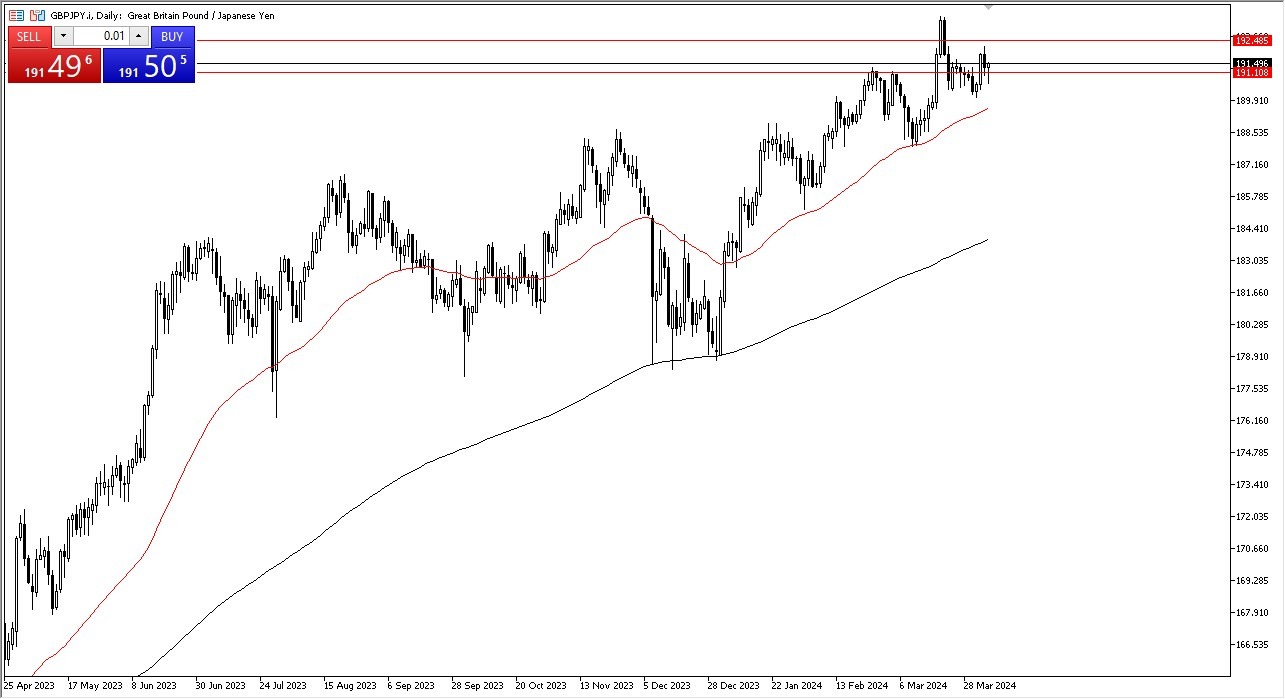

- The British pound initially pulled back just a bit during the course of the trading session on Friday but has turned around to recover quite nicely.

- At this point in time, it looks like the market is going to end up forming a bit of a hammer, right at a support level in the form of the ¥190 level.

- This is a market that’s been in a strong uptrend for quite some time, so I think it’s probably only a matter of time before we continue to go higher.

At this point in time, the market looks like it’s going to try to get back to the recent highs, if we can break above that level then we are free to go looking to the ¥195 level. That’s an area that a lot of people will be paying attention to, as it opens up the possibility of a move all the way to the ¥200 level. This is a market that’s been there before but it’s been several years so expect a bit of a fight if we get anywhere near there.

Top Forex Brokers

Interest-rate differential

There is a massive interest-rate differential between the 2 economies, therefore I think it makes sense that we continue to hold this pair. In fact, I have been long of this market for quite some time, and I think that Friday was yet another opportunity to add even more to an existing position. However, if you have not been involved already, this might be yet another opportunity to start buying.

The Bank of Japan is currently trying to do everything it can to protect its currency, but you can’t do that with zero interest rates and a massive amount of debt. In general, this is a market that I think continues to see plenty of buyers due to that, as the world knows the Bank of Japan can’t do much beyond the occasional intervention, but it’s likely that it would only be a short-term turnaround. With this being said, I think that you have to look at this through the prism of the upside.

For additional & up-to-date info on brokers please see our Forex brokers list.