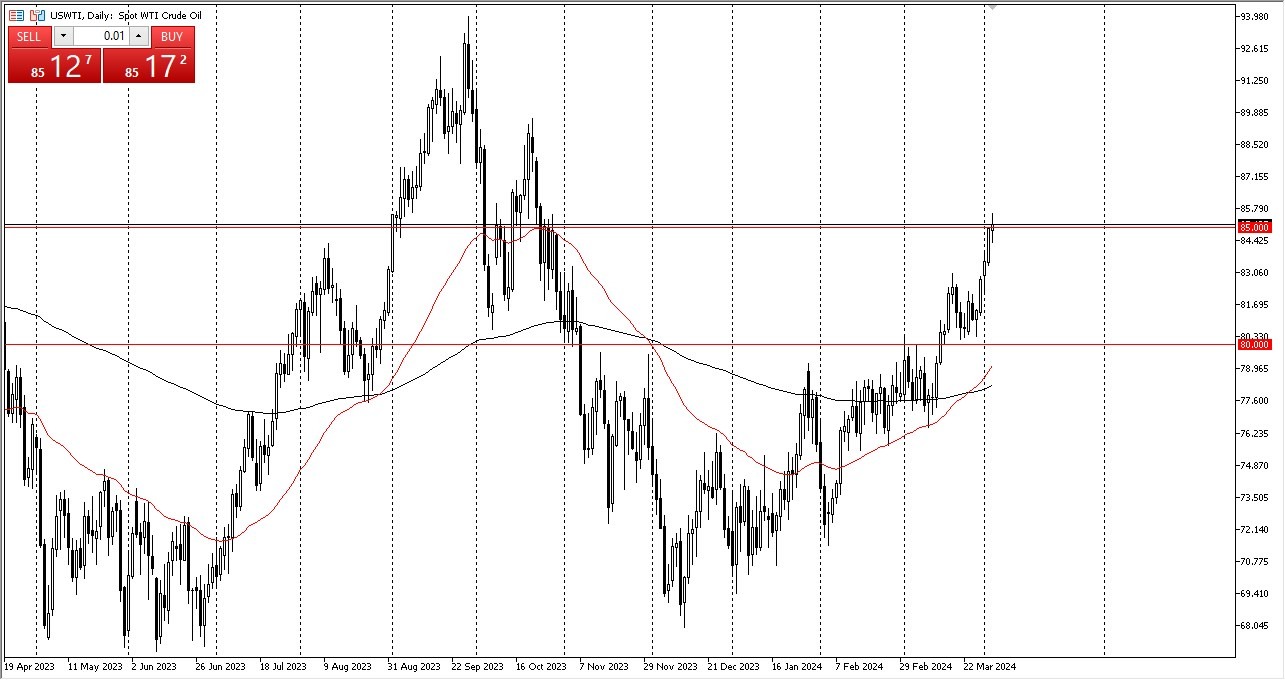

WTI Crude Oil

- The WTI crude oil market rallied a bit during the early hours on Wednesday, as we continued to chip away at the resistance around the $85 level.

- At this point, I think any short term pullback more likely than not will have traders coming in the market to pick up value, and I would expect a pullback sooner or later just due to the fact that we are a bit stretched.

- This is a situation where you need to pay close attention as it can cause a bit of a drop suddenly.

But ultimately, this is a market that I think you have to look at each opportunity with wide open eyes, because there are so many reasons for oil to go higher underneath. I think the $82.50 level is support, and the bottom of the overall trend at this point would be the $80 level. In general, it's very likely that we will continue to go higher, but I also think that you need to find a little value.

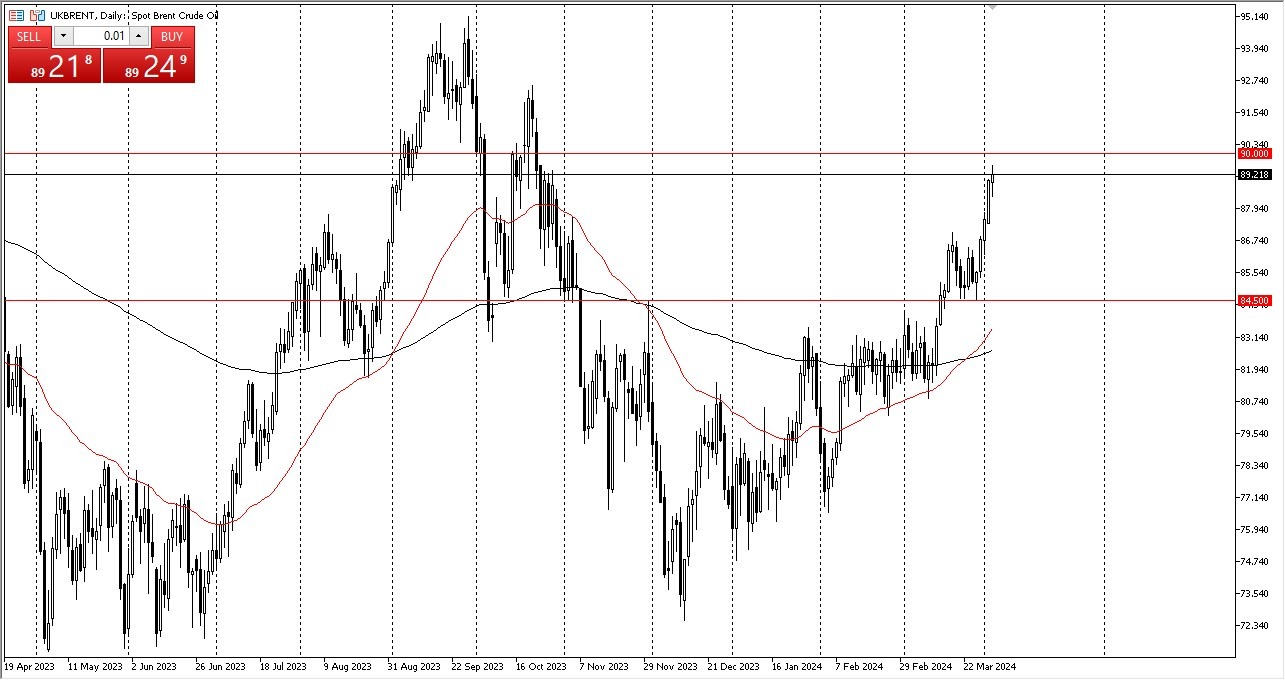

Brent

Top Forex Brokers

The Brent market looks very much the same as I think we could go looking to the $90 level. Any short term pullback at this point in time probably finds quite a bit of support at the $87 region. All things being equal, this is a market that I think continues to see a lot of value hunting.

Any time they get the opportunity in this market, just like they are doing in the WTI crude oil market, the $90 level being broken could open up the possibility of a move to the $92.50 level underneath. I think the bottom of the overall range is near the $84.50 level. So paying attention to that floor is crucial. Crude oil is starting to head into a cyclically bullish time of year anyway. So between this and the problems in the Middle East right now, I think it makes quite a bit of sense that oil continues to go higher over the longer term, and perhaps could be a major mover this summer as demand will certainly be there.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.