- The EUR/USD was all over the place during the early hours on Tuesday as we continued to consolidate in general.

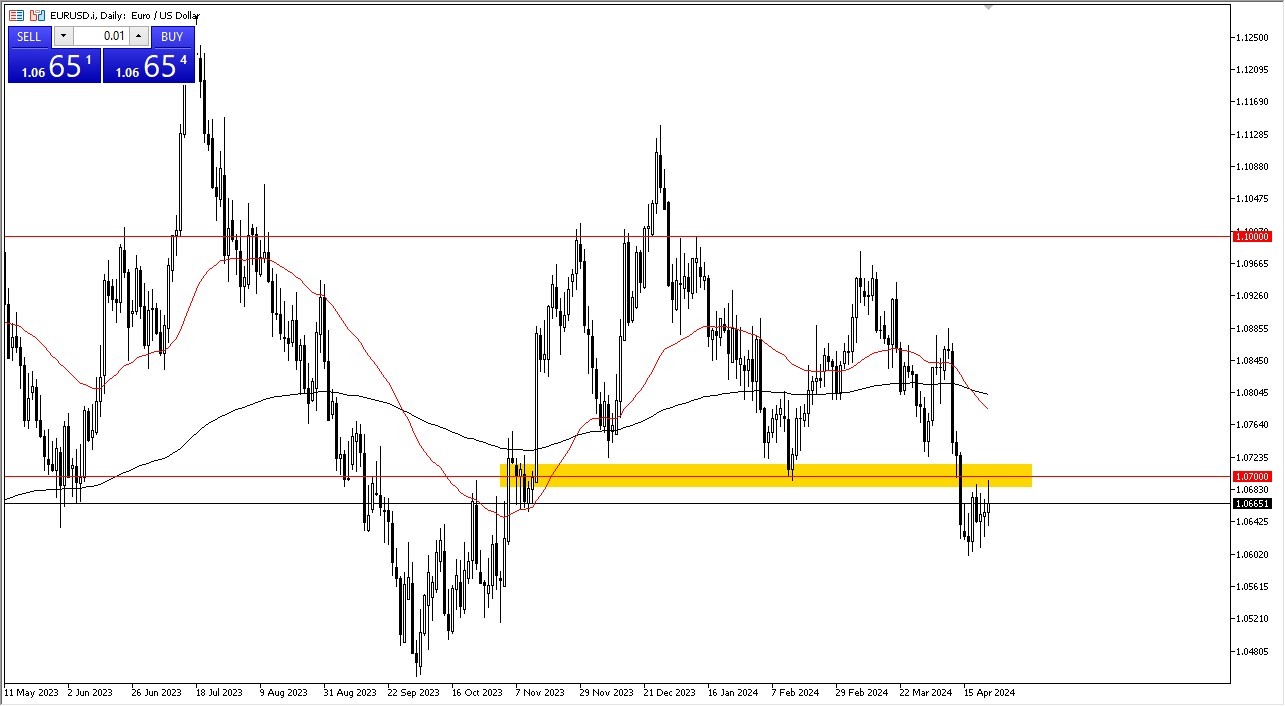

- The 1.07 level above has offered resistance, which makes sense because there's a lot of market memory there, as it previously had not only been resistance, but it's also been support.

- Underneath we have the 1.06 level that is going to offer quite a bit of support and has been here over the last couple of sessions.

Essentially you have a market that doesn't know which direction it wants to go, but at this point in time I think it's somewhat obvious that we are going to consolidate in the short term. This does make sense considering that there are a lot of concerns out there and we did just fall rather significantly due to the fact that the ECB looks likely to cut rates before the Federal Reserve.

Top Forex Brokers

Tit-For-Tat Trading?

That being said, we now find ourselves in a situation where the EUR/USD market is likely to continue to see a lot of tit-for-tat trading here as the Federal Reserve is likely to cut later as well. So really at this point, I don't see a clear winner here with the exception that the US dollar does get a little bit of a boost due to geopolitical concerns. So perhaps this remains a fade the rally type of trade.

The 50 day EMA above would be a target if we break above the 1.07 level, but I think also would also end up being a significant barrier. If we break down below the 1.06 level, then the 1.05 level underneath would be a target. While I don’t see that happening easily, it is a very real possibility at this point in time as there are so many things that people will be concerned about overall. This market will continue to see a lot of chop more than anything else from what I see. However, if you are a short-term trader, you might find value in this type of behavior.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.