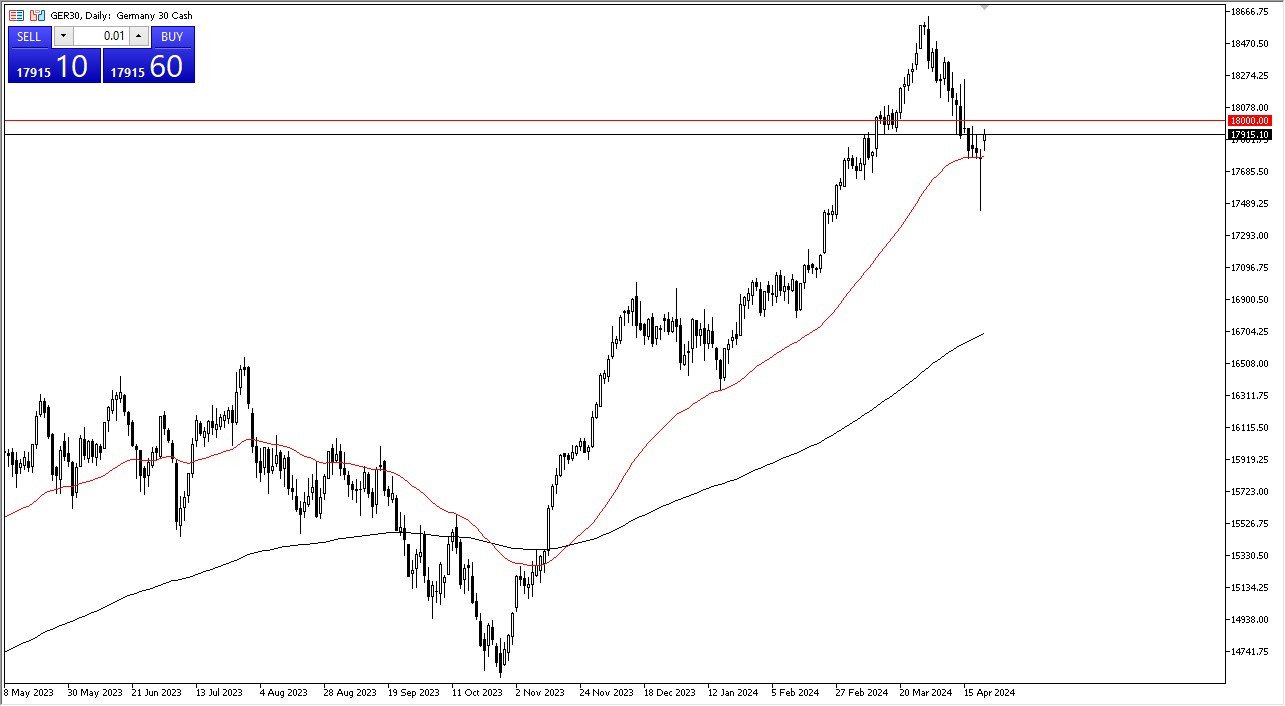

- The German DAX gapped to the upside during the early hours on Monday, as it looks like we are trying to recover.

- The €18,000 level above will continue to be an important area to pay attention to, as it is a large, round, psychologically significant number, and it is also an area where we have seen a lot of action as of late.

Keep in mind that the DAX index is considered to be the bellwether index for the European Union, so you should be thinking far beyond Germany, and the health of the European Union itself. Since the Great Financial Crisis, there has been this perverse correlation between loose money and stocks going higher, and quite frankly with the European Central Bank likely to cut rates later this summer, it does make sense that European stock markets start to rise. This is especially true in a place like Germany which is such a major exporter, and benefits from loose monetary policy as it can make the euro less expensive for foreigners. In other words, “bad news is good news”, as a recession in Germany is good for corporate earnings. I know, it’s counterintuitive but this is the world we live in.

Top Forex Brokers

Buying on the dips

At this point, it looks like buying on the dip will continue to be the favored way to approach this market, because quite frankly I do think that has much further to go. If we can break above the crucial €18,000 level, then I suspect that there will be more momentum chasing involved, and that the market will find a way to start buying again. At that point, I would suspect that the market would find a way to go looking toward the €18,500 level above, where we had seen a bit of selling pressure. After that, it could open up a move all the way to the €20,000 level. That being said, I think it would take a significant amount of effort to make that happen.

Potential Signal

- I believe that if we can break above the €18,000 level, it’s time to start buying the DAX again.

- At that point, I would have a stop loss just below the 50-Day EMA indicator, it would be aiming for a move to the €18,525 level.

- At that point in time, I would move my stop loss to break even and hold on to my position.