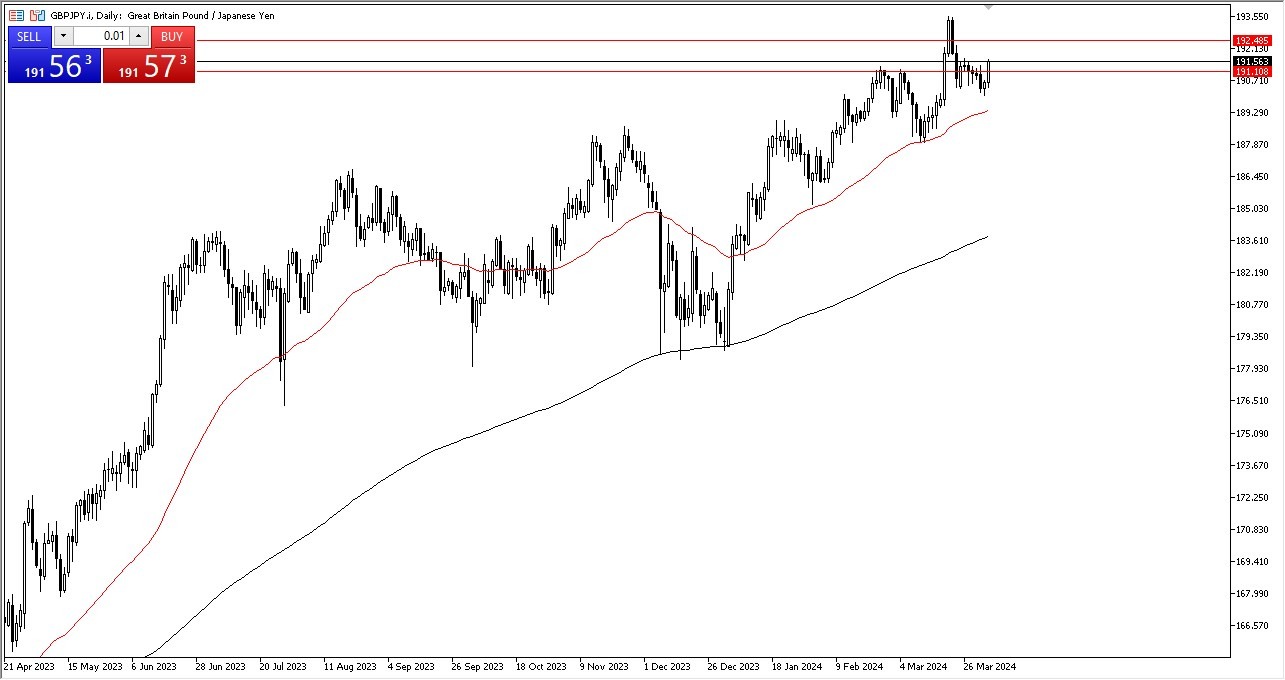

- The British pound has risen significantly during the course of the trading session on Wednesday, as it looks like we are now getting ready to rally yet again.

- All things being equal, this is a market that continues to pay you to hold onto the currency pair, and therefore you need to be aware of the fact that there are longer-term traders involved in the so-called “carry trade.”

Short-term pullbacks continue to be buying opportunities going forward, and therefore I like the idea of looking for value every time I can. With this being the case, I do believe that we eventually go looking back to the upside, and then try to get to the ¥193 level. Underneath, the ¥190 level is an area that is significant support, with the 50-Day EMA reaching toward the ¥190 level as well. In general, I like this market quite a bit as the Bank of Japan is completely feckless.

Top Forex Brokers

Bank of Japan

The Bank of Japan has recently risen rates to 0% interest, therefore I think although it’s a positive sign, the reality is that they are nowhere near closing the overall gap between the 2 currencies, therefore you get quite a few traders taken advantage of this behavior. All things being equal, this is a very strong looking candlestick for the day and I think it’s probably only a matter of time before we do continue to see upward trajectory play itself out.

Keep in mind this pair is highly sensitive to risk appetite as well, so if we start to take on more risk, it does make quite a bit of sense that this pair continues to go higher. If we can reach the highs again, then we could open up a move all the way to the ¥195 level, which would be a continuation of the longer-term upward trend that we have seen sense the end of last year.

For additional & up-to-date info on brokers please see our Forex brokers list.