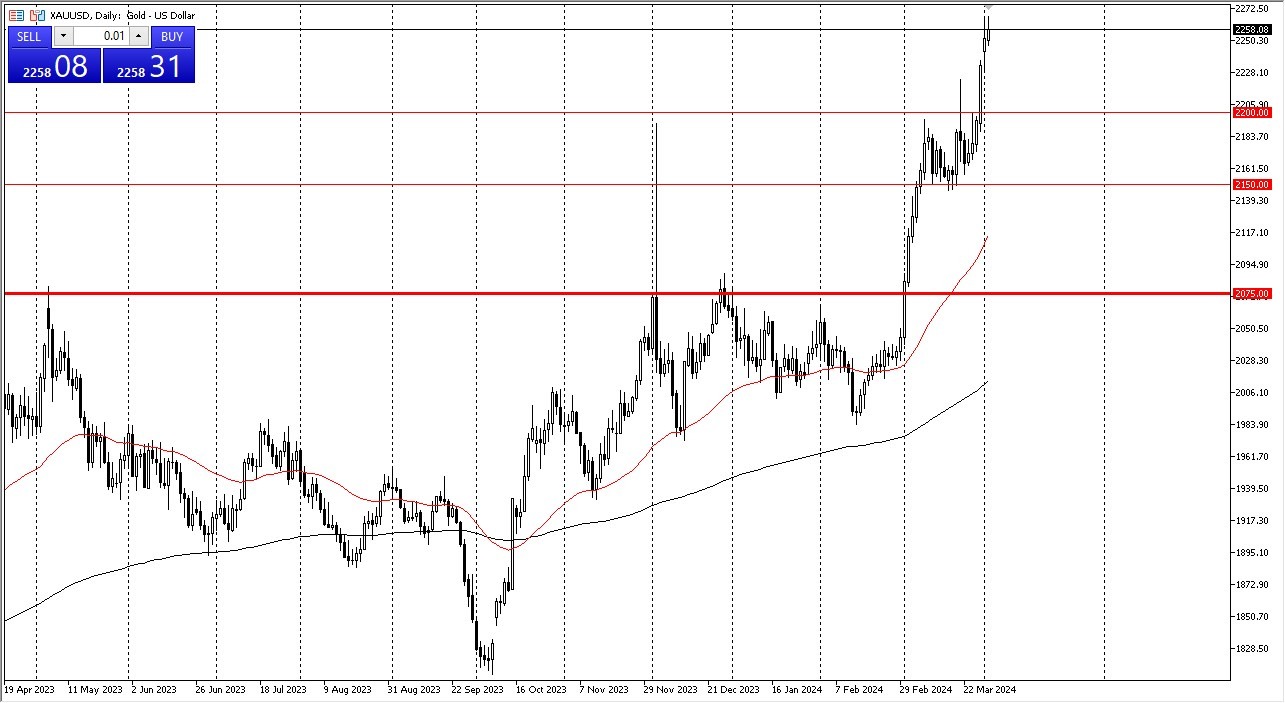

- Gold initially tried to rally during the trading session on Tuesday but has given back some of the gains as we continue to see the market stretched.

- Being as stretched as it is, it does make a certain amount of sense that we probably need to consolidate, and we may see a lot of that this week due to the fact that the jobs number comes out on Friday.

- This will continue to see a lot of volatility, but the volatility will more likely than dry up between now and then.

Ultimately, Gold is a market that I do think goes higher, but you have to look at it through the prism of a buy on the dip strategy. Given enough time, I don't see any reason why we don't make a fresh new high in this market, and for that matter, go looking towards the $2,500 level. I have no interest in shorting this market regardless, and therefore continue to look at it through the prism of trying to find value.

Top Forex Brokers

Multiple Support Levels

Underneath I see multiple support levels including the $2,200 level the $2,150 level and then finally the 50-day EMA and the $2,075 level which for me is the bottom of the overall trend. In general this is a market that I think continues to be very noisy and that does make a lot of sense considering what drives it after all we are talking about interest rates. The markets continue to pay close attention to inflation figures, via CPI, Core PCE, jobs, etc.

Geopolitical concerns and of course the fact that central banks are buyers. In general, this is a situation where we had surged higher previously, consolidated for the better part of a couple of weeks, and then turned around to break out to the upside again. I think we will probably continue that pattern going forward. Either way, I have no interest in trying to short this market.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.