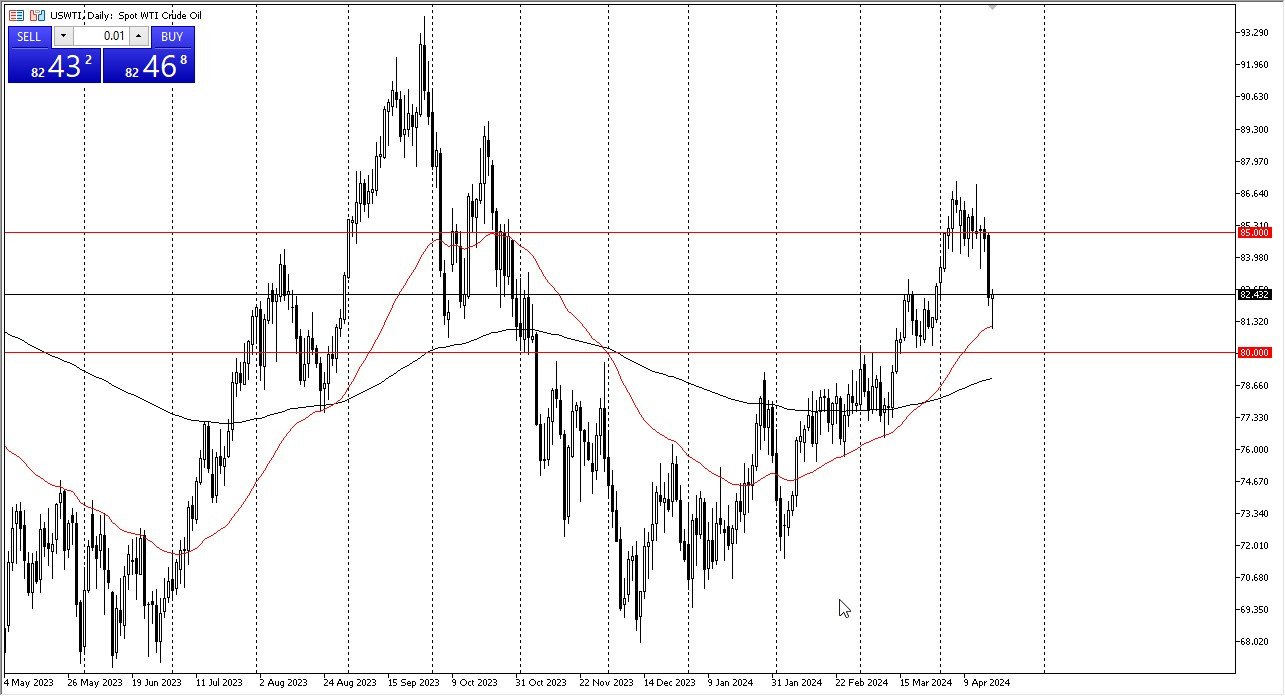

- The WTI crude oil market has initially fell during the trading session here on Thursday, but then turned around as we bounced from the 50 day EMA.

- At this point, I think we have just got a little oversold and we are starting to dig into a block of previous trading.

- So, I think a little bit of a bounce makes sense.

But at this point in time, it seems like the crude oil markets are moving on to the latest headlines coming out of the Middle East and that of course is not an easy thing to predict. With this being the case, I think we are more likely than not to continue to go higher over the longer term but may have a bit of work to do in this general vicinity. As things stand right now, I believe the $80 level underneath will continue to be a major support level and as a result as long as we can stay above there, I think you still have to look to the upside.

Brent

The Brent market has fallen as well and much like the WTI market has found the 50-day EMA to be supportive at this point in time a market bounce does make a certain amount of sense just as the pullback was probably necessary it's been a little overdone to the upside but as things play out, I think we will continue to see some cyclicality come back into the market as driving season is now hitting.

Top Forex Brokers

The $90 level above will be a target. If we can break above there, then we can continue to grind to the upside. Either way, I think you're going to see a lot of volatility, so be cautious with your position sizing, but recognize that we probably have further to go to the upside.

One thing is for sure, I anticipate that we will see a lot of noisy behavior in this market, it is very likely that we will continue to have to be very cautious. After all, oil is normally noisy to say the least, and therefore I think the trader will be well served to keep their position size reasonable in this environment.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.