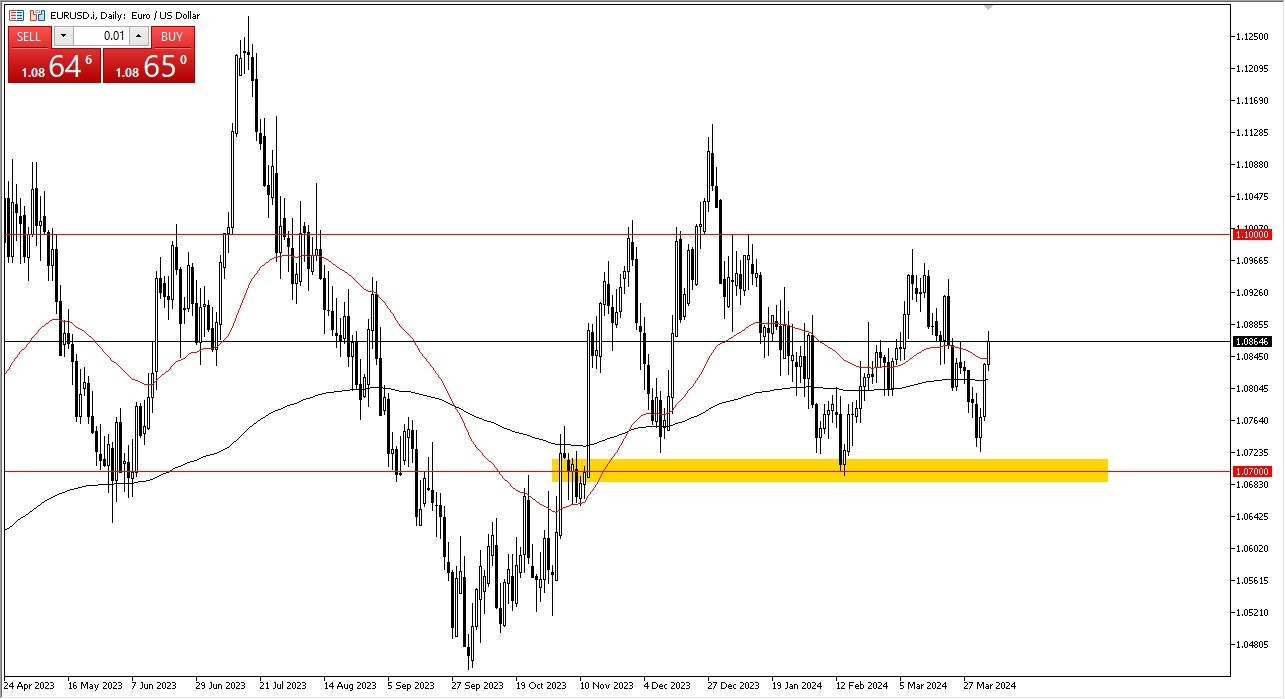

- The euro rallied a bit during the trading session on Thursday, as we continue to see a lot of recovery from the bottom of the overall consolidation area.

- After all, keep in mind that the 1.07 level underneath has been a significant support level, right along with the 1.10 level above which of course has been a significant resistance barrier.

- At this point in time, we are essentially hanging around in the middle, and therefore it looks like we are going to continue to see traders hang around this area as it is essentially where I would mark “fair value.”

Non-Farm Payroll

The nonfarm payroll announcement comes out during the day on Friday, that will almost certainly have a major influence on what happens next. This is probably why we have ended up at “fair value”, and therefore I think it makes perfect sense that we are sitting right where we are. I like the idea of waiting to see what Friday does before putting money to work, but I think the set up from a technical analysis standpoint currently is to wait to we get to the outer part of the consolidation range to put money to work and then start to fade signs of exhaustion, regardless of what direction it is. That being said, if we were to break out of this range, it’s very likely that we could see quite a bit of momentum, but at this point it doesn’t look like we are going to see that anytime soon as we are so far away from both edges.

Top Forex Brokers

The ECB and the Federal Reserve both are likely to cut rates sometime this year, and therefore neither central bank has a “leg up” on the other. Because of this, I don’t necessarily think that any direction has more strength than the other, and it’s also possible that any knee-jerk reaction from the jobs figure will fade by the end of the session. This is typical for nonfarm payroll Friday anyway, so that would not be a surprise to me at this point in time.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.