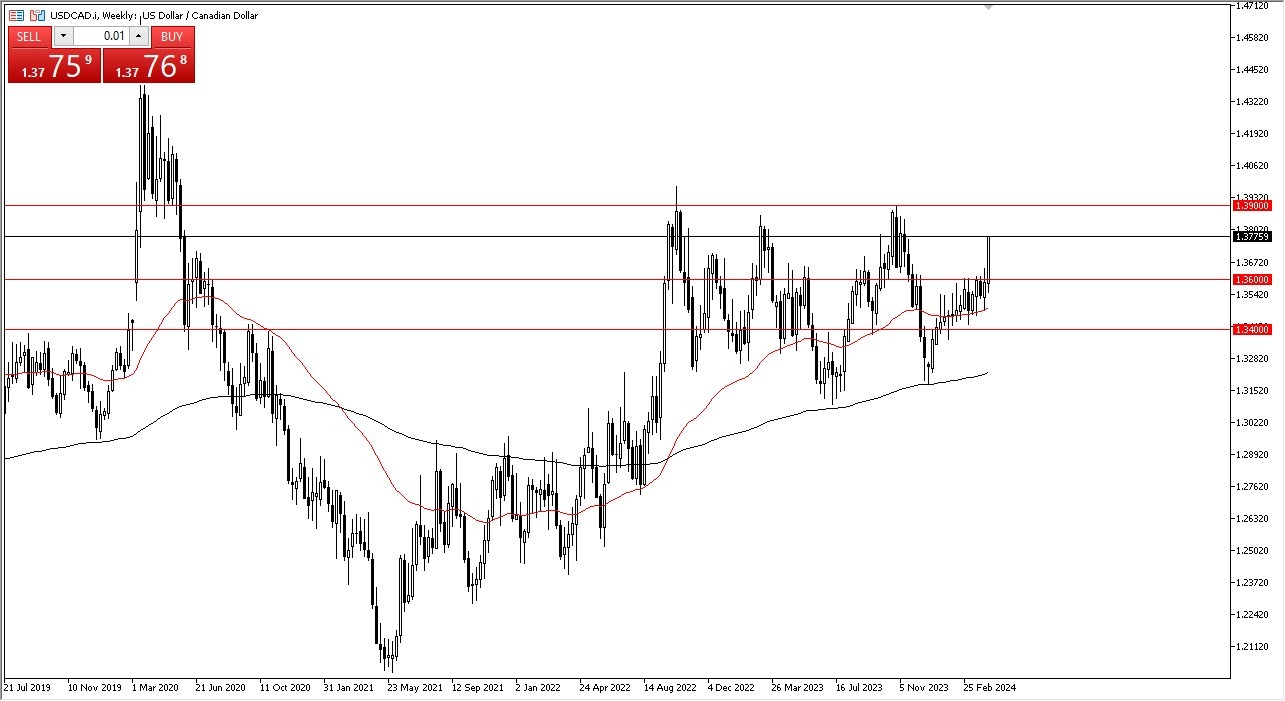

USD/CAD

The US dollar has absolutely exploded to the upside against the Canadian dollar during the week, and at this point I think it’s likely that we continue to reach toward the significant resistance barrier in the form of 1.39 above. That being said, I would love to see some type of short-term pullback in order to get involved, as this is a market that is a little bit stretched at the moment. That being said, even though oil is extraordinarily strong at the moment, the US dollar should continue to see upward pressure in general.

DAX

The German DAX has had a rough week, and it looks like we are going to continue to drop a bit. At this point, I’ll be very interested in seeing how the week ends up, because it could give us an opportunity to pick up this market on a nice dip. Pay special attention to the €17,750 level, as it was a previous support level. While the €18,000 level has been interesting, it does not look like it’s going to hold this market.

Top Forex Brokers

GBP/CHF

The British pound has been all over the place this week against the Swiss franc, ending up forming a massive shooting star right at resistance. While this is a negative sign in and of itself, I think that the more interesting trade is if we can break above the 1.15 level above. If we were to break above there, then it’s likely that we could see this market eventually go to the 1.21 level. In the short term, we may get a little bit of a pullback, but I’ll be watching the 1.12 level underneath for signs of support in order to start getting longer again as the interest rate differential will continue to favor the upside in this market.

