- Gold rallied a bit during the trading session on Friday, which is not a huge surprise considering that it's been in an uptrend.

- However, one of the biggest drivers of the gold rally, at least early in the day, was the Israeli attack on Iran.

- By attacking Iran, it had everybody running for cover of safety type assets and that of course includes gold.

With that being said, we don't really know what's going to happen over the weekend, but I do recognize that we have a scenario where a lot of traders are going to be very nervous heading into the weekend and trying to hang on to a lot of assets. That being said, owning gold is one way that they will protect themselves.

Top Forex Brokers

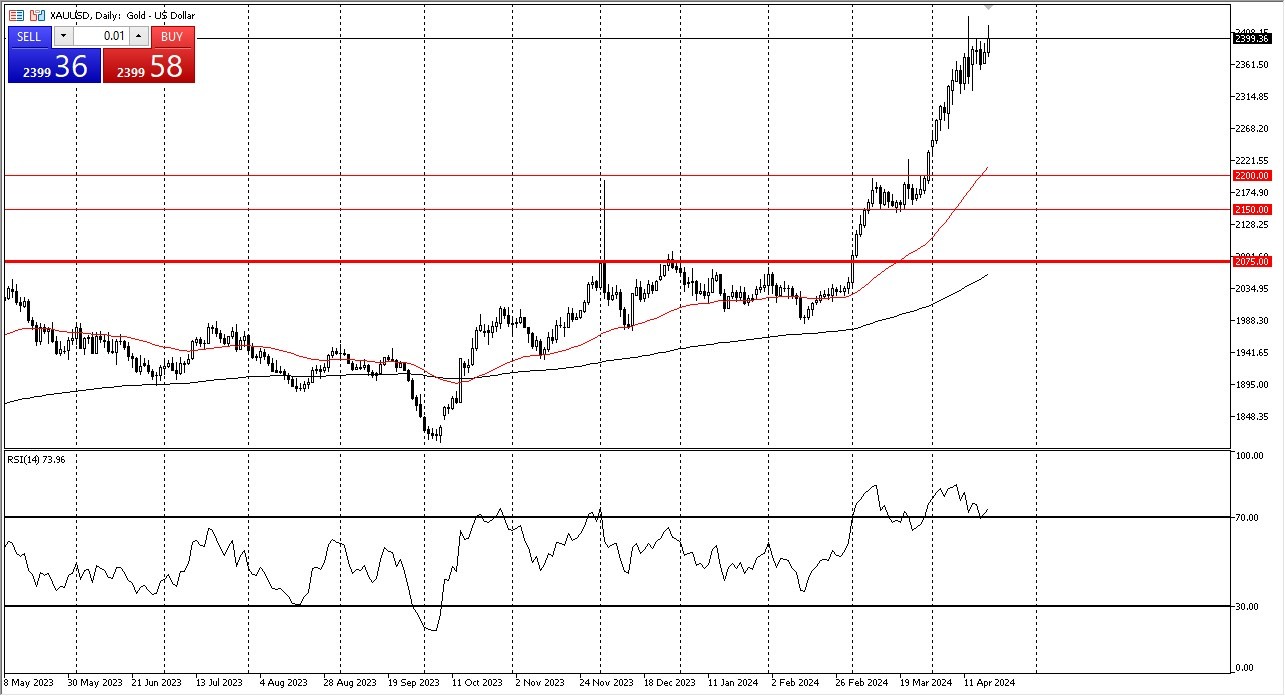

It's also worth noting that we gave back quite a bit of the gains once the reality of the attack and its lack of magnitude became apparent. With this being the case, I think you have to look at the market through the prism of one that is, of course, bullish, but at the same time is probably a little overdone. We are above 70 in the relative strength index and, of course, had gone straight up in the air for a while.

The Resistance Above

The $2,400 level continues to offer a bit of resistance, so that is worth paying attention to, and I think ultimately could cause the market to grind sideways a bit. It'll be interesting to see how this plays out because over the weekend, if we don't get any new tensions, that might cause the market to drift a little bit lower. On the other hand, something could happen, and we may gap straight up in the air.

With that being said, gold's difficult to hold right here unless you got in a while ago. I would love to see a pullback, perhaps as much as $200 to find value, but we will have to wait and see whether or not that actually presents itself. As things stand right now, I think you've got a market that you can't short under any circumstances, just simply because there are so many people rushing to get into it.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.