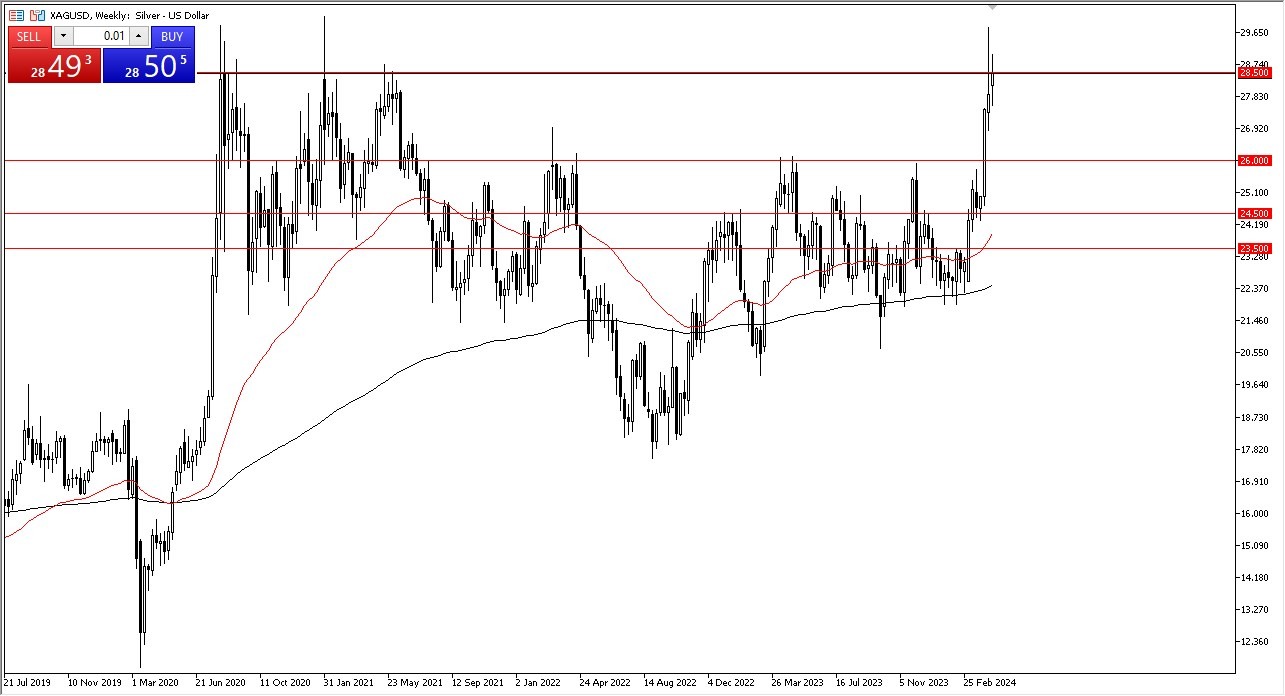

Silver

Silver has had another volatile week, but the thing that I am paying the most attention to right now is the fact that the $28.50 level continues to be a major barrier. Between the $28.50 level in the $30.00 level, there is a significant amount of selling pressure as we have seen multiple times over the years. Because of this, I have no interest in trying to buy in this market at the moment, and quite frankly I would love to see some type of pullback. If we get some type of collapse toward the $26 level, that could be your entry point.

DAX

The German DAX has been all over the place during the week, but it looks as if the buyers are trying to step in and pick up the market a bit. By doing so, I think that a move above the €18,000 level will attract a lot of attention, perhaps bringing traders into the fold, allowing for a move back to the recent high. Short-term pullbacks at this point should continue to see support near the €17,500 level, an area that has a certain amount of psychology attached to it. As the ECB is likely to cut rates in the next few months, that could benefit German equities.

Top Forex Brokers

Gold

Gold has been positive for the week, as we continue to dance around just below the $2400 level. This is a market that is going to continue to be very noisy, but you should be aware of the fact that we are most certainly overbought on the Relative Strength Index. Because of this, a bit of a short-term pullback probably opens up the possibility of buying into a strong market, and at this point in time I believe that the $2200 level is a significant amount of support just waiting to happen. At this point, I have no interest in trying to get short of this market.

