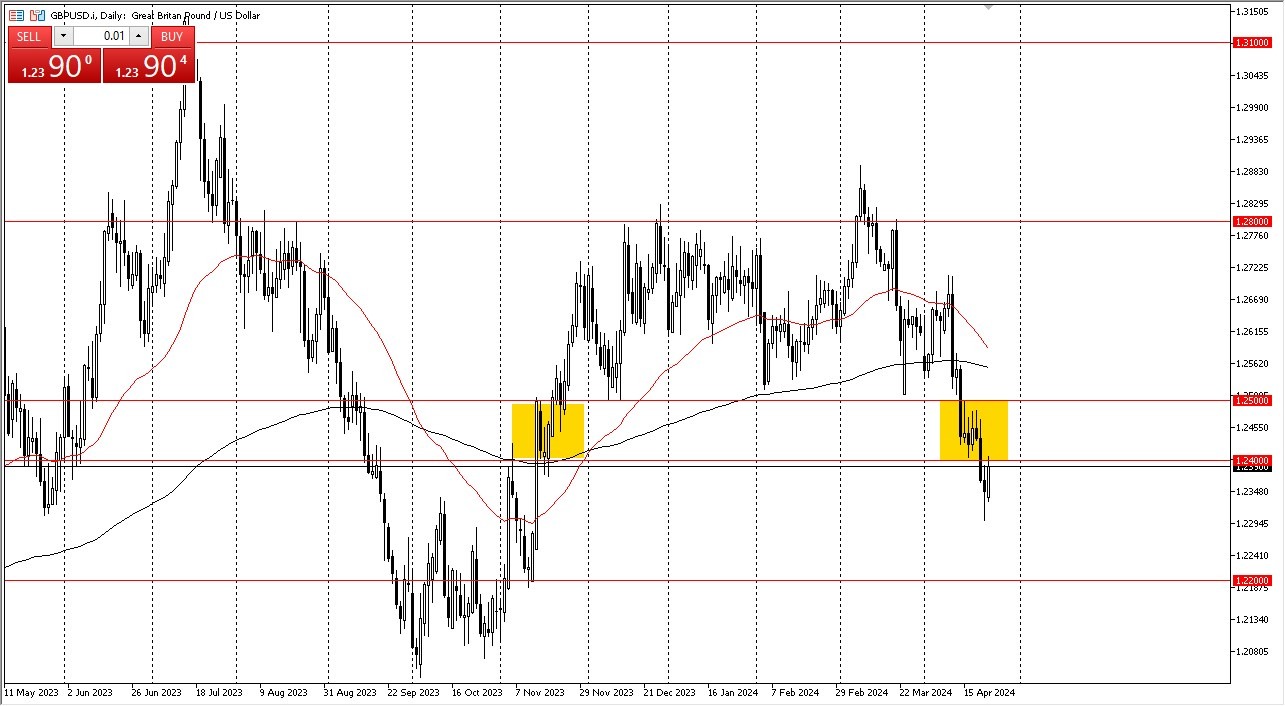

- The British pound has rallied a bit during the Tuesday session as we are testing the crucial 1.24 level.

- The British have now exited recession. So that's a good sign, but whether or not that's enough to get it to rise against the US dollar for a longer period of time remains to be seen.

- The 1.25 level above would be significant resistance.

As the charts look right now, choppiness could be expected, but you can also make that argument with a lot of other Forex pairs, especially when you are talking about pairs that are directly influenced by the movement in the United States dollar. As long as the Federal Reserve is likely to keep rates higher for longer, then the USD will continue to be attractive for some traders.

Top Forex Brokers

Fade the Rally?

I see this as a fade the rally at the first signs of exhaustion type of setup. If we were to break above the 1.25 level, then you can make an argument that perhaps we have much further to go. Until then, I look at this with a bit of skepticism as there is so much noise between the 1.24 and the 1.25 levels. This is the “arena” that I expect to be trading in this GBP/USD pair over the next several days.

If we break down below the 1.23 level, then I think it opens up the possibility of a move down to the 1.22 level. Keep in mind that the Federal Reserve is likely to stay tighter for longer, and that's part of what we're seeing in the currency markets and the behavior towards the US dollar. But we also have to pay attention to the idea that perhaps the market participants will continue to look at this through the likelihood of geopolitical concerns. That of course helps the US dollar quite drastically. So, keep that in mind. Expect volatility. I think that will continue to the play here, but in general, I'm watching this block between 1.24 and 1.25 very carefully to see whether or not traders see that as resistance.

Ready to trade our daily Forex analysis? Check out the best forex trading company in UK worth using.