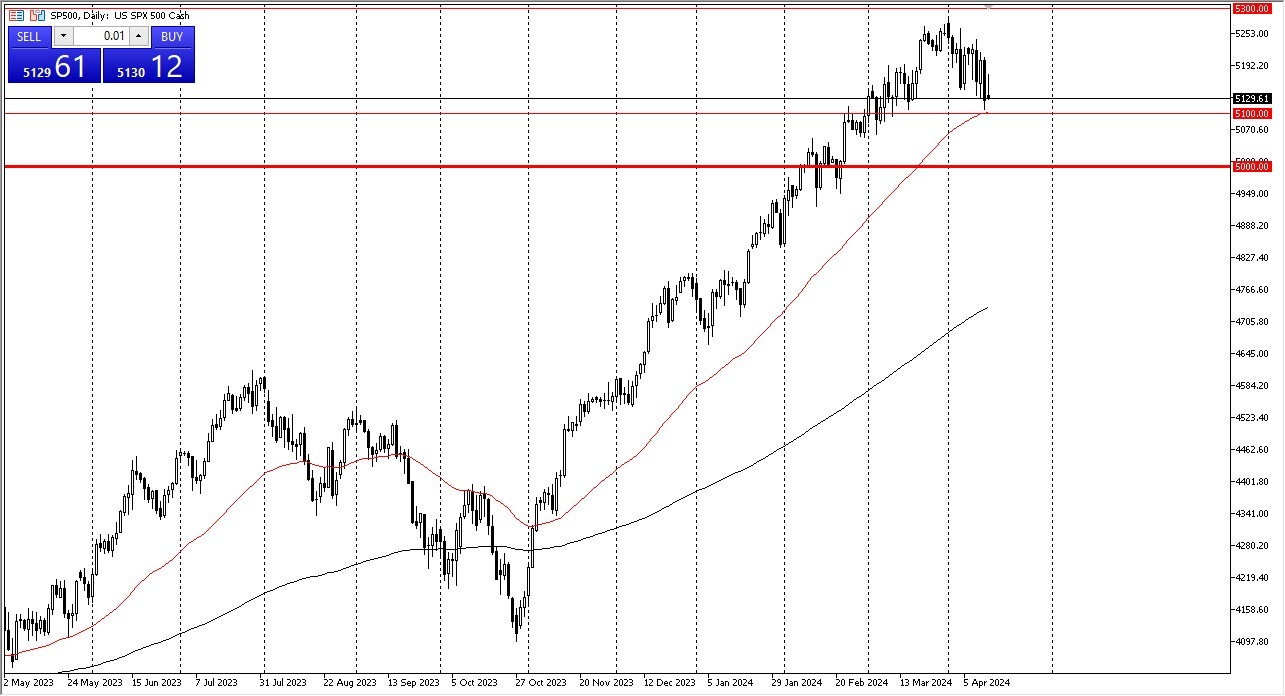

- The S&P 500 initially tried to rally during the course of the trading session on Monday, as the 5100 level underneath continues to be supported.

- The 50-Day EMA sits just below there, and it does make a certain amount of sense that we would continue to see interest in the market.

- On the other hand, the market rally and from here would open up the possibility of a move toward the 5200 level, as we continue to consolidate overall.

Earnings Season

Earnings season of course has kicked off, so I think a lot of this noise that we see will ultimately end up being the norm. All things being equal, I think it’s likely that the market will be very noisy, but ultimately, we are still very much in an uptrend. The earnings season causes quite a bit of noise, and therefore it’s likely that the market will continue to be difficult to hang onto, but the overriding fact is that we are most certainly in an uptrend, and that has not changed.

Top Forex Brokers

Even if we were to break down below the 50-Day EMA, the 5100 level itself is supported as well. Breaking through all that then puts the market in the mode of looking at the 5000 level to see whether or not we can see enough buyers in that region to keep the market supported. As long as we can say above the 5000 level, I think that there’s a real shot at this market continuing to go higher.

Regardless, I have no interest in shorting any of the US indices as everybody is hanging out and waiting for monetary easing to come out the Federal Reserve, something that should be the case during the later part of this year. Ultimately, it’s also worth noting that retail sales has still been strong, so even if we don’t get monetary policy easing, the reality is that Americans continue to spend. As long as that’s the case, it’s likely that we will try to revisit the 5300 level over the longer term. I have no interest in shorting US indices at the moment as the momentum has been so strong.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.