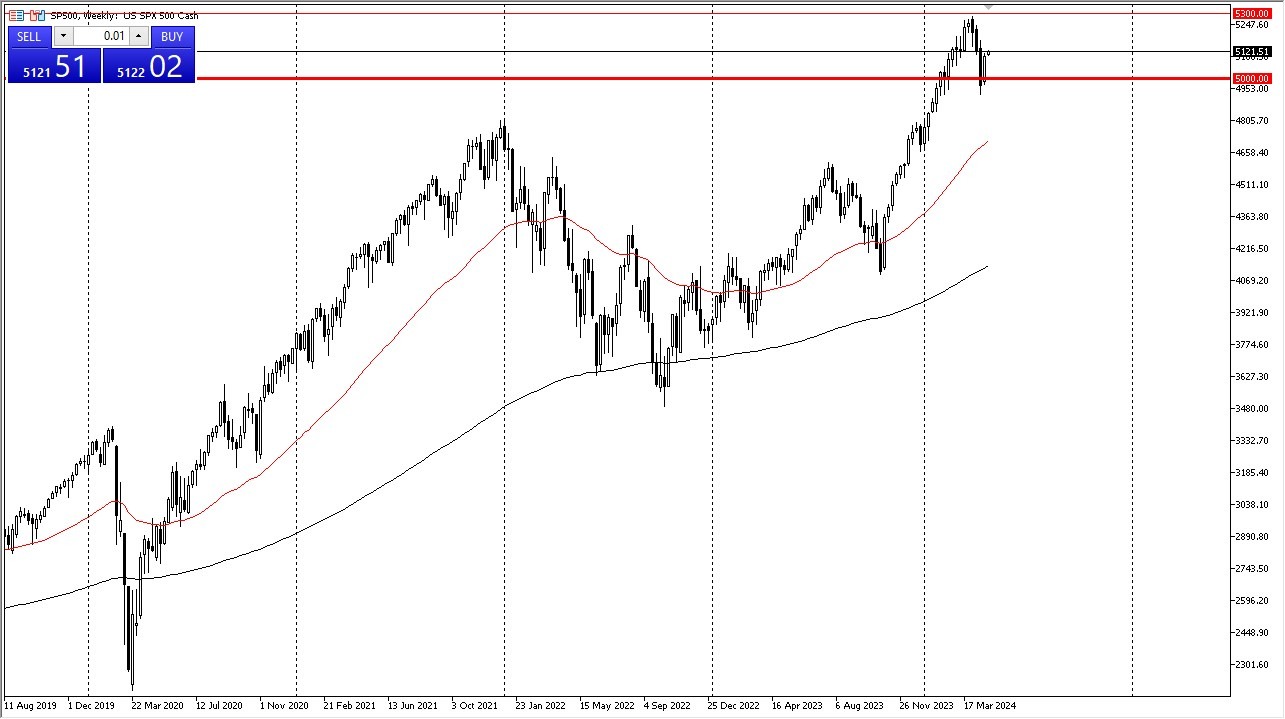

- The S&P 500 has been very noisy for the month of April, which should not be a huge surprise considering that we have seen so much in the way of upward momentum.

- Sooner or later, we had to consolidate, and therefore work off some of the excess froth that had been built up in the markets.

- I think given enough time, this is a market that will eventually take off to the upside again, and as we are going through earnings season, it does make a certain amount of sense the volatility would be part of the market anyway.

At this point, I have to assume that the S&P 500 remains more or less a “buy on the dips” market, as we have seen so much in the way of upward pressure of the longer term, and therefore a lot of traders will be out there wishing that they had gotten involved that in earlier level. However, they did get a little bit of an opportunity to pick up “cheap contracts” in this market, therefore I think that’s part of what we are seeing happen right now. Underneath, we have the 5000 level that will almost certainly offer a significant amount of support, and then after that we have the 4900 level. Anything below the 4900 level could open up a major correction.

Top Forex Brokers

All things being equal, this is a market that will continue to see a lot of volatility during this time of year, but I also believe that we have a situation where plenty of value hunters are willing to get involved. If we can break above the 5300 level, then it’s likely that the S&P 500 will go looking to the 5500 level. Underneath, if we were to break down then the 50-We EMA will be right around the 4700 level, and it could be a bit of support as well. That being said, at the end of the month of April, it looks like the buyers are starting the flexor muscles again, so I think it’s probably only a matter of time before we continue to go higher. Ultimately, I think you have a noisy market, but you still have to look at this through the prism of a market that is still bullish from a long-term perspective.

Ready to trade our S&P 500 monthly forecast? Here’s a list of some of the best stocks brokers for you to check out.