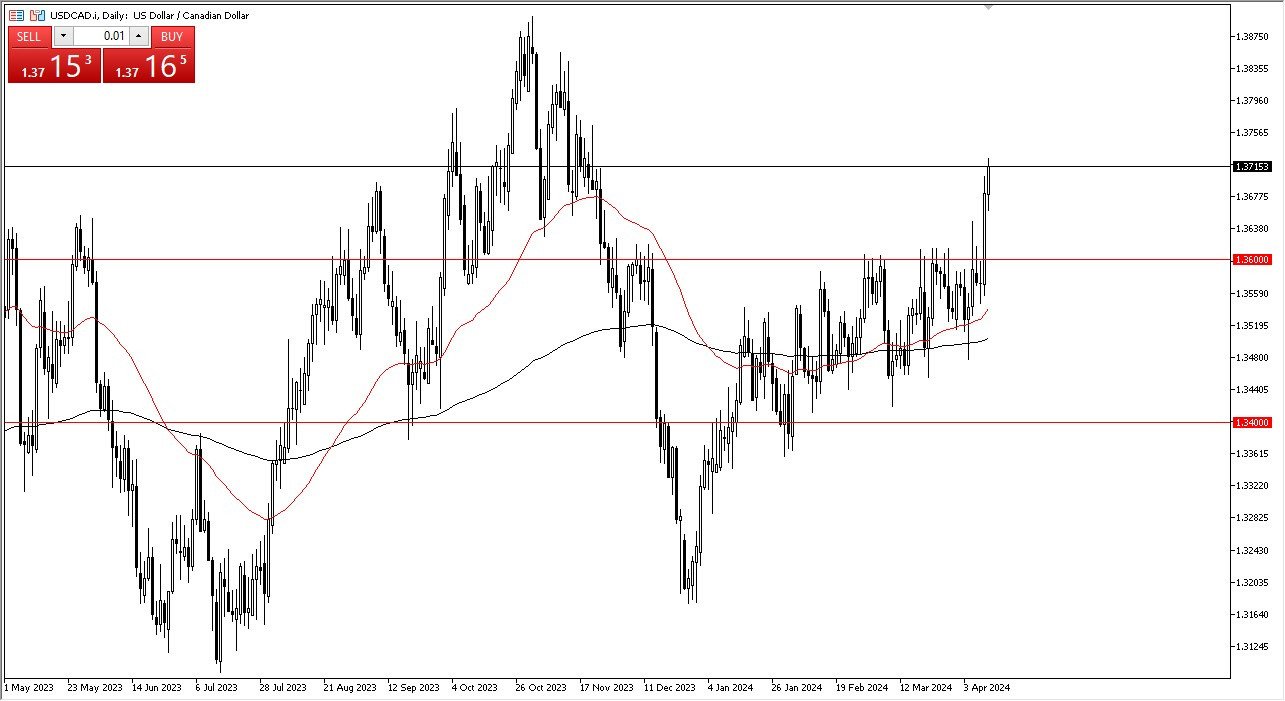

- The US dollar initially pulled back just a bit during the trading session on Thursday, only to turn around and show signs of strength and break above the 1.37 level.

- Underneath, I think there is a massive amount of support at the 1.36 level, and any pullback at this point in time will more likely than not attract a lot of inflows.

- The US dollar is in the process of destroying almost everything it’s touching, and the Canadian dollar course will be any different.

Inflation in America

A lot of what we are looking at here is a reflection of the inflation numbers in America being much stronger than many other markets and economies. With that being the case, think you got a situation where the US dollar continues to be crucial, at least for determining where we go next. The size of the candlestick on Wednesday was rather impressive, and I think there are plenty of buyers underneath willing to get involved. In fact, it’s not until we wipe out the Wednesday candlestick to the downside that I would be concerned about the overall uptrend. At this point, believe that the US dollar is going to go looking to the 1.38 level above, possibly even all the way to the 1.350 level after that.

Top Forex Brokers

Keep in mind that the Canadian economy is struggling a bit at this point, and the Bank of Canada is likely to cut rates much quicker than the Federal Reserve will, so we are seeing this play out in the currency markets. That being said, I don’t necessarily want to chase this trade, I want to see some type of pullback in order to get long of the USD/CAD pair yet again. I have no interest in shorting, at least not until we break through the bottom of that massive Wednesday candlestick. If that were to happen, then I think the US dollar trace down to the 1.34 level, something that I just don’t see happening in this environment.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers in Canada for beginners to trade Forex worth using.