Gold

Gold markets have been very volatile this week, and truly took off on Friday. However, we have since seen a massive reversal late in the day on Friday to end up forming a bit of a shooting star for the weekly candlestick. By doing so, the market looks very likely to continue to see a bit of a selloff. If we do, it should end up being a buying opportunity eventually, but it is worth noting that a lot of people just got hurt. With this, I’d be very interested in gold closer to the $2200 level, but we will have to wait and see if we can even break below the $2300 level to begin with.

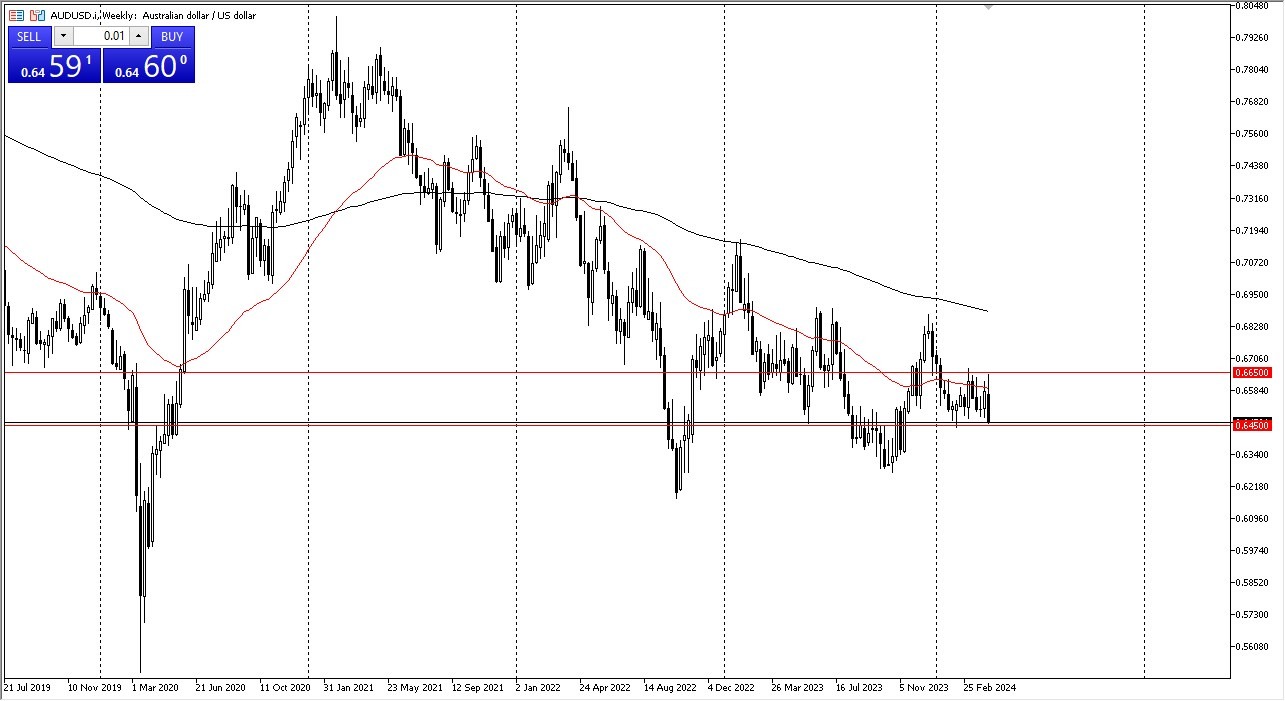

AUD/USD

The Australian dollar initially rally during the week but gave back gains at the 1.06650 level. This was mainly due to the CPI numbers in America coming out hotter than anticipated, followed by fairly high PPI numbers. As we close out the week, we are testing major support in the form of the 0.6450 level, and therefore we need to pay close attention to whether or not it holds. If it does not, then it’s likely that this pair could drop down to the 0.63 level. On the other hand, if we bounce from here it could open up more consolidation going forward. Keep in mind that a lot of this comes down to risk appetite as well, as the US dollar is considered to be a safety currency.

