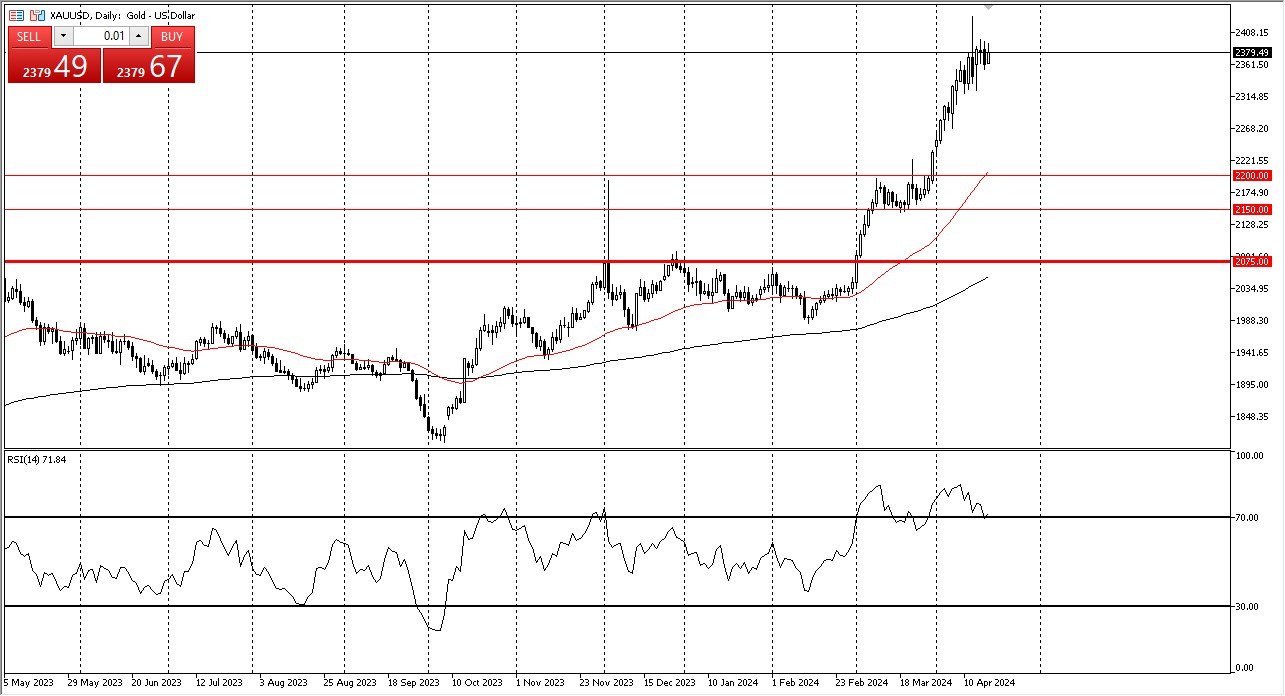

- Gold has done a little bit of sideways dancing during the early hours on Thursday just as we have seen it do all week.

- That does make a certain amount of sense because gold had gotten so overbought.

Furthermore, we are starting to look at the $2400 level as a potential barrier not only from a psychological standpoint but perhaps after all, this is a market that I think continues to be very noisy, but there are a lot of reasons to think that we eventually do go higher given enough time. After all, the geopolitical situation in the Middle East is still a huge moving target, and I don't think that you can get too aggressive one way or the other right now.

Top Forex Brokers

As we continue to go sideways though, people will become more and more comfortable with the idea of being involved in this market. And that in and of itself could perhaps give people a little bit of inspiration to start buying. All things being equal, we could pull back all the way to the $2,200 level and still look very strong and beautiful opportunity to pick up gold on the cheap as it were. Whether or not that happens remains to be seen but typically when you get a huge move higher like we've had you do one of two things you either go sideways and work off the excess through time or you pull back in order to offer value.

Volatility Will Continue

I think at this point in time you are going to continue to see a lot of volatility, and therefore you need to be cautious about your position size. However, you also need to be very patient as this is a market that had shot straight up in the air, and quite frankly needs to offer value for people to take advantage of and put money to work. I think each pullback will more likely than not get bought into, but Gold prices could drop all the way down to the previously mentioned $2200 level. In that situation, I would become much more aggressive, but at this point I think you have to look at it through the prism of a longer-term trend that should continue.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you