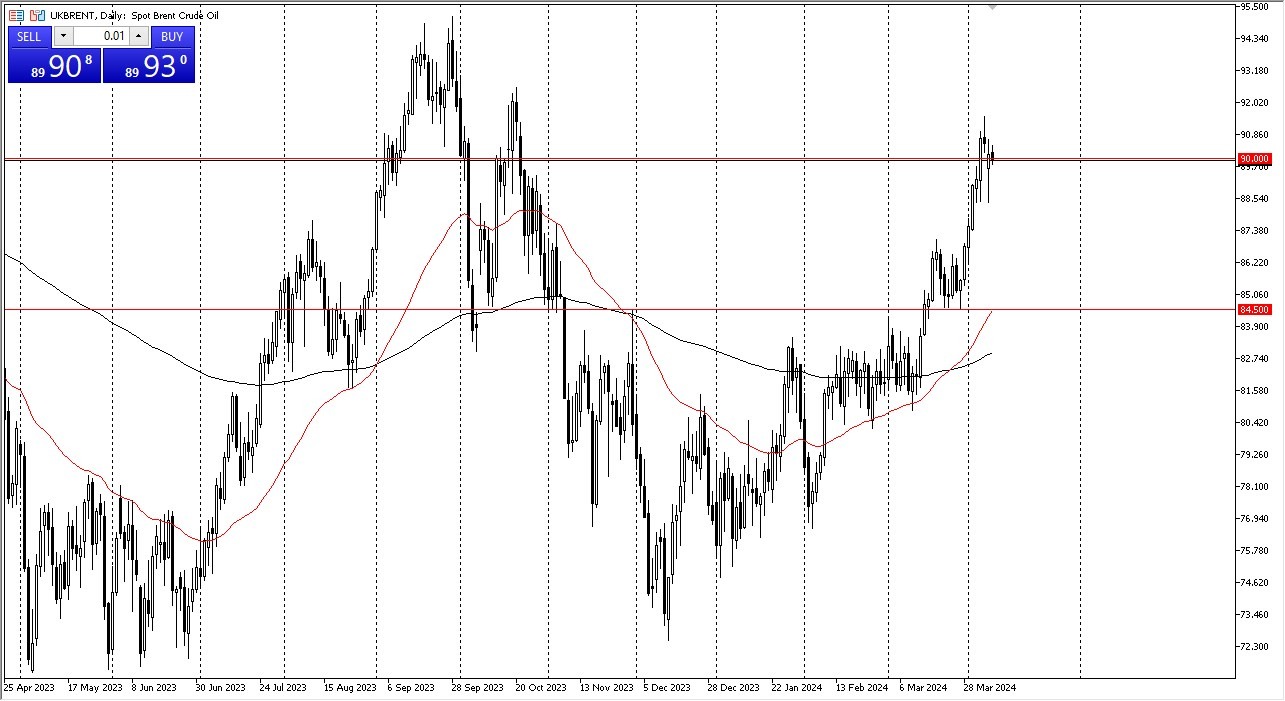

Brent

Brent, or “UK Oil”, continues to look bullish in general, as we had formed a hammer during the Monday session, and then are just simply sitting at the $90 level on Tuesday, suggesting that perhaps we are able to hang on to gain without much concern. Brent also has a lot of the same influences that the WTI market has, so you need to be paying attention to all of the usual suspects.

The biggest one of course is the supply and demand issue, which is starting to show supply struggling to keep up a bit. However, we also need to pay attention to the geopolitical issues in the Middle East, as they will more likely than not come into the fray as well. After that, then you have to keep in mind that central banks around the world cutting interest rates will drive demand higher for energy as industry kicks off again. In other words, it’s very difficult to be a seller of oil. Buying on the dips will continue to be the way forward.

Ready to trade WTI/USD? Here are the best oil trading brokers to choose from.