USD/MXN

The US dollar initially fell against the Mexican peso during the week, but then turned around to show signs of life. Ultimately, this is a market that I think continues to see a lot of volatility, but we are still very much in a downtrend. Quite frankly, if you’re looking to buy the US dollar you are better off buying it against other currencies as the Mexican peso is backed by an 11.75% interest rate! With this, I’m not willing to pay to hold this position. Quite frankly, if this market continues to go higher and probably going to buy the US dollar against other currencies so that I can also take advantage of a bit of a swap. On the other hand, if we start to see the US dollar weekend across the board, this might be an excellent short.

EUR/JPY

The euro initially rallied against the Japanese yen during the trading week, but then plunged on Friday right along with so many other currencies against the yen. That being said, it looks like we do have plenty of support underneath and I think this ends up being a buying opportunity. While I’m not necessarily bullish of the euro, I absolutely hate holding the yen and refused to do so. I think it is only a matter of time before this market turns around and goes looking toward the highs again.

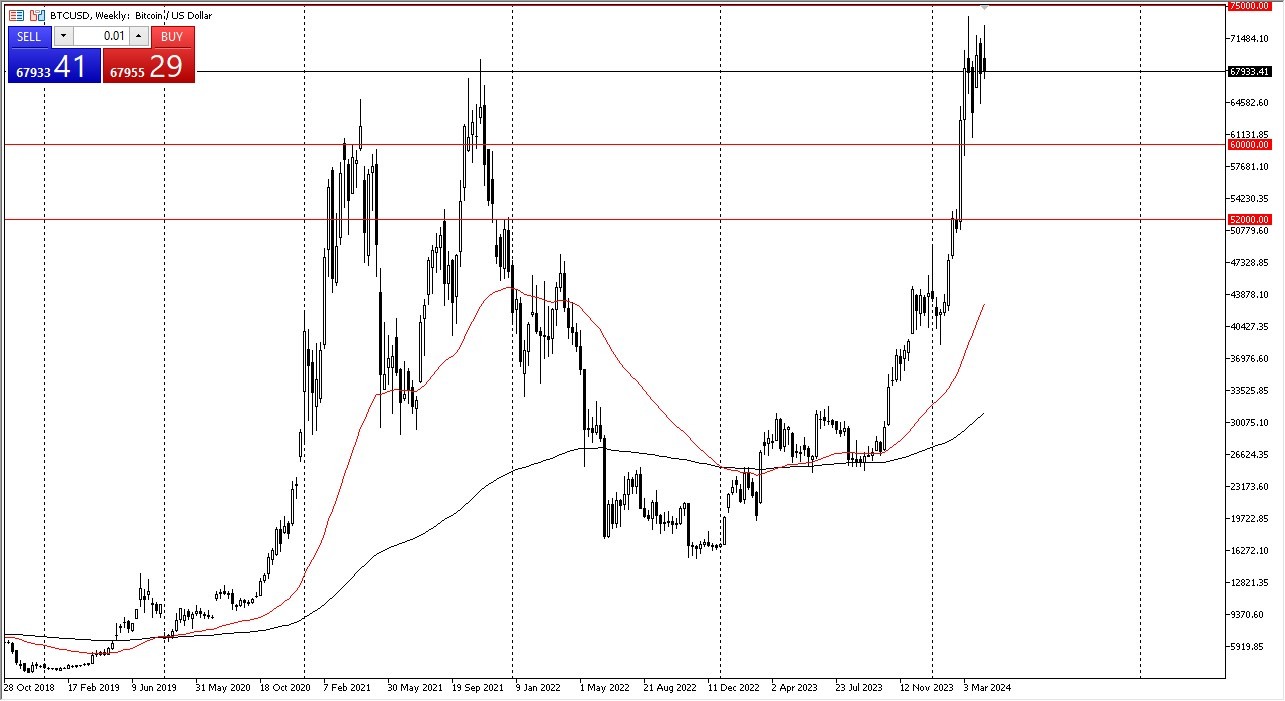

Bitcoin

Bitcoin initially rallied during the week but gave back gains as we continue to see a lot of volatility and choppiness. I think this is just simple consolidation, and if we drop another couple of thousand dollars, I’m more than willing to step in and pick this up. The $60,000 level underneath continues to be a major support level as we are working off the massive froth from the run higher. It’s a “buy on the dip” market.

Ready to trade our weekly Forex forecast? We’ve made a list of some of the best regulated forex brokers to to choose from.