- Gold initially fell during the trading session on Thursday, but then turned around to show signs of life.

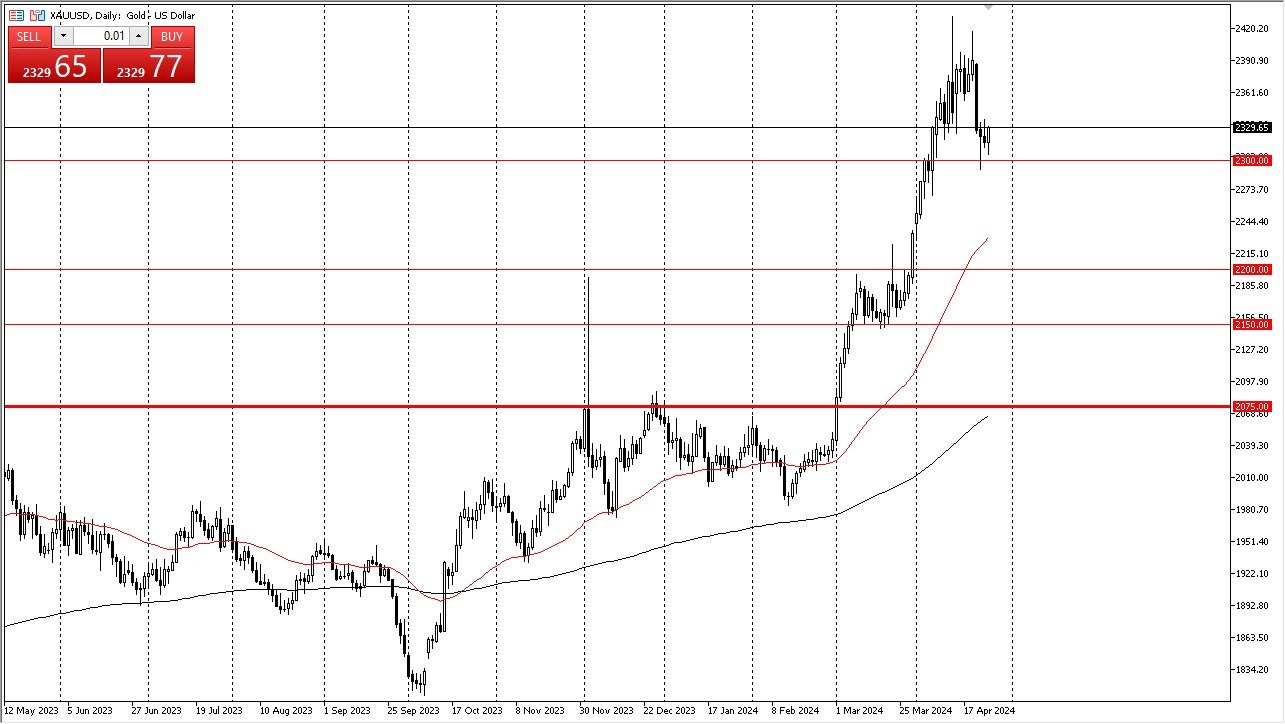

- It looks like the $2,300 level will continue to be important, and the market is trading at such.

- With all of that being said, I think you've got a situation where you have to look at this as a market that is building a little bit of a base in what has been a fairly strong uptrend: this is something that I wouldn’t be surprised to see continue at this point in time.

We had a significant sell off. We had some stabilization over the last couple of days, and now it looks like we are trying to do everything we can to go higher. If that is in fact what ends up happening, gold will eventually break above the $2,350 level and then go looking to the $2,400 level again. Either way, at this point in time, I like the idea of buying short term pullbacks.

Top Forex Brokers

Selling Isn’t Possible

I certainly don't have any interest in shorting the gold market, which has been so strong until the last week or so. Geopolitical concerns, interest rate decisions, and several other things are driving what's happening with gold. But keep in mind that central banks are major buyers of gold also. And that, of course, creates a little bit of a flaw in the market to begin with.

If we were to break down below the $2,300 level, the 50 day EMA and the $2,200 level underneath both offer significant support levels as well. In other words, although the market is stretched, the downside is probably somewhat limited. The relative Strength index is well under the 70 level for the first time in what seems like ages. So that means that perhaps we will continue to see people jumping into this market, trying to take advantage of cheap gold as it appears. “Buying on the dip” makes a lot of sense in this market, as the fundamentals all line up for longer term buying.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.