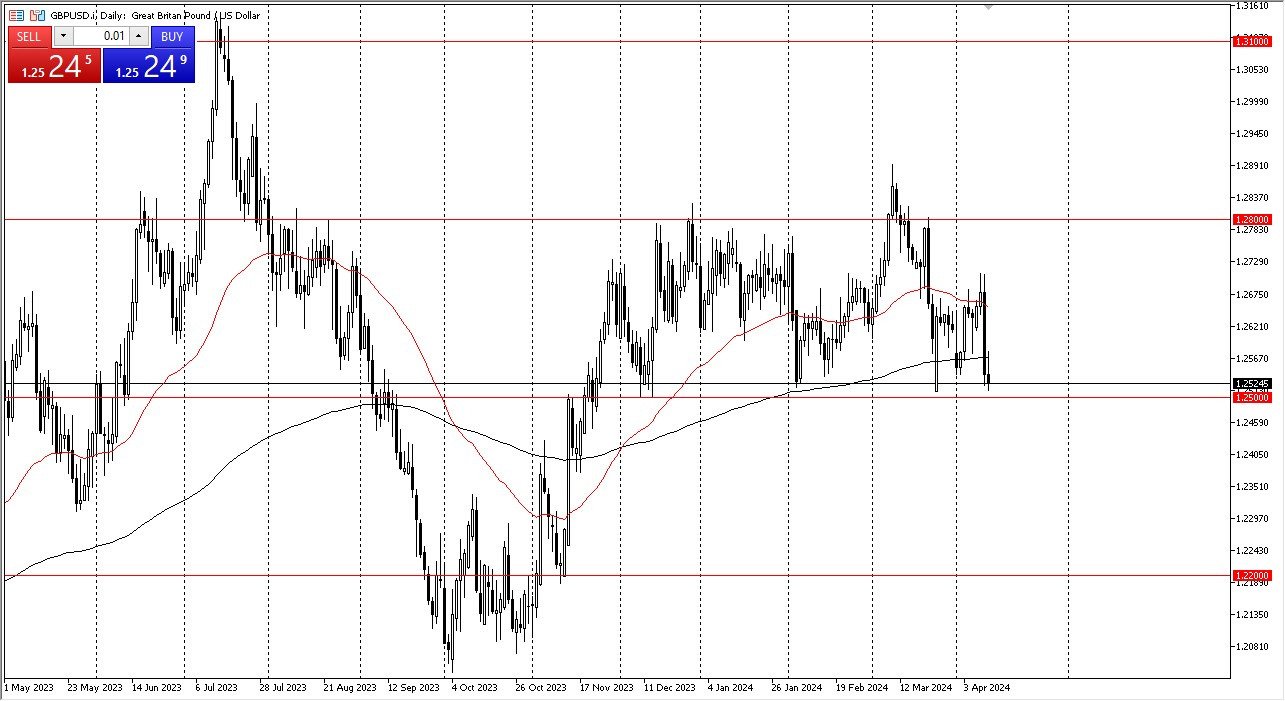

- The British pound initially rally during the trading session on Thursday to reach the 200-Day EMA, but then turned around to show signs of negativity.

- By doing so, it looks like we are trying to form an inverted hammer, and it’s probably worth noting that this inverted hammer sits on top of the 1.25 level, an area that is obviously a large, round, psychologically significant figure, and an area that has seen a lot of support previously.

What makes me pay close attention to this area is because I am seeing a lot of currencies give up initial gains against the US dollar, and that suggests to me that we will continue to see the US dollar try to strengthen, because it’s not just against the British pound that I’m see in this action, it’s also the Australian dollar, the euro, and several others. If the GBP/USD pair does break down below the 1.25 level, then it’s likely that this pair drops rather significantly, perhaps as low as the 1.22 level underneath.

Support

This is an area that I would expect a certain amount of support, so if we turn around and take out the 200-Day EMA on a bounce, then I think you have a real shot at the British pound going higher to reach the 1.27 level, and then eventually the 1.28 level which is a major resistance barrier. In general, I think it’s going to take some type of ship to make that happen, as we have so clearly rebuked the buying pressure that came into the picture early on Thursday. That being said, I think the Friday session is going to be crucial for the British pound as it could dictate where we go for the next 300 pips.

Top Forex Brokers

I would expect a certain amount of volatility, but I would wait until we see some type of daily close to make a bit of a decision, because there is high probability of a significant amount of volatility in this area. In general, this is a market that I expect a lot of noise in, but I am very interested in the British pound against the US dollar at the moment, as it could be a nice set up.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms UK to choose from.