- Gold has been a bit all over the place during the early hours on Monday, and perhaps a little bit of relief is starting to creep into the market that the Middle Eastern War hasn’t expanded.

- It shouldn't be overly surprising that we will be trading on the edge of a knife, meaning that it's only going to take a couple of bad headlines this in this market straight back up in the air.

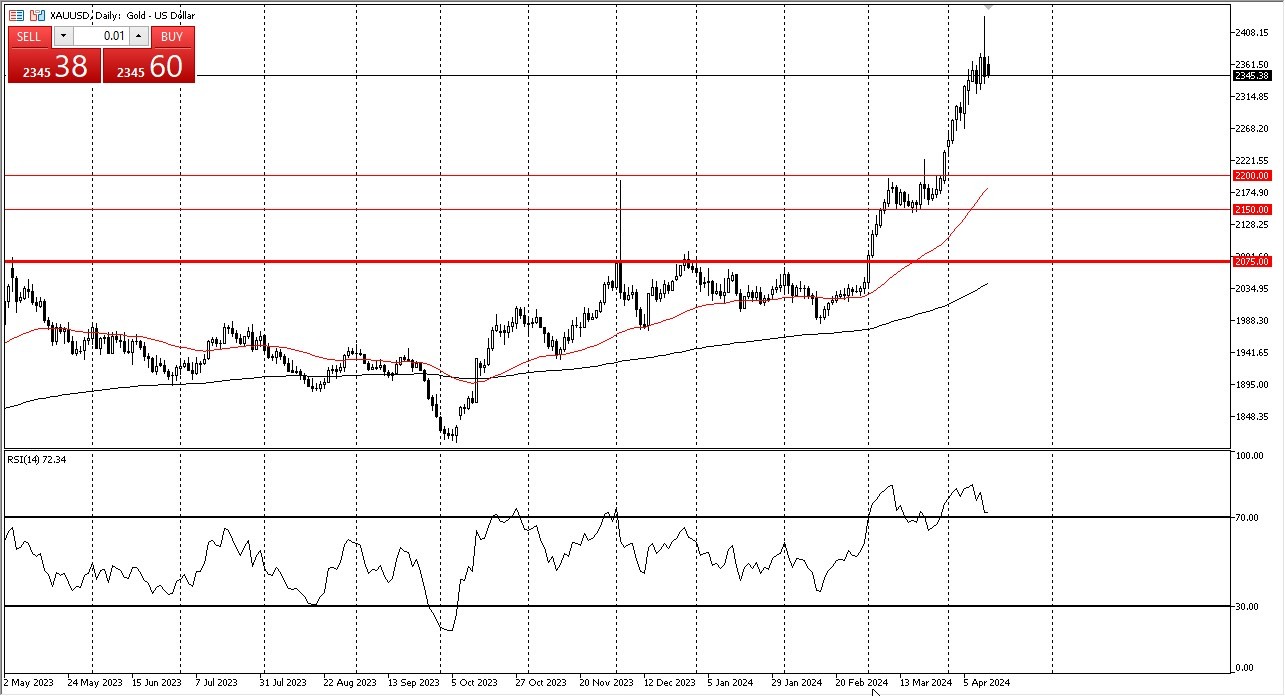

We are still in a secular bullish market when it comes to gold anyway, so I don't see any reason to short the gold market. The gold market has gotten a little bit ahead of itself, but I think a short term pullback makes a certain amount of sense, and it will end up offering value that traders will be taking advantage of.

Top Forex Brokers

Support Under Here

The $2,200 level will be an area of support based upon previous market memory. And of course, we also have the 50 day EMA sitting in that same general vicinity that assumes, of course, that we even pullback that steeply. I think that a pullback would be very healthy for the market as the RSI is well over 70. But at this point, anytime we pull back, you have to assume that there will be buyers willing to get involved.

I do think that gold goes looking to the $2,500 level. I do not have a scenario in which I'm willing to short gold, unless of course, something changes quite drastically from a fundamental analysis standpoint. But right now, I just cannot make that argument, as gold has been so strong. Ultimately, this is a market that I think will continue to reach higher, but every once in a while, you might have to deal with a sharp retracement.

The market will continue to move on to the idea of central banks buying gold, and the idea that interest rates will have to fall longer-term. Whether or not that happens remains to be seen, but there are also a lot of geopolitical risks out there that you will have to be aware of as well.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.