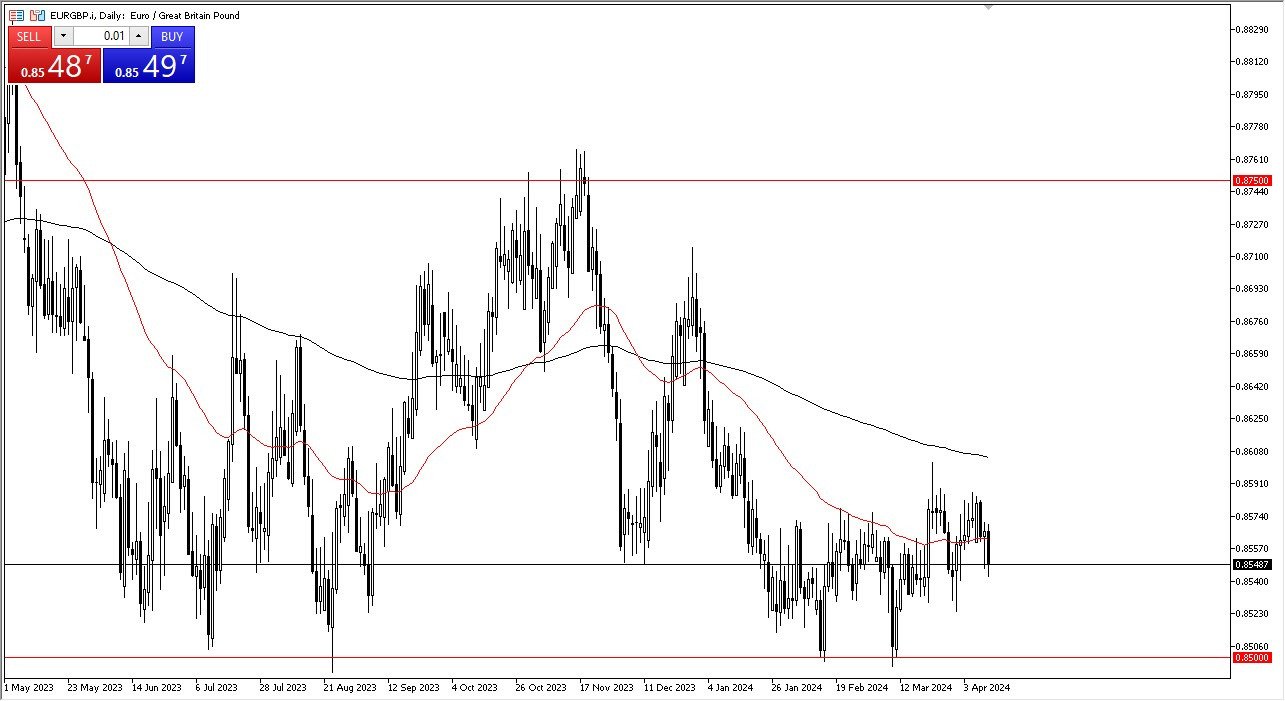

- The euro has fallen against the British pound during the trading session on Thursday, breaking down below the 50-Day EMA.

- Ultimately, a lot of what we are seeing here is a simple continuation pattern of a potential accumulation phase.

- The market is currently dancing around the 0.8550 level, which is right in the middle of the overall range that we have been in for some time.

Underneath, we have the 0.85 level as a major support region, an area that has been tested multiple times. I think at this point in time, the market is likely to continue to look at that as a “hard floor” in the market, as it has been important more than once. The 0.86 level above is a major resistance barrier that a lot of people would pay close attention to, especially as the 200-Day EMA is sitting in that same area as well.

ECB Press Conference

The European Central Bank had an interest rate decision which of course was no change, but at this point in time, the market was paying more attention to the press conference afterward. Christine Lagarde suggested that the central bank would do something as soon as they think the inflation situation gets down to a reading of 2%. In fact, she even suggested that they were going to do things proactively down the road.

Top Forex Brokers

All things being equal, this is a market that I think is trying to form some type of accumulation phase and then bounce. The market is going to pay close attention to that 0.85 level, because it is so important from a longer-term technical analysis standpoint, and if we were to break down below there, it would obviously send the euro plunging. At this point, I don’t necessarily see that owning one currency over the other makes a huge difference, so I think we get a lot of back-and-forth more than anything else. However, we will eventually break out of this trading range, and once we do it’s likely that we will make a very significant move.

Potential signal

The EUR/GBP breaking above 0.86 has me buying this pair. I would have a 100 point stop, with a target of 0.8725 above. However, keep in mind that this market tends to move slowly, so patience will be needed.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.