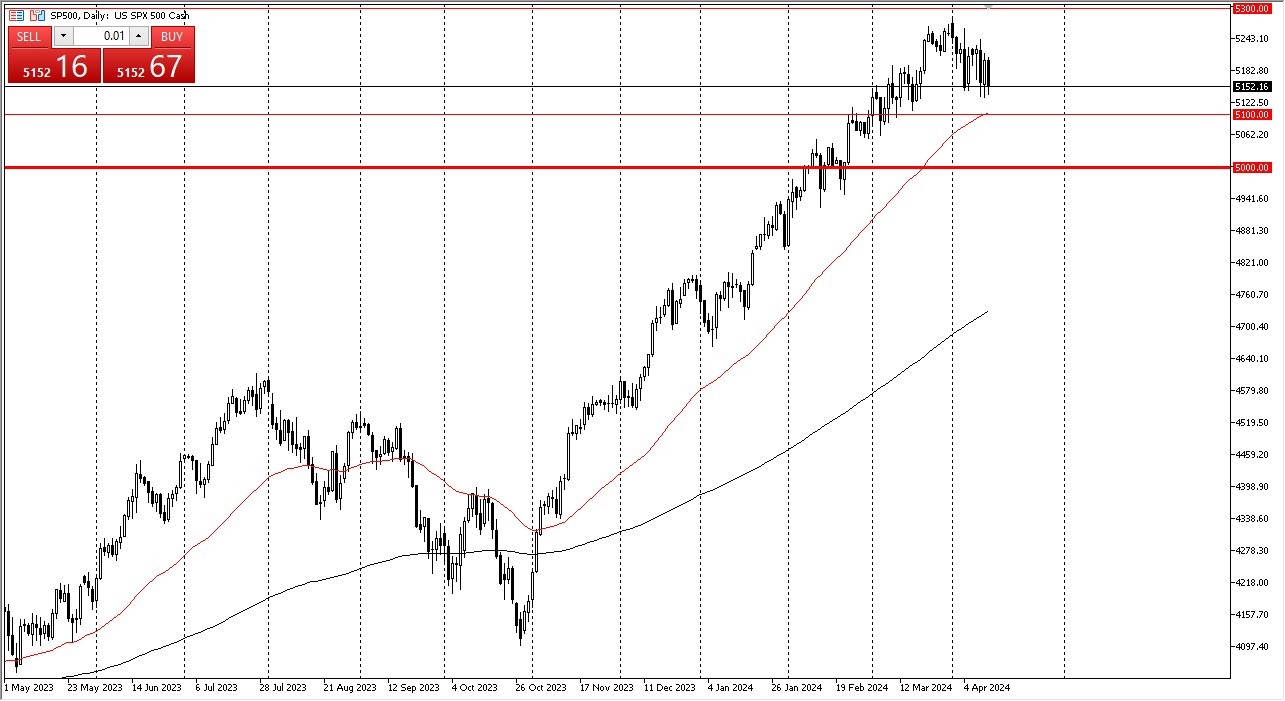

- The S&P 500 fell a bit during the trading session on Friday, but we continue to see a bit of support near the 5,150 level.

- At this point the market is likely to continue to find plenty of buyers in this area as well as the 5100 level.

Keep in mind that the S&P 500 has to deal with earnings season now, so we could see a bit of volatility and a little bit of sideways action would make a certain amount of sense. In this environment I think you've got a situation where you are buying dips taking advantage of the market being cheap.

Top Forex Brokers

Banks Earnings and Disappointment

The banks earnings calls early in the Friday session were a bit disappointing, and that's part of what you're seeing on the chart right now. But quite frankly, I think the big part is just working off some of the excess froth. We've gone straight up in the air for several months now. The 50-day EMA hanging around the 5100 level, of course, will attract a lot of attention. So, if we do pull back towards that area, I think a lot of people would be willing to get involved. This is an area that has shown itself to be important more than once, so “market memory” is the big factor here.

Underneath there, we could have the $5,000 level offer a huge floor in the market. In the short term, I would anticipate a lot of back and forth, but the $5,300 level above is a bit of a ceiling that I think is going to take some type of catalyst to break through. It might be earnings; we just don't know. But at this point, a lot of what Wall Street is paying attention to is whether or not the Federal Reserve is going to be cutting later this year. There are some people now pricing in the possibility of no cuts between now and New Year's Day. Inflation continues to be a major issue in the United States, and you are seeing that in this chart.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.