- The West Texas Intermediate Crude Oil market has been very noisy during the month of April as we continue to see a lot of tension in the Middle East.

At this point though, it looks like the war is not going to spread any further, and I think a lot of traders are starting to relax a bit due to that. We had initially seen the market jump, but since then we have seen nerves settle a bit as the Iranians chose not to accelerate the war itself. That being said, you need to keep in mind that there is a certain amount of geopolitical risk when it comes to this market, and therefore you have to be very cautious about getting too aggressive.

Top Forex Brokers

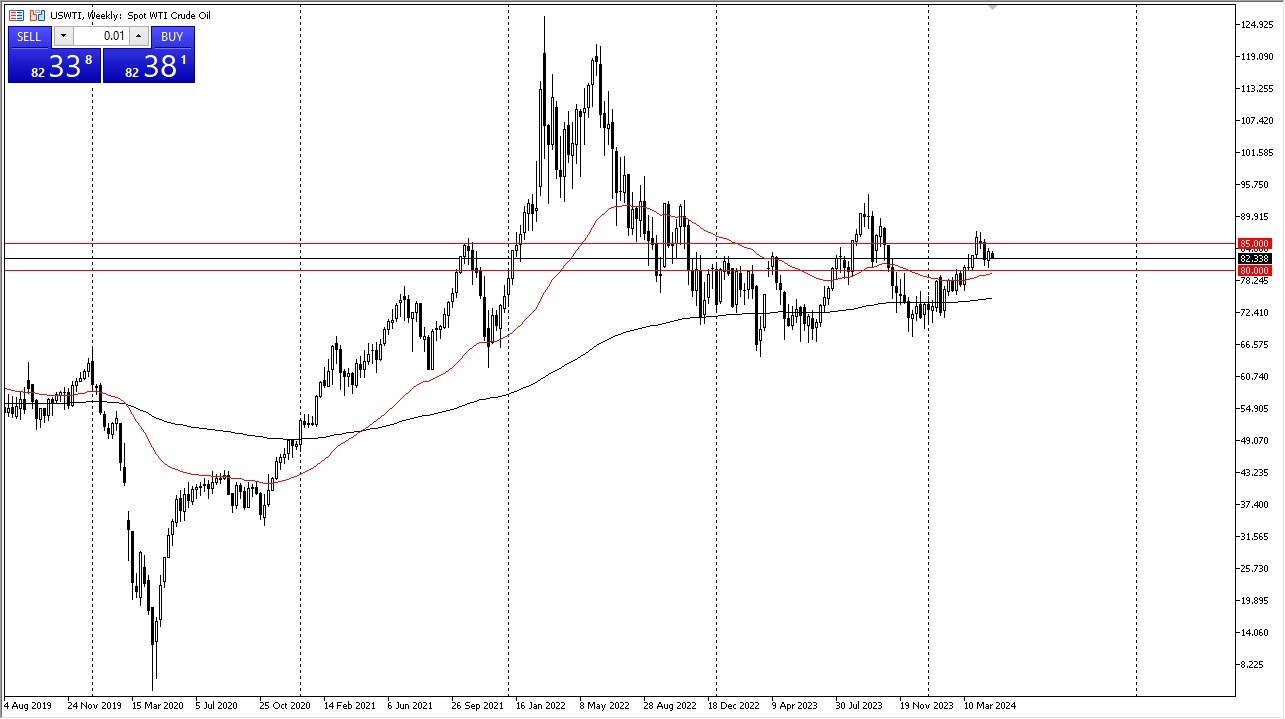

Underneath, we have the $80 level and I think the $80 level end up being a short-term floor in the market. This is as the $85 level above offers a certain amount of resistance. After that, then we have the $87.50 level offering significant resistance as well. Ultimately, we could go racing toward the $90 level, but I think at this point in time we need to see some type of specific reason. After all, we do have a cyclical trade in the fact that the demand for crude oil tend to pick up this time of year, but at the end of the day, the supply isn’t as bad as it once was feared to be.

That being said, the risks in this market are probably higher to the upside than they are to the downside, as there are so many undeterminable geopolitical issues that could come in and cause chaos in this market. Because of this, I look at pullbacks as a buying opportunity and you probably will get that during the month of May. I’d be especially interested near the $80 level, but it doesn’t necessarily have to be in that area. Quite frankly, the lower we go, the more interested I am in buying in this market. On the other hand, this is a market that I think will continue to see a lot of volatility so be cautious with your position sizing. Longer-term, this is a market that I do think breaks higher and by the end of May it would not surprise me at all to see this market closer to the $87.50 level above.

Ready to trade WTI/USD monthly forecast? Here are the best Oil trading brokers to choose from.