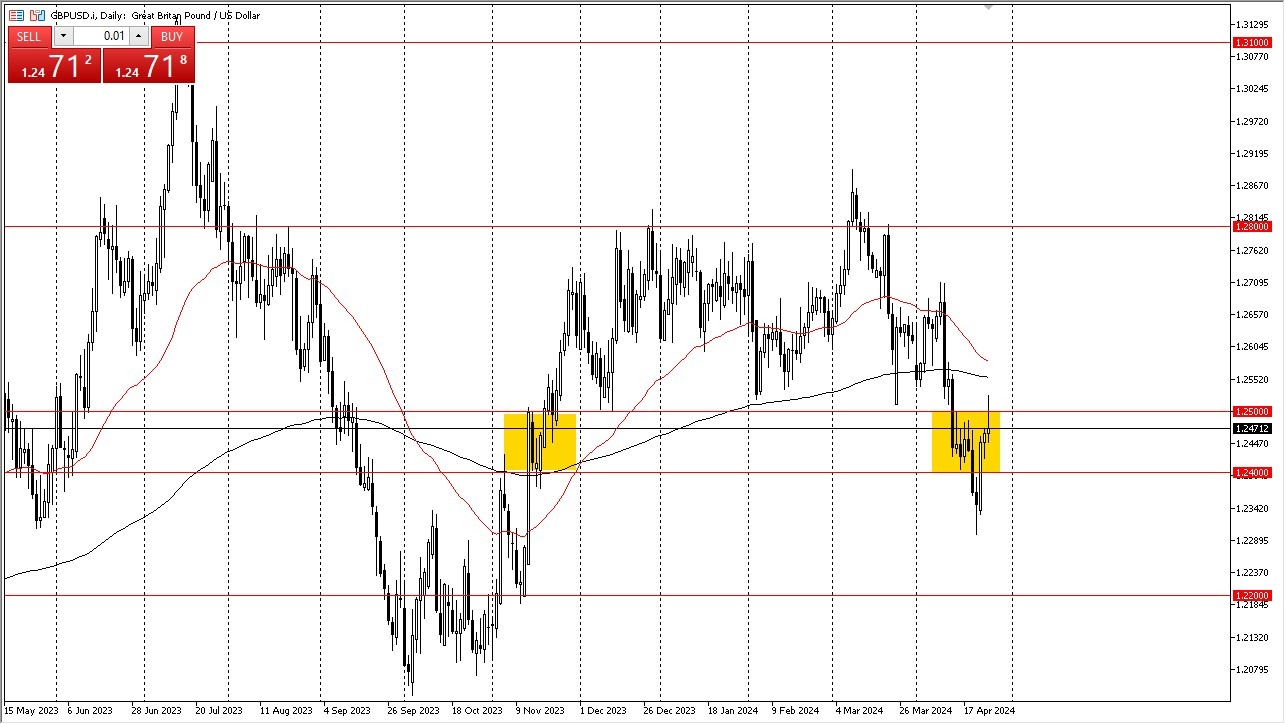

- The British pound initially rally during the trading session on Thursday but seems to be looking at the 1.25 level as a major barrier that’s all but impossible to stay above for any significant amount of time.

- Whether or not that ends up being the case remains to be seen, but it’s also worth noting that the 200-Day EMA is just above the 1.2550 level, and that will cause a bit of trouble in and of itself.

The fact that we have been repelled at a major round figure does suggest that perhaps we will continue to see pretty pound weakness, or perhaps more importantly, US dollar strength. We have been in a downtrend for a while so if this does track correctly, but at this point I think the one thing you can probably count on is a lot of volatility. Underneath, we have the 1.24 level, which is a large, round, psychologically significant figure that people have pay close attention to previously.

False Breakout?

There is potential that we have just seen a false breakout in the GBP/USD pair but and it’s a little early to call for the. We will have to see how it behaves from here, but it certainly plays well when looking at this pair through the prism of being in a downtrend for a while. Yes, we had seen a huge shot higher, but at this point it doesn’t seem as if we have enough momentum to chew through all of that resistance just above. In general, I think you continue to see a lot of noisy behavior, and therefore you have to look at this through the prism of a market that is going to continue to be very noisy, but also squeezed to the downside as the greenback has been so strong for so long.

At this point, it’s very difficult to short the US dollar, despite the fact that the British pound itself is representing an economy that just exited a recession. At this point in time, I think you have to look at any rally with a bit of suspicion, although the British pound may do fairly well against other currencies.

Ready to trade our Forex daily analysis and predictions? Here’s the best forex trading company in UK to trade with.