Traders of WTI Crude Oil this week should expect noise to come from all corners and speculative volatility to be seen on Monday and Tuesday.

- Traders with open positions in WTI Crude Oil this weekend are likely paying attention to the news developing between Iran and Israel.

- Plenty of noise will be heard early this week in the energy sector and WTI Crude Oil price will be spoken about throughout the media.

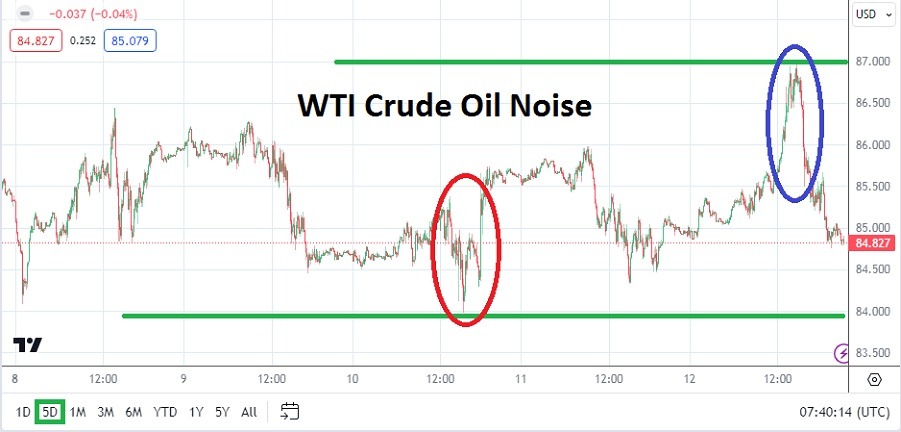

- WTI Crude Oil went into the weekend having come off earlier highs seen on Friday and finished near the 84.830 mark. A gap upon the opening of the commodity early on Monday will not be a surprise.

Traders who do not have open positions in WTI Crude Oil working, and are curiously speculative need to be careful, perhaps monitoring price action while sitting on the sidelines is the safest strategy. Logically it is suspected the price of WTI Crude Oil should see an early jump in price, but expect volatile and lightning quick changes in value. The high for WTI Crude Oil on Friday did hit the 87.000 level before reversing lower.

Speculative Notions and Middle East Reality in WTI Crude Oil

Friday’s high before reversing lower came within sight of apex values seen the week before. However, the conflict between Iran and Israel is international news and WTI Crude Oil traders via large players will certainly react, and perhaps with a bit of nervousness. It should be said that large traders in WTI Crude Oil understand geo-political dynamics quite well, so retail traders who want to bet blindly on upside value in the commodity should be very careful, because price dynamics may also produce strong reversals lower periodically.

While it may be tempting to believe WTI Crude Oil will see early spikes this week, there is a chance the price of the commodity will soon start to have realistic perspectives influence trading. The supply of Crude Oil is not in jeopardy at this moment. Clear thinking strategy from day traders will be needed. Entry price and stop loss orders will be essential to make sure WTI Crude Oil wagers are not vulnerable to sudden bursts of news which causes surprises.

Top Forex Brokers

WTI Crude Oil and Inflation Considerations

Not only has this weekend’s Middle East developments made traders nervous as they get set to participate in WTI Crude Oil early this week, but news regarding U.S inflation will also factor into outlook regarding the price of the commodity. Higher prices in WTI Crude Oil will not be welcome internationally as many nations clearly still have battles to wage against inflation. However, wanting the price of WTI Crude Oil to come down because inflation is too high is wishful thinking.

- Trading early on Monday and the first handful of hours in WTI Crude Oil will be dynamic and risk management is urged for day traders who want to speculate.

- Swift price action in WTI Crude Oil could start to create whipsaw results, this as large speculative positions are taken by market participants who hold different outlooks about geo-political risks and supply as logistics from the Middle East are considered in the short-term.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 83.600 to 91.000

Speculative risks would appear to be on upside direction and the volatility which could develop in WTI Crude Oil early tomorrow and as the week develops. While downside risks is certainly a consideration, support near the 84.000 may prove to be durable, particularly if there is early upside price action early this week in WTI Crude Oil.

Day traders should be cautious and make sure they are not over leveraged, and that they are not too ambitious regarding upwards price mobility in WTI Crude Oil. While it is hard to judge what geo-political scenarios will develop this week, if a certain amount of calm is restored this might allow for reasonable trading results. The high for WTI Crude Oil around the 20th of October was near the 89.650 level. It seems reasonable this value could be challenged if fear builds among large traders in the near-term, but there are no guarantees and retail wagers should be made carefully.

Ready to trade our Crude Oil weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.