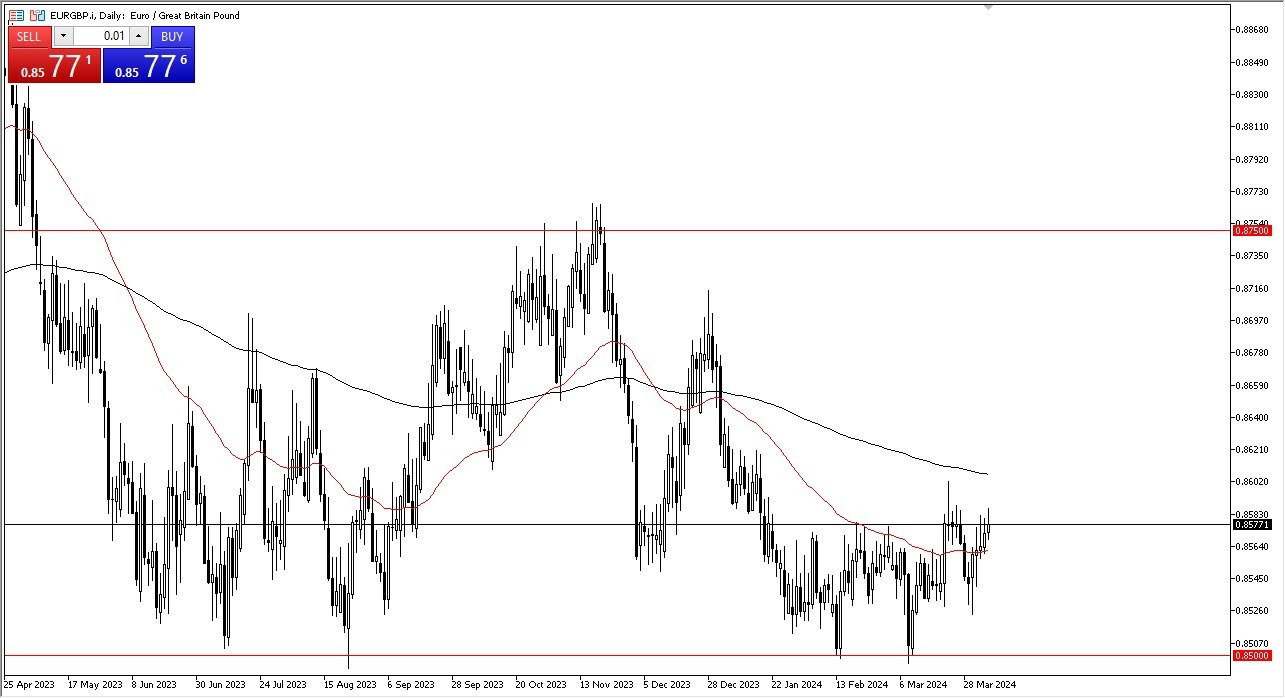

- The euro initially rally during the trading session on Friday, as we continue to see a lot of resistance near the 0.86 level.

- All things being equal, this is a market that I think continues to see a lot of volatility, but if we continue to see the 0.68 level offer resistance, it may be very difficult to continue to go higher.

- That being said, if we can break above the 200-Day EMA, it could very well open up a much bigger move.

That being said, if we do pull back, I think at this point we continue to see a lot of consolidation between here and the 0.85 level underneath. The 0.85 level is an area that a lot of people will look at as a “hard floor” in the market, as it is not only a large, round, psychologically significant figure, but it is also an area where we have seen a lot of action in the past. The question now is whether or not we are starting to form some type of bottoming pattern that could turn around and send this market higher given enough time.

Top Forex Brokers

Building a base?

At this point in time, I think it’s probably a market that is trying to build some type of base for a return to an uptrend, but we continue to see a lot of resistance above that seems to keep a lid on this market. That being said, if we do break out to the upside, it could bring in a lot of momentum following it as there would be a certain amount of a “FOMO trade” coming into the picture.

Pay attention to the EUR/USD pair and the GBP/USD pair. If you start to see one outperform the other, that will give you an idea as to which direction you should be trading this market. That being said, the market is likely to continue to see a lot of volatility, because this pair is typically choppy to begin with. However, this is a market that I think you need to pay close attention to, due to the fact that we could have a big move coming somewhat soon at this point in time.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.