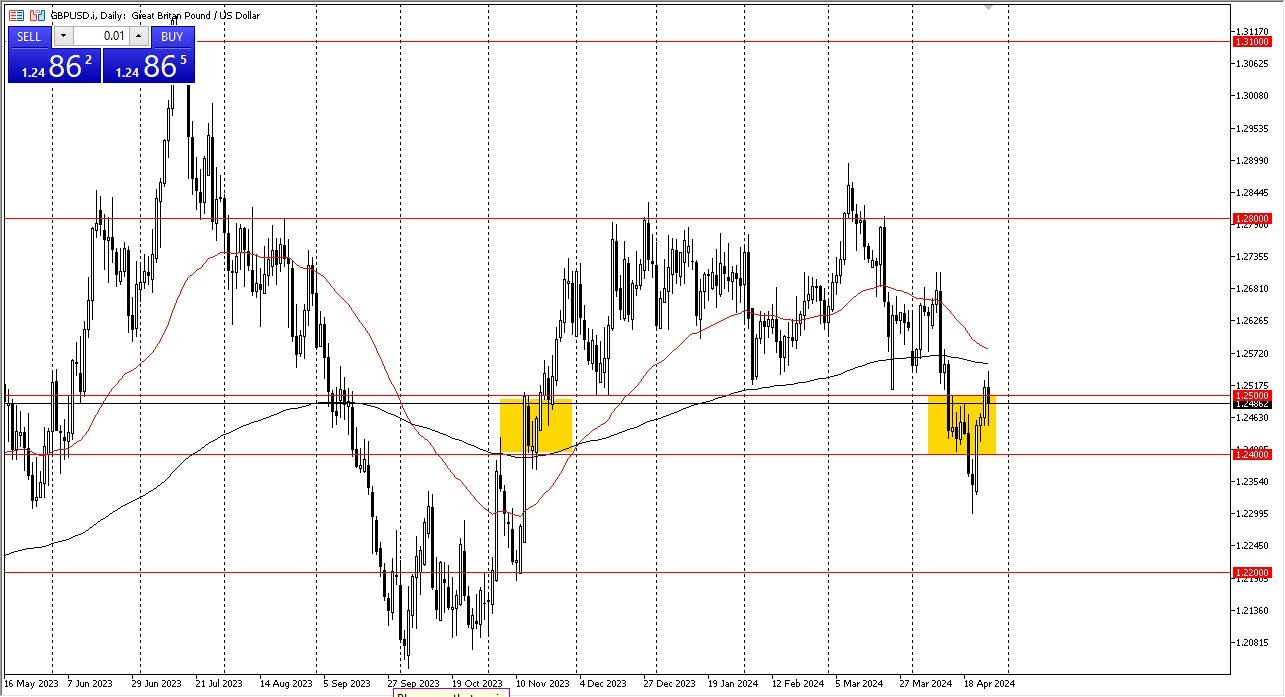

- The British pound initially fell during the trading session on Friday, only to turn around to show signs of life near the 1.2450 level.

- This is an area where we have seen a lot of noise in the past, and therefore I think it does make quite a bit of sense that we would see “market memory” coming into the picture and showing signs of life.

- The fact that we closed on a slight bounce is a somewhat positive situation, but we still have a lot to work through just above.

The 200-Day EMA is just above the candlestick for the trading session on Friday, and therefore I think it’s a situation where we would have to pay close attention to it as a possible barrier that will be difficult to overcome. That being said, we could break above the 200-Day EMA, the GBP/USD market could go looking to the 1.27 level. That obviously would be very bullish, but at this point in time we also have a lot of strength in the US dollar, so that is something worth paying attention to.

Top Forex Brokers

Expect Volatility

I think at this point in time it makes quite a bit of sense that we would see noisy behavior here, because we are trying to break out of a very small consolidation range. Furthermore, we also have the 50-Day EMA dropping toward the 200-Day EMA, so with that being said we are getting close to getting the so-called “death cross”, that a lot of people pay close attention to from a longer-term standpoint.

In general, I believe that we are going to go back and forth for some time and it’s likely that we will struggle to get any type of clarity. The British pound of course has been so left quite viciously against the US dollar, but at this point the pair is probably going to take his cues from what’s going on with the US dollar, and of course interest rates in the United States as well. With this, the market is likely to continue to see noise.

Ready to trade our daily Forex analysis? Here are the best regulated trading platforms UK to choose from.