- The US dollar seems to be running out of a little bit of momentum, as we have seen a lot of gains recently, and now it looks like some consolidation could be coming into the picture.

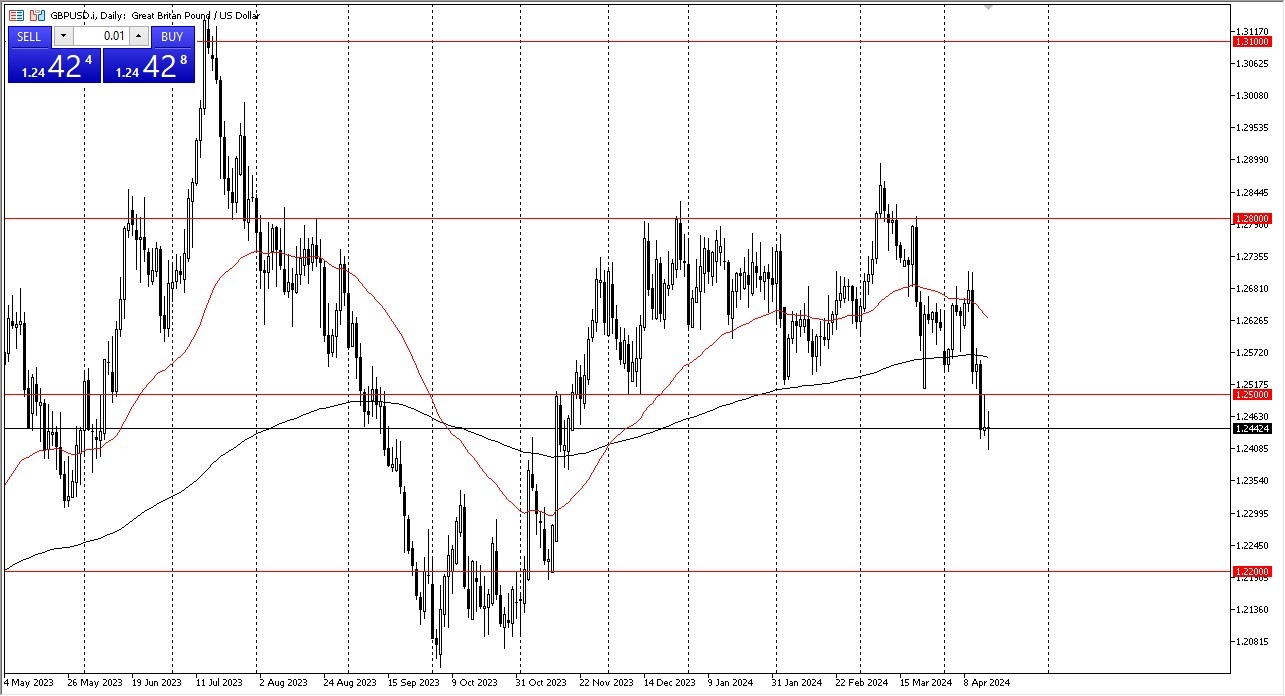

GBP/USD

The GBP/USD has been rather noisy during the course of the trading session, as we are trying to sort out whether or not we will recover from here. The market has seen so much in the way of negativity that it would not surprise me at all to see a short-term bounce. That being said, I believe that the 1.25 level above continues to offer resistance, and therefore you will have to look at it through the prism of a significant barrier. Recapturing the area above there on a daily close would be bullish, but at this point I think it is still more or less a “sell the rallies” type of market at the first signs of exhaustion.

