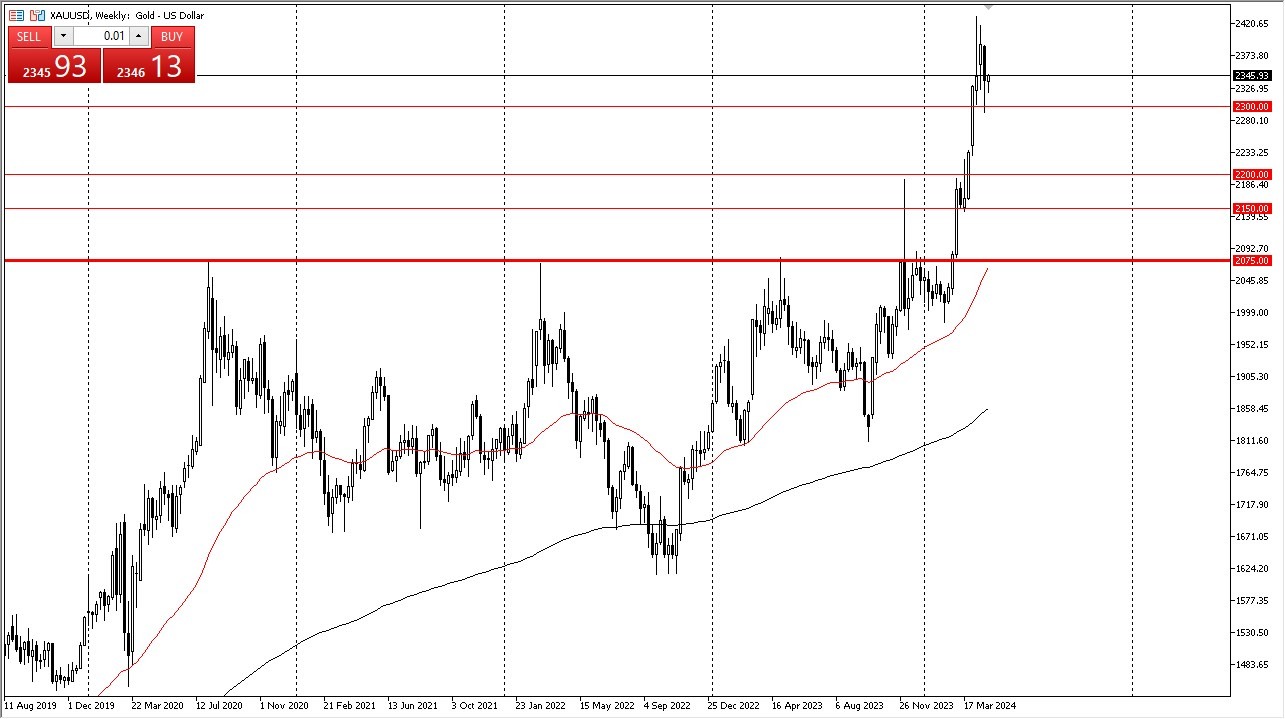

- Gold continues to be very noisy as the month of April was very choppy.

- This does make a certain amount of sense considering that gold shot straight up in the air over the course of the last couple of months, and therefore I think we needed to spend a little bit of time breathing and perhaps even soaking in some of the momentum.

Because of this, I think the month of May will be very difficult. I don’t mean this in the sense that I think the month of May will be necessarily negative, just that the markets could see a little bit in the way of volatility that causes issues. Ultimately, in the short term I do think that anytime we get a significant pullback, there will be plenty of buyers willing to jump in and take advantage of this market. With that being said, gold is a market that has a lot of different things working for it at the same time and therefore I think you have to look at this through the prism of whether or not risk appetite is increasing or falling, as well as many other things.

Top Forex Brokers

Looking at this chart, it’s obviously a bullish one, so at this point in time I remain very bullish on gold. That doesn’t mean that we will get a significant pullback, but I would probably keep an eye on this market as one that is a good way to play risk appetite. Furthermore, we also have to pay close attention to the interest rate markets, because they continue to see a lot of higher rates, and that has people a bit concerned. However, if we were to break down below there, then the $2200 level could be an area that I would become even more aggressive at. After all, that just means that gold is much cheaper. As far as buying at these high levels, then I think you have to be a little bit more cautious in the sense that we are a bit overstretched.

I suspect that most of this month will probably be about consolidation, but I also recognize that we will possibly break out to the upside or even downside, but either way the trend will remain the same. In other words, this is a “long only market” at the moment.

Ready to trade our Gold monthly forecast? Here’s a list of some of the best XAU/USD brokers to check out.