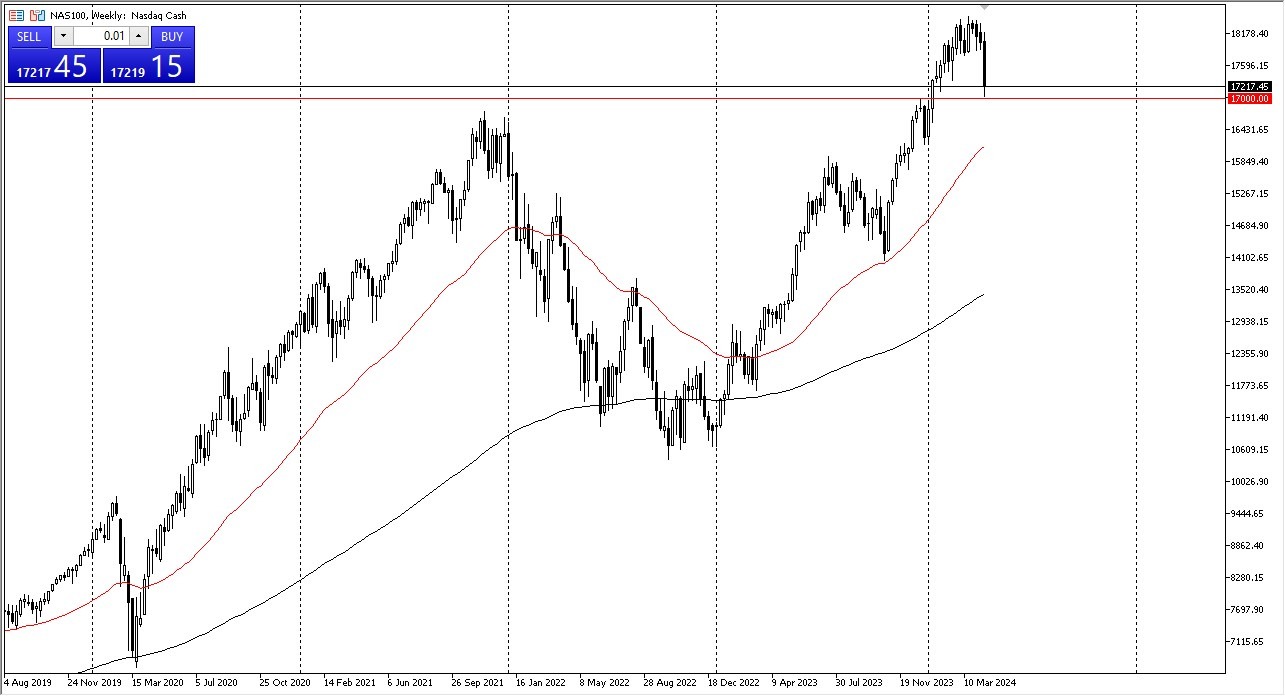

NASDAQ 100

The NASDAQ 100 has had a very rough week, as traders continue to worry about the likelihood of interest rates staying high for longer. With that being said, I think the $17,000 level is an area that a lot of traders will watch, as it was the “flash crash low” from the overnight trading between Thursday and Friday during the Israeli attack on Iran. As long as we can hold the above there, there is the possibility that we get a bit of a bounce but it’s also worth noting that the earnings season of course will continue to be front and center as well.

