Potential Signal:

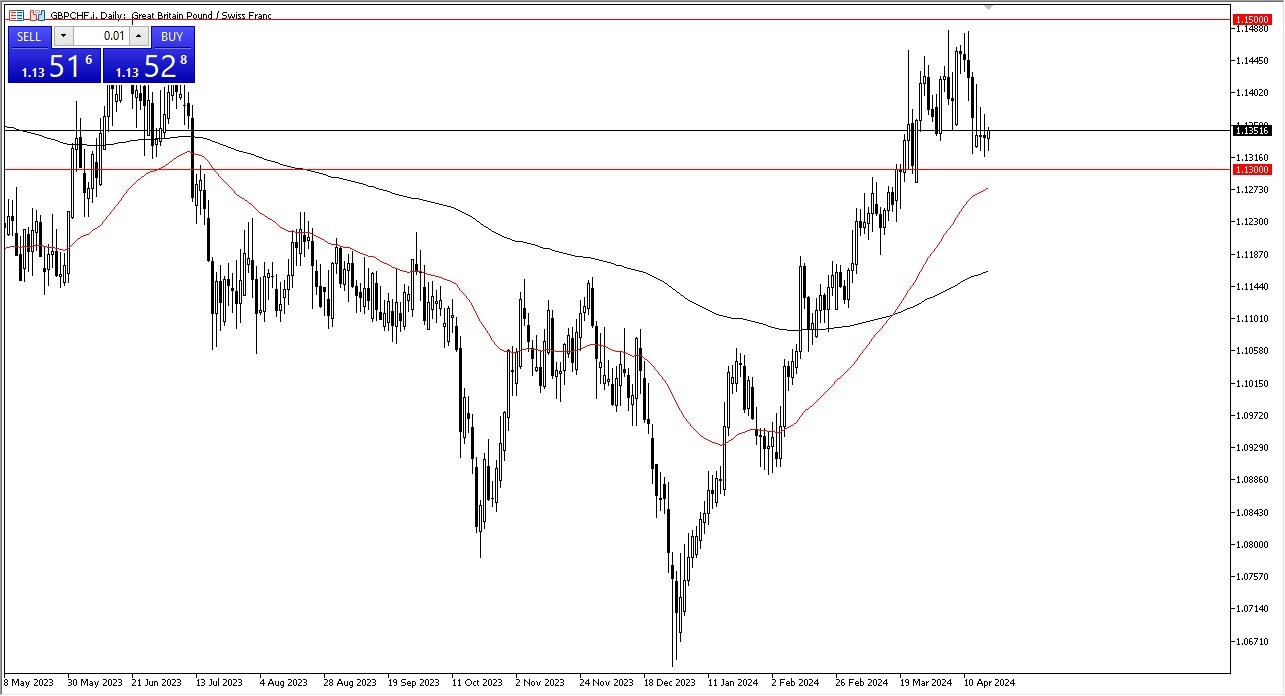

The British Pound continues to look strong against the Swiss franc, and as we are close to a major support barrier in the form of the 1.13 level, I am a buyer at this level. I would have a stop loss underneath the 50-Day EMA. My short-term target is 1.1475 above.

- Over the last several sessions, I have been paying close attention to the GBP/CHF pair, as it has such a significant amount of swap that you can get paid, and of course there is a major divergence between the two major central banks.

- Ultimately, the Swiss National Bank recently cutting rates has a major influence on this market, as the SNB is the first major central bank in the world to cut rates.

- This will continue to keep the Swiss franc on its back foot and is likely that will continue to drive the value of the Swiss franc lower over the longer term.

Top Forex Brokers

Technical Analysis

The pair does look very bullish, and the 1.13 level underneath is going to continue to be important. It’s an area that we’ve seen a little bit of action at previously, but we also have the 50-Day EMA approaching that region a little bit of a bounce from there does make quite a bit of sense, due to the fact that you get paid at the end of every day to hold this currency pair. Furthermore, it’s possible that the Swiss National Bank may continue to cut rates, and if that’s going to be the case, the Swiss franc becomes a massive funding currency for currency traders.

On the upside, we have the 1.15 level above offering a significant amount of resistance, and I think we simply bounce back and forth in this area as we continue to build up the necessary momentum eventually to perhaps break out. If we can break above the 1.15 level, then it is likely that we could go higher, perhaps reaching as high as 1.20 over the longer term.

On the other hand, if we were to break down below the 50-Day EMA, then it’s possible that the market could go down to the 200-Day EMA, which sits right around the 1.1150 level. All things being equal, this is a market that I think continues to see a lot of volatility, but I still favor the upside as the swap at the end of the day continues to be a major feature of this pair.

Ready to trade our free trading signals? We’ve made a list of the top 10 forex brokers in the world for you to check out.