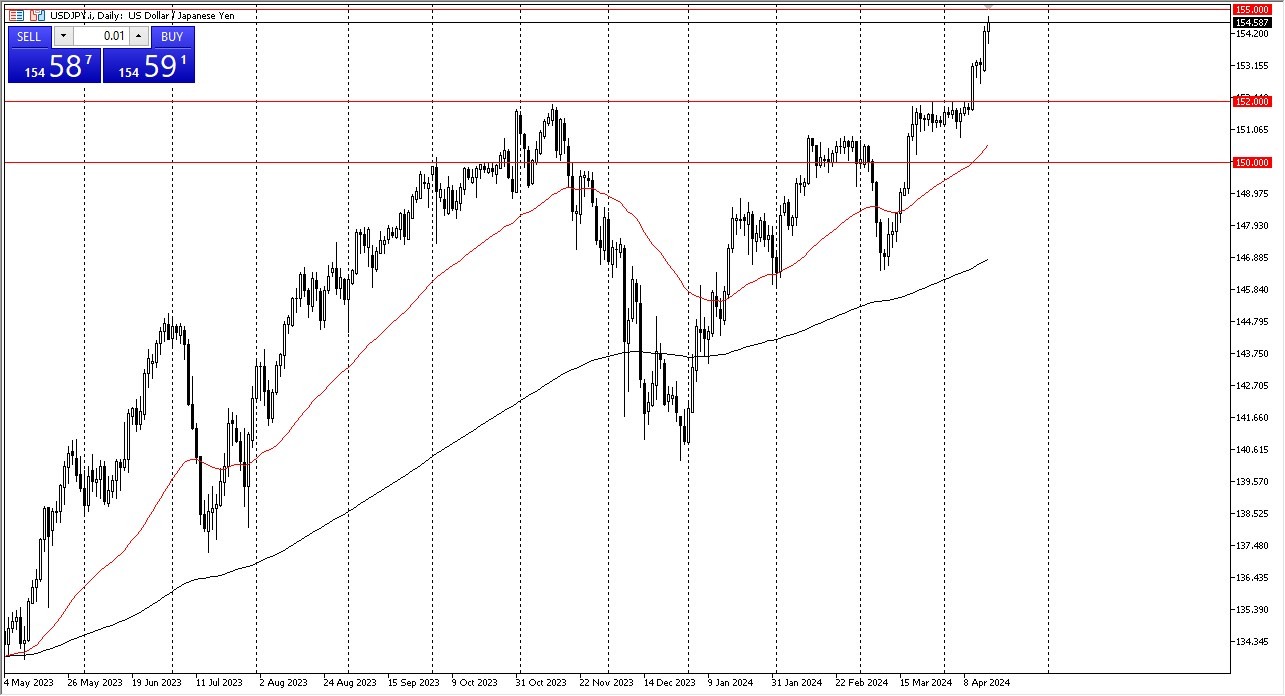

USD/JPY

The US dollar initially fell against the Japanese yen but then turned around to show signs of life again. Ultimately, you get paid to hang on to this USD/JPY pair at the end of every day, and I think the swap is going to continue to be a major driver of where we go next. The ¥155 level above continues to be an area of interest, but I don’t see any reason why we don’t break through there eventually.

On the downside, the ¥152 level underneath should continue to be a major level of interest, as it was significant resistance previously. We should have a lot of “market memory” in this area, offering an opportunity for buyers to come in and pick this market up. The 50-Day EMA has broken above the ¥150 level and is racing toward that area. Regardless, I have no interest in shorting this market.

Top Forex Brokers

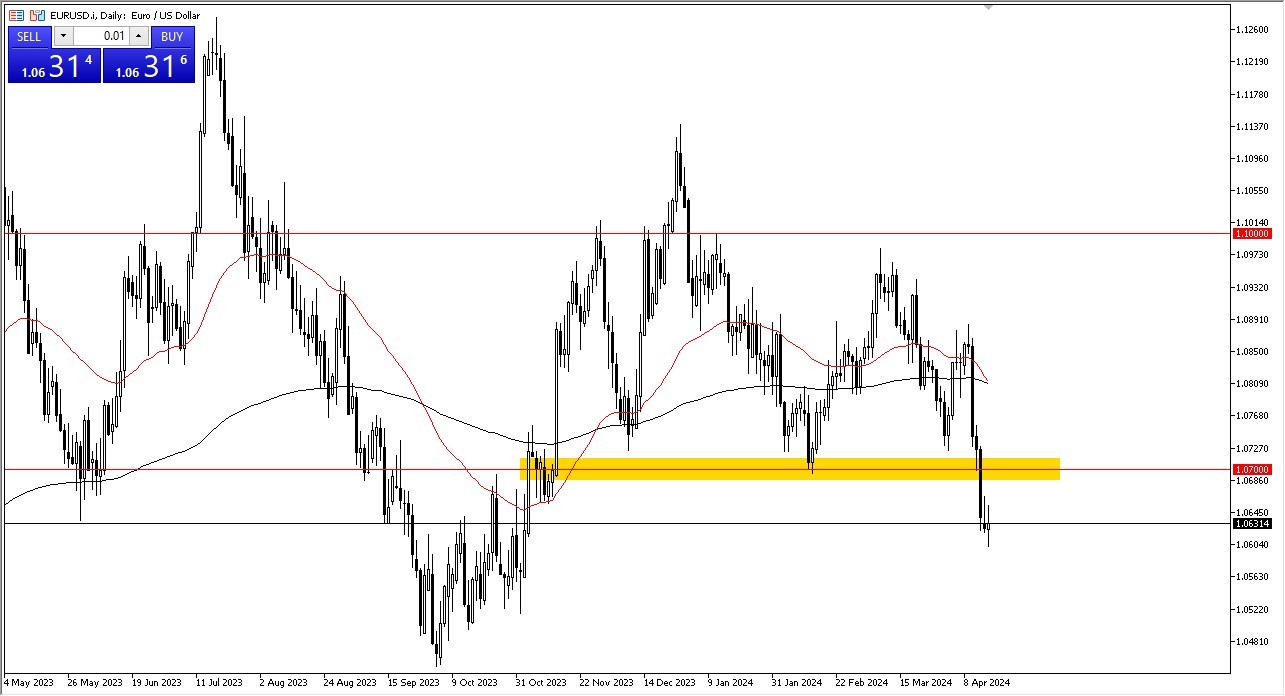

EUR/USD

The EUR/USD was all over the place during the course of the trading session on Tuesday, as the selling pressure may have reached a bit of a short-term climax. Any rally at this point in time will more likely than not get sold into, with the 1.07 level offering a significant amount of resistance. The 1.07 level is important as it had previously been support, so I think a lot of order flow will be in that area. For what it is worth, the 50-Day EMA looks as if it is trying to break down below the 200-Day EMA, kicking off the so-called “death cross.” This of course is a negative sign, but it is quite often very late in the move.

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.