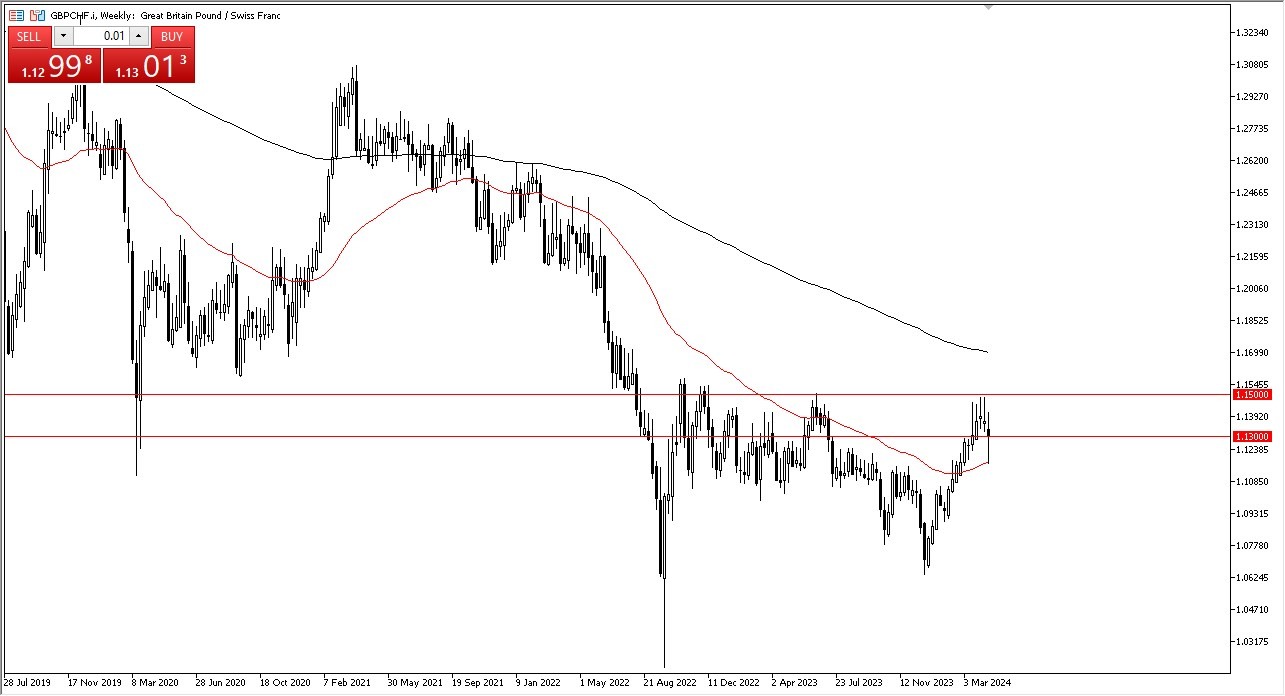

GBP/CHF

The British pound has been very volatile against the Swiss franc during the trading week but bounced quite drastically after the Israeli attack send this market lower. The 50-We EMA is an area that seems to be offering support, and now we find ourselves hanging around the 1.13 level. In other words, resiliency has shown itself and it does suggest that perhaps we will continue to grind to the upside. If we can break above the 1.15 level, it’s very likely that this market will go much higher. In the meantime, keep in mind that you get paid a positive swap at the end of each trading session and therefore it’s a positive market.

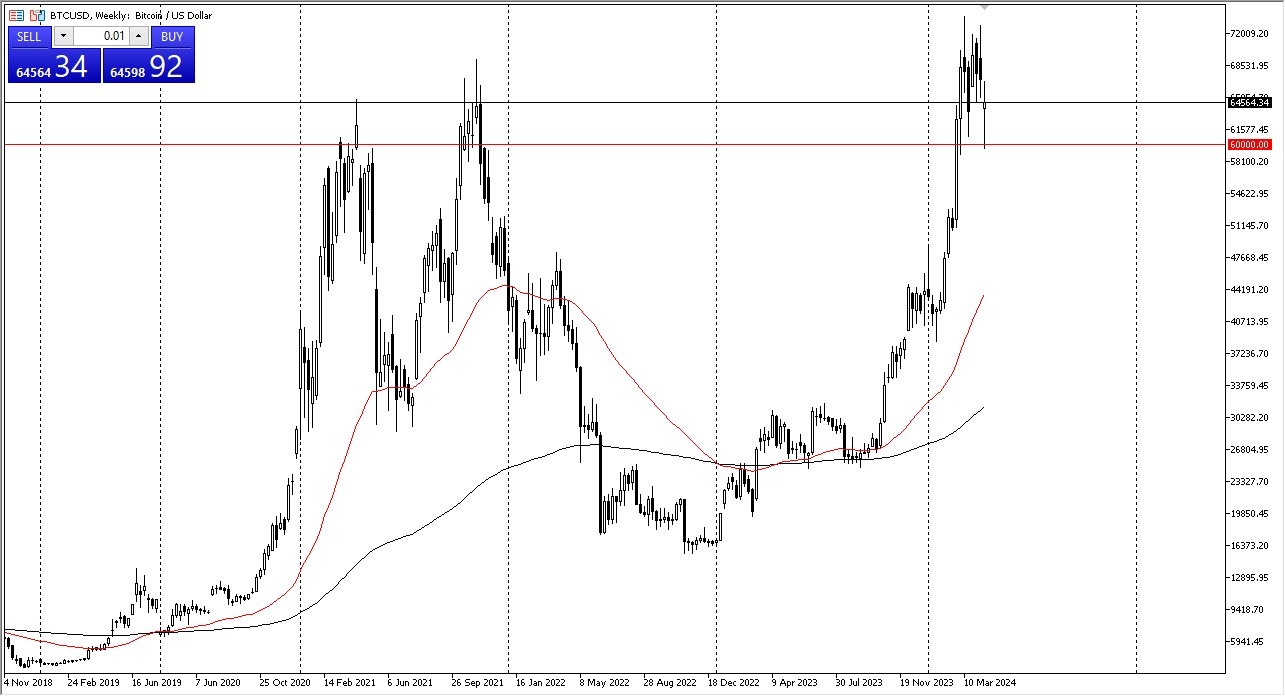

Bitcoin

Bitcoin has plunged during most of the week but has found massive amounts of buying pressure near the $60,000 level, which is an area that I continue to pay close attention to. It’s a large, round, psychologically significant figure, and an area that previously had meant quite a bit to the market. The fact that we have bounced almost $5000 from that level suggests to me that buyers are willing to come in and pick this market up as it offers value and what should be a very strong uptrend longer term. At this point, I would not be surprised at all to see bitcoin reaching toward the $70,000 level.

GBP/JPY

The British pound has rallied rather significantly during the week against the Japanese yen, and it seems as if every time we pull back, there are plenty of buyers waiting to get involved. In fact, you can say the same thing about almost all yen denominated currency pairs. In general, as long as the market continues to see buyers coming in on dips, I don’t see any reason why we won’t go higher. Furthermore, the interest rate differential favors the British pound, so therefore I think we continue to see a lot of upward pressure over the longer term.

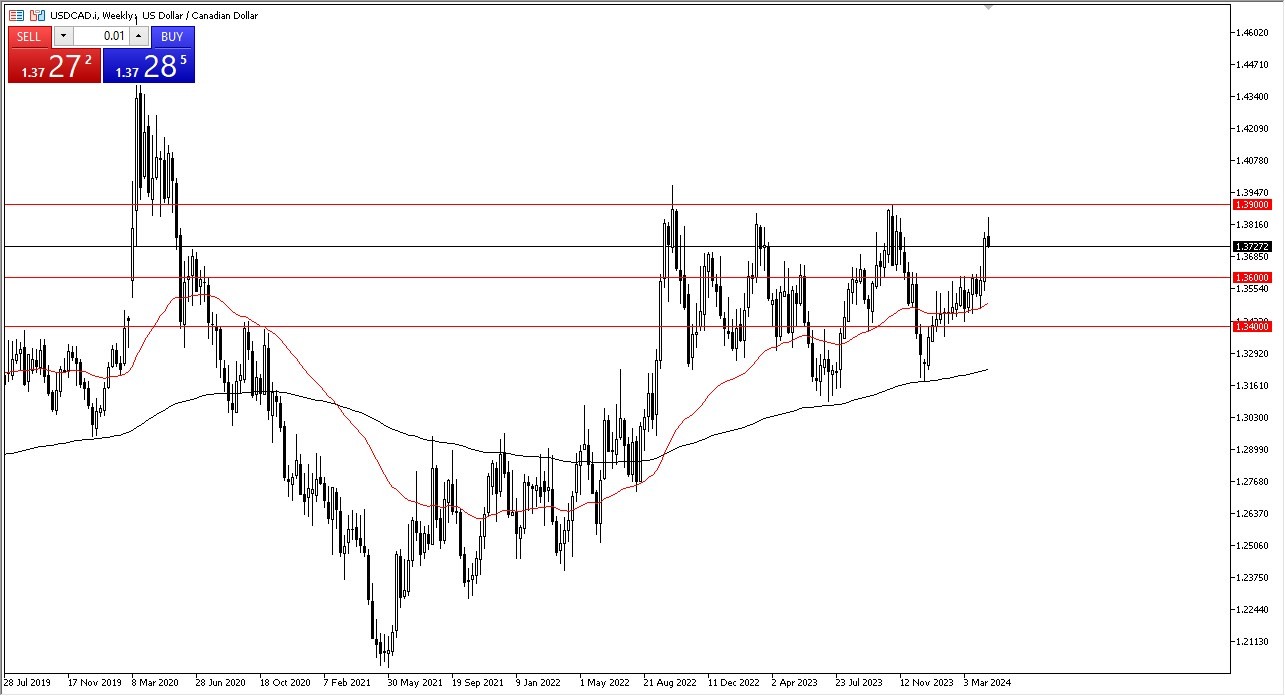

USD/CAD

The US dollar initially rallied during the week, but then turned around to show signs of negativity. We did get fairly close to the 1.39 level, which is a large, round, psychologically significant figure. Because of this, I think we had gotten a little bit ahead of ourselves, and short-term pullback is more likely than not in the cards. I believe that the 1.36 level underneath is going to end up being a massive support level.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.