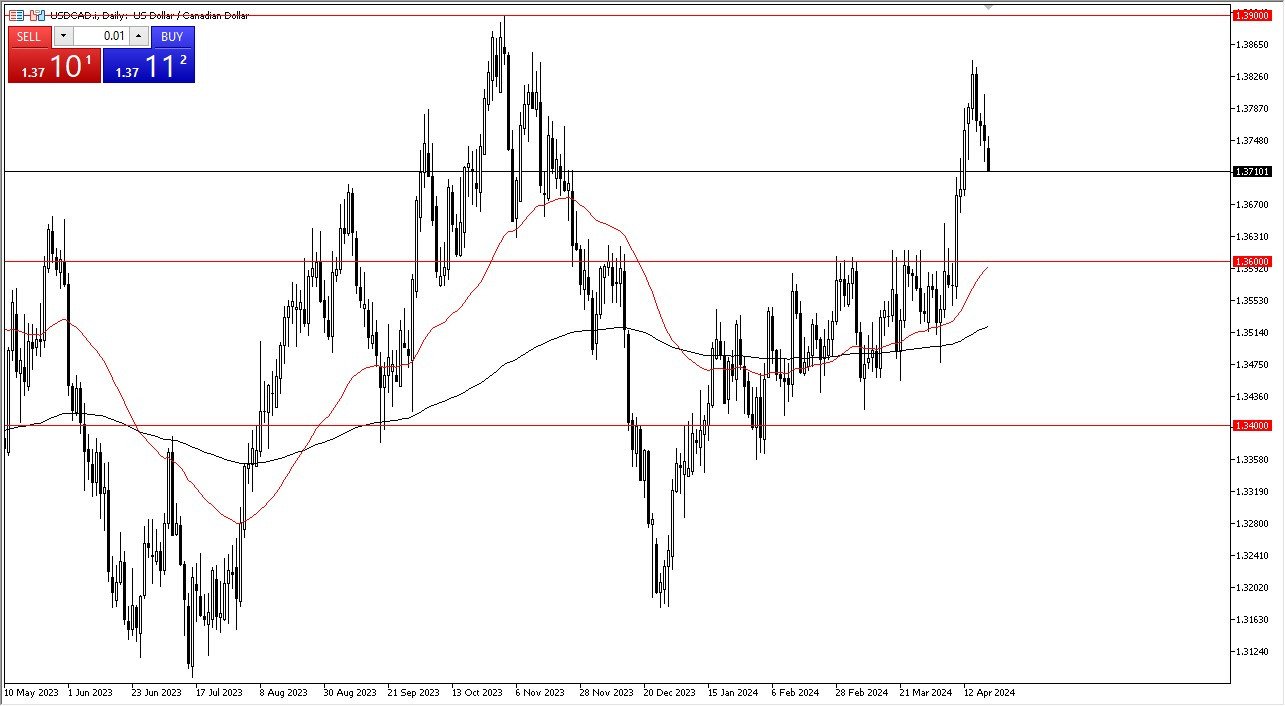

- The US dollar initially tried to rally against the Canadian dollar on Monday but gave back gains as it looks like we are going to continue to pullback.

- This makes a certain amount of sense considering that we had shot straight up in the air for a while, and of course momentum will eventually leave the marketplace.

- As that continues to be the case, I think you have a situation where you have to look at this through the prism of potentially buying a dip, but we are nowhere near seen enough support to turn things around.

Federal Reserve

The recent strengthening of the US dollar can be summed up in 2 words: Federal Reserve. This is because the Federal Reserve has recently stated that they will probably stay tight for longer than the market anticipated, in which this of course has a major influence on what happens next. Quite frankly, tight monetary policy is good for currency, as the thinking is that more money will flow into those bonds as they pay more. Furthermore, we also have to keep in mind that there is a bit of a divergence between Ottawa and Washington, as it looks like the Canadians are much more likely to loosen monetary policy first. After all, the Canadian economy has been suffering for a while, and is in the midst of a housing issue that seemingly is only going to get worse.

Top Forex Brokers

At this point, I’m paying special attention to the 1.36 level, because I think that’s an area where market memory comes into play as it was previously a major resistance barrier. We also have the 50-Day EMA approaching that level, so I think you have to look at it through the prism of perhaps offering a bit of value the people might be willing to take advantage of. I also recognize that the USD/CAD market is one that tends to be very choppy, so will not be surprising at all to see it go back and forth for a while. The recent breakout has been brutal and coincides nicely with the US dollar strengthening against almost everything else. At this point though, it certainly looks as if a pullback is in the cards.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.