Bearish view

- Sell the EUR/USD pair and set a take-profit at 1.0765.

- Add a stop-loss at 1.0820.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 1.0800 and a take-profit at 1.0850.

- Add a stop-loss at 1.0750.

The EUR/USD exchange rate rose slightly after last Friday’s US inflation gauge. After tumbling to a monthly low of 1.0768 on Thursday, it rose to 1.0795 as the focus shifts to the upcoming US jobs, PMIs, and statements from key Fed officials.

Key economic data ahead

The EUR/USD pair drifted upwards as investors reacted to the Federal Reserve’s favorite inflation gauge. In a report on Friday, the US said that the personal consumption expenditure (PCE) inflation rose by 0.3% in February. The core PCE figure rose to 0.3%, meeting analysts estimates.

On a YoY basis, the two numbers rose to 2.5% and 2.8%, respectively. Further, the real consumer spending rose by 0.4%, beating the estimated 0.1%. These numbers signal that inflation is moving gradually to the Fed’s target of 2.0% while the economy is doing well.

The EUR/USD rate will be muted on Monday as most countries are closed for Easter Monday. As such, the volume will be lower than other Mondays.

Top Forex Brokers

The pair is bracing for major economic numbers later this week. In Europe, Eurostat will publish the flash consumer inflation number for March on Tuesday. Economists expect the data to show that the headline CPI dropped to 2.5% while the core CPI narrowed to 3.1%.

This report will come two days after Yannis Stournaras, a member of the governing council, estimated that the bloc would slash rates four times totalling to 100 basis points by the end of the year.

The most important number will come out on Friday when the Bureau of Labor Statistics (BLS) publishes the March non-farm payrolls (NFP) data. Economists believe that the labor market remained tight in March, with the jobless rate set to move below 4%. Jerome Powell, the head of the Federal Reserve, will also deliver a statement on Wednesday.

EUR/USD technical analysis

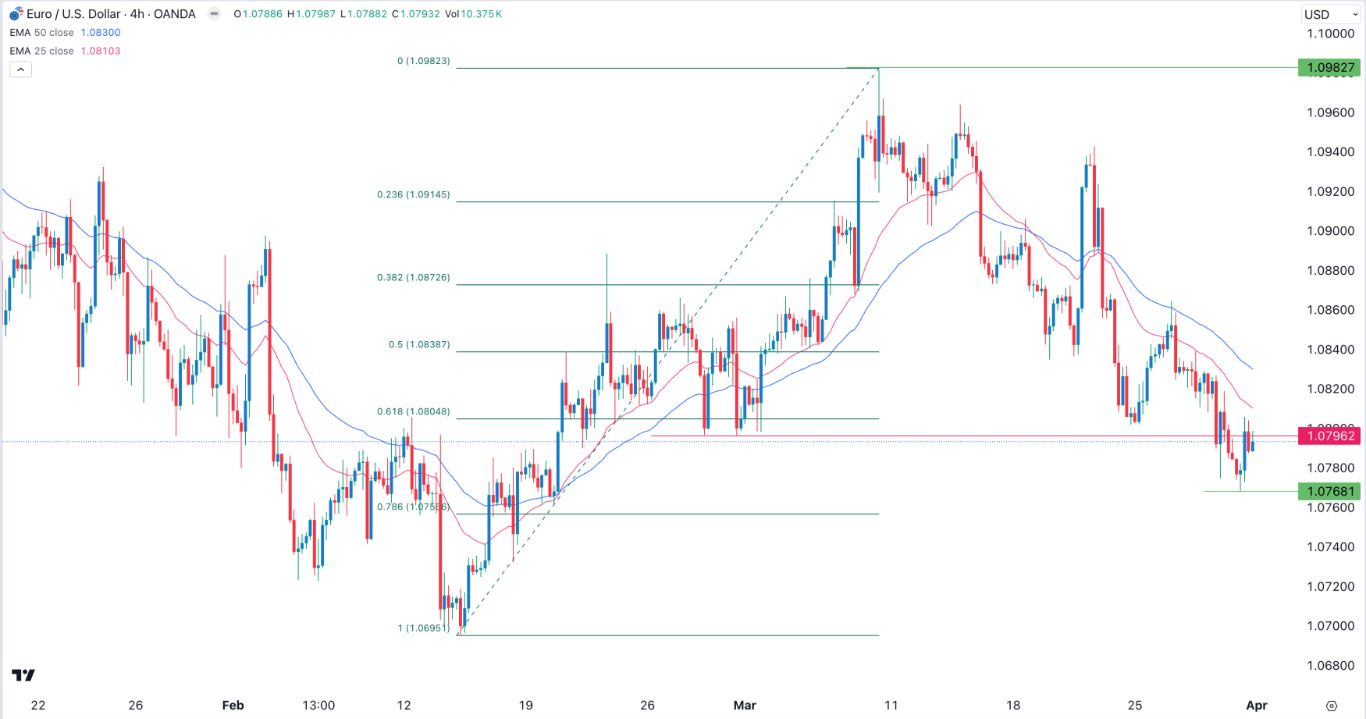

The EUR/USD pair has been in a strong bearish trend after peaking at 1.0982 in March. It retreated to a low of 1.0788 on Thursday where it formed a small morning star pattern. The pair has remained below the 50-period and 25-period moving averages.

It also slipped below the 61.8% Fibonacci Retracement level, which is a bearish sign. The pair has retested the key resistance level at 1.0795, its lowest swing on February 29th. Therefore, the outlook for the pair is extremely bearish, with the initial target being last week’s low at 1.0768.

Ready to trade our free Forex signals? Here are the top brokers in Europe to choose from.