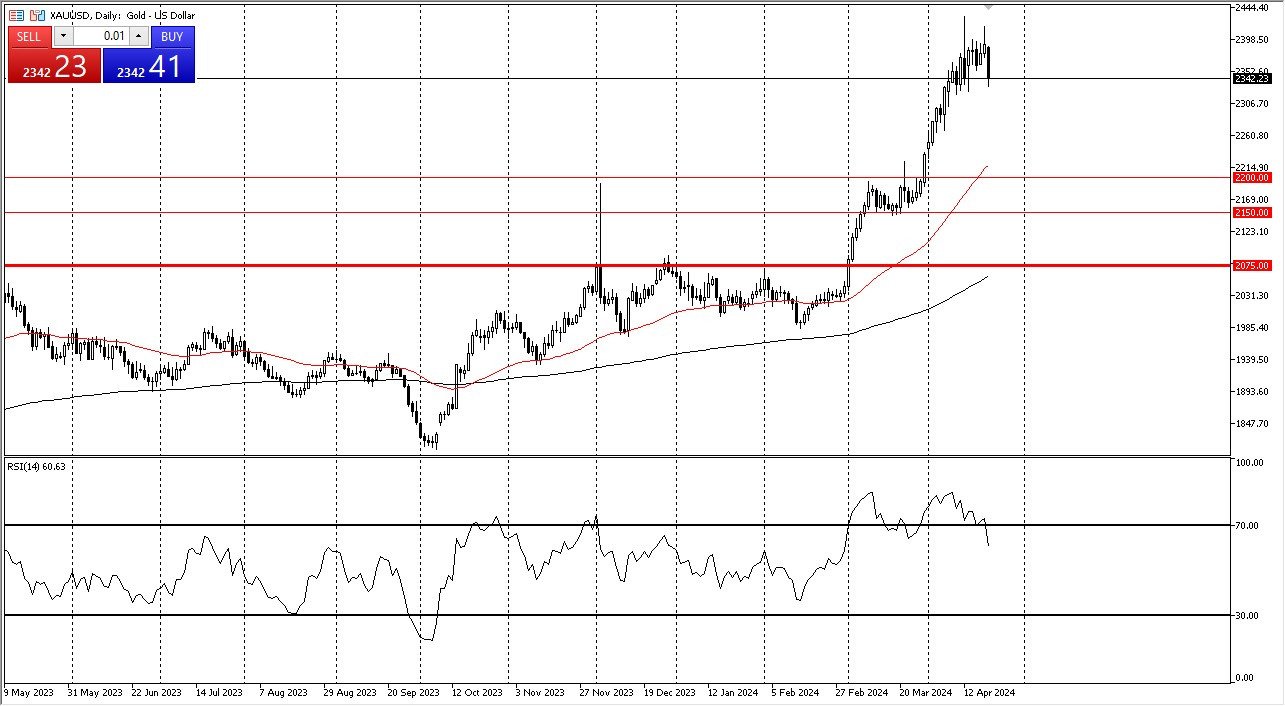

- Gold has fallen rather significantly during the course of the trading session on Monday, as it looks like we are going to perhaps take a bit of a breather in the uptrend.

- That being said, we are still very much in the consolidation zone, and therefore I think you can only read so much into this, the market has been very noisy for a while.

Gravity Matters? It Seems So.

Gold prices shoot straight up in the air for a while, so I also think that is something that you need to be aware of. The $2,400 level above has been like a brick wall, and as a result, I just don't see how you can make an argument for breaking through there easily. We had been oversold, and as there was no major escalation and tension in the Middle East over the weekend, it is clear to me that people are stepping away. Now, whether or not we break down remains to be seen.

Top Forex Brokers

A lot of this comes down to whether or not the Federal Reserve is also going to stay tight for longer. It looks like they might, so that might weigh upon gold as well. But any pullback at this point in time will just end up being a nice buying opportunity. The $2,200 level or the 50-day EMA would look interesting to me. I think you would have to look at both of those with the idea perhaps offering value, but we'll have to wait and see. Either way I don't have any interest in selling in this market, it's far too strong and a pullback is probably the best thing that could happen for it to be quite honest.

That being said, you need to be very cautious with the idea of geopolitical tension around the world, and therefore it’s likely that we will see sudden moves given enough time. All things being equal, this is a scenario the is very erratic to say the least, but ultimately this is a situation where we have to look at this through the longer term uptrend, but also recognize that the news flow has been somewhat, as of late, so that of course helps gold stays somewhat quiet.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.