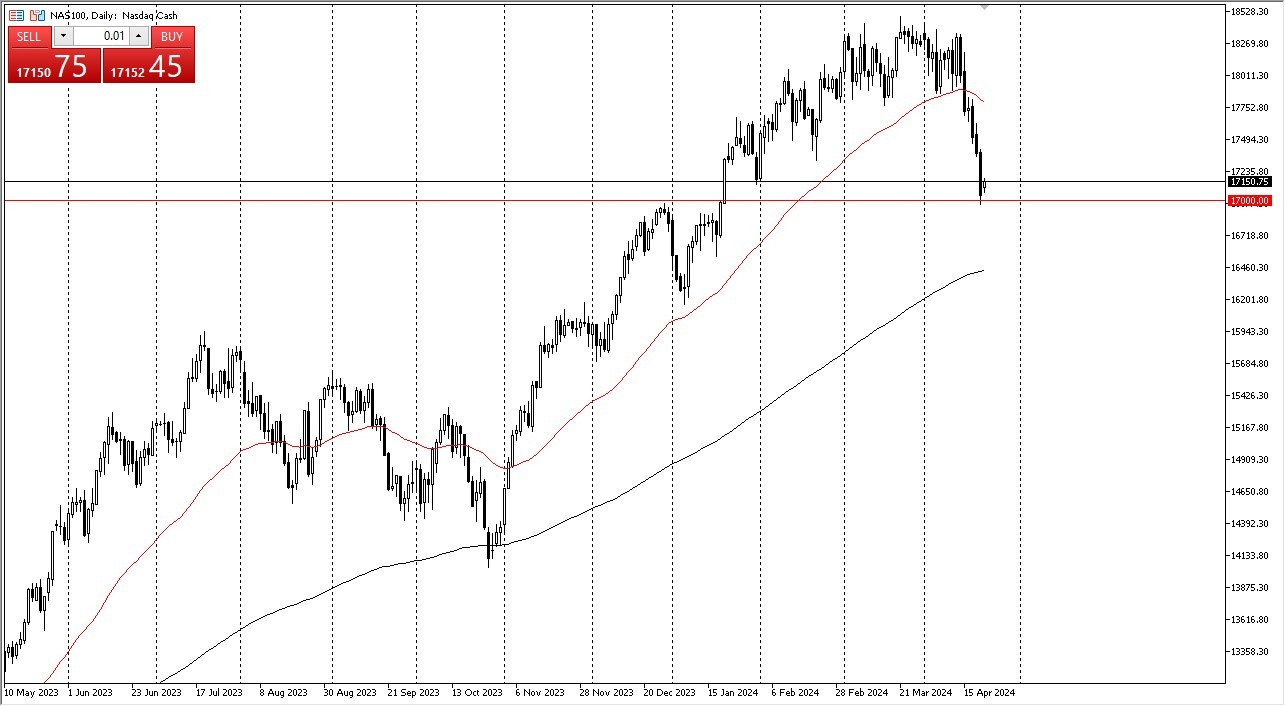

- The Nasdaq 100 rallied a bit during the early hours on Monday, as it looks like we are trying to bounce a bit from the massive sell-off that we had seen previously.

- Quite frankly, this is a market that I think continues to see a lot of interest in the 17,000 level, and the 17,000 level is not only a large round figure, but it's also an area that previously had seen resistance.

Because of this, the NASDAQ 100 market memory comes into play. And I think if for no other reason than simple value hunting, we probably have a bounce just waiting to happen. Keep in mind that the lack of economic announcement during the session could help as well. So really all things being equal, I do think we will continue to go higher, at least for the short term. Whether or not it's sustainable is a completely different question altogether, but I do think eventually we have to look at that potential.

Top Forex Brokers

The breaking above Friday's highs opens up the possibility of moving to the 50 day EMA, but that's going to take some effort. I do think there are a lot of questions out there when it comes to what's going to happen next, and of course with earnings season being front and center. That can cause some headaches, but right now, I think a little bit of value hunting is going on, and that will, more likely than not, continue to be the case.

Earnings Season

Keep in mind that the earnings season will cause a bit of volatility in and of itself, but ultimately, I do think it is probably only a matter of time before we get some type of bounce simply due to the fact that Wall Street doesn’t know what else to do with itself. Yes, they will always look for the handout from the Federal Reserve, but eventually they will find some type of narrative to sell stocks, because that’s what Wall Street does. Given enough time, this will end up being a lovely buying opportunity.

Ready to trade the NASDAQ 100? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.