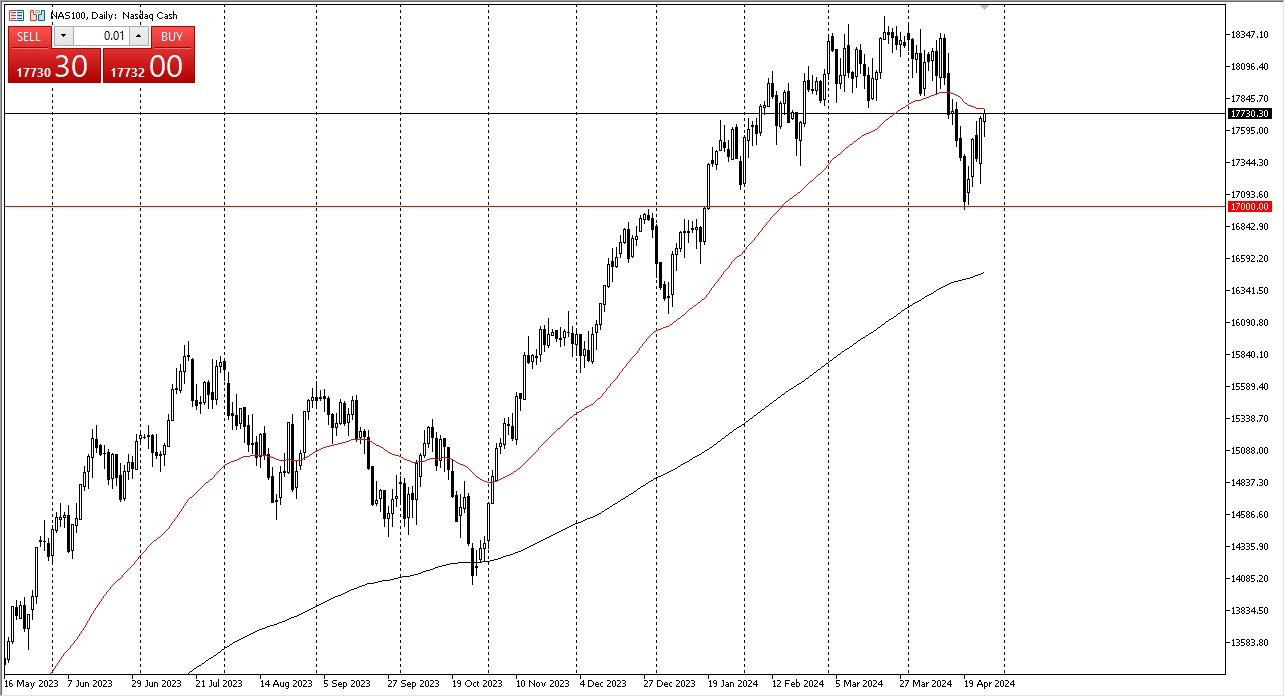

- As you can see, the Nasdaq 100 has pulled back to show signs of weakness and then turned around to show signs of life.

- I think at this point the market is likely to continue to see a lot of choppy volatility but there are plenty of people out there willing to buy the Nasdaq 100 from a technical analysis standpoint, it's probably worth noting that we are sitting just below the 50 day EMA, which of course is an indicator that a lot of people pay attention to.

The Massive Support Level Underneath

It's also worth noting that we slammed into the 17,000 level several days ago and have now rallied over 700 points from that level. In other words, this is a pretty significant bounce. We do have earnings season to deal with, and of course we have to worry about interest rates. But at this point, it looks like the market is doing everything it can to continue to the upside.

Top Forex Brokers

And it would not surprise me at all to see the Nasdaq 100 go looking towards the 18,500 level again. In fact, as long as we can stay above the 17,000 level, I just don't see a scenario where you get short of the market. After all, it's been in an uptrend for a long time and even though we had a significant pullback, it was the first real buying opportunity on value.

Going back to October of 2023. With this, it makes sense that people are trying to get in and push this market to the upside. Wall Street has absorbed the idea of rates staying higher for longer now, and I think at this point in time, it's only a matter of time before we reach the highs again and perhaps even take them out.

While I think that this market can and will eventually break out past that high, it is going to take a lot of momentum and effort to make this move a reality. While I believe it is going to happen, it is going to be a fight.

Ready to trade the NASDAQ